Today, the yen is weakening, while USD/JPY is rising, recovering from the strongest losses and trading at the time of publication of this article around 132.65. The yen has so far been little helped by the actions of the Bank of Japan that followed the December meeting (on Thursday, the Bank of Japan announced an unscheduled purchase of bonds, offering a purchase in the amount of 1.325 trillion yen: 3-5-year bonds worth 650 billion yen, 5-10-year bonds in the amount of 675 billion yen) and statements by bank officials that the Central Bank will not hesitate to further ease monetary policy if necessary.

Many economists believe that the yen will strengthen next year, and the USD/JPY pair will fall. In their opinion, this movement of the pair “south” will intensify when the Fed again takes steps to slow down the pace of monetary tightening, and especially when the Fed stops raising rates. If the Bank of Japan changes its monetary policy (in the direction of its tightening), USD/JPY may fall even more. Recall that now the interest rate in Japan is in negative territory, amounting to -0.1%.

Today, the volatility in the market, including USD/JPY, will increase again when at 13:30 (GMT) the latest data on PCE (personal consumption expenditure) in the US and orders for durable goods and capital goods (for more details, see Key Economic Events of the Week 12/19/2022 – 12/25/2022).

In this case, two scenarios would also be appropriate: the main one, which assumes the strengthening of the dollar, despite its today's weakening in the market and in the DXY index, and the alternative one - the resumption of the decline in USD/JPY.

A buy signal will be a breakdown of today's high at 132.81, and a sell signal will be a breakdown of today's low of 132.15.

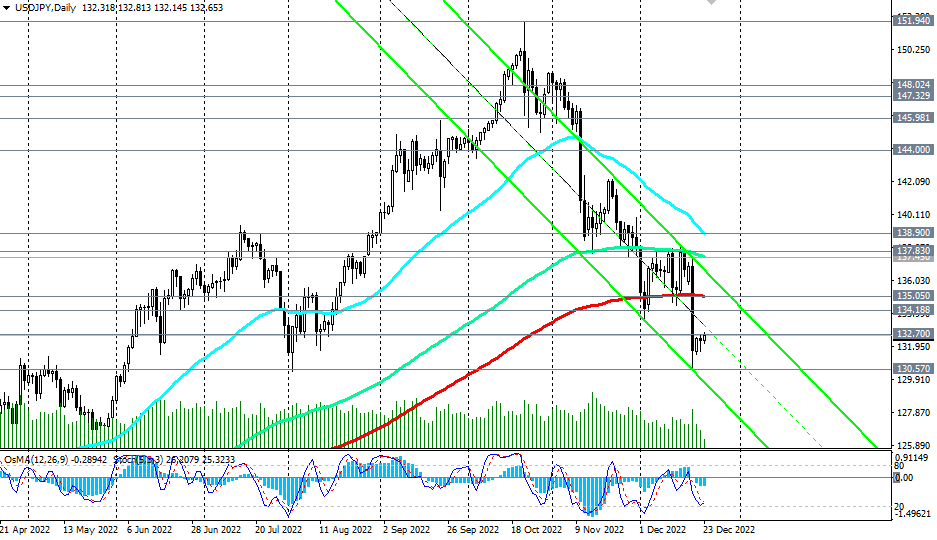

In the first case, the target will be the key resistance level 135.05 (EMA200 on the daily chart) with intermediate targets at 133.00, 134.00, 134.18 (EMA200 on the 1-hour chart).

In case of a decline, the target will be a local intra-week low at 130.57, reached last Tuesday, with intermediate targets at 132.00, 131.00.

*) for important events of the upcoming week, see the Key economic events of the week 12/26/2022 – 01/01/2023

Support levels: 132.70, 132.00, 131.00, 130.57, 130.00

Resistance levels: 132.80, 133.00, 134.00, 134.18, 135.05, 137.45, 138.90

- details - https://www.instaforex.com/ru/forex_analysis/330668/?x=PKEZZ

- or https://www.instaforex.com/en/forex_analysis/330668/?x=PKEZZ

- signals -> https://www.mql5.com/en/signals/author/edayprofit

- see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading