AUD/USD: on the eve of the NFP and the meeting of the RB Australia

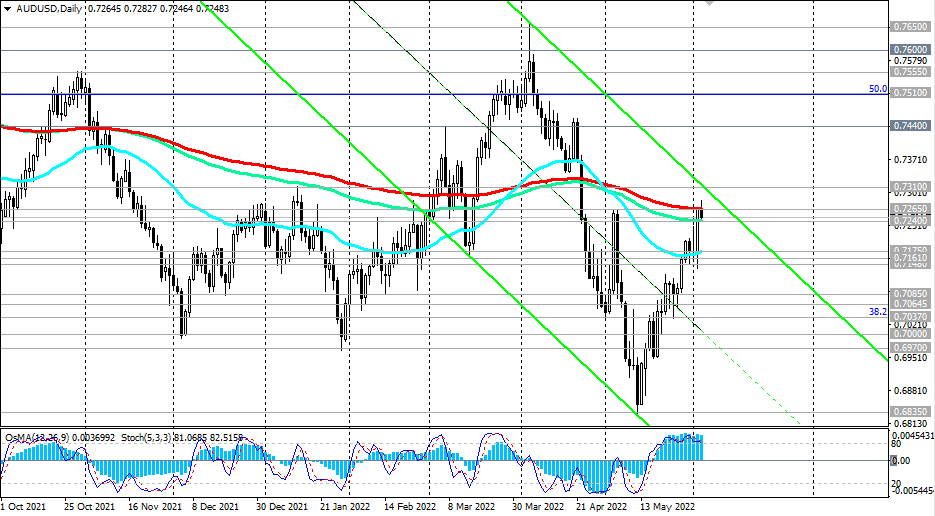

At the time of writing this article, AUD/USD is trading near 0.7248, remaining in a range between the most important long-term levels 0.7265, 0.7240. If there is a rebound from these levels, and AUD/USD resumes its decline, then we can say that the upward correction of the pair, which has been observed since mid-May, has ended, and the price is returning to the global downtrend.

This will be confirmed by a consecutive breakdown of 3 important support levels 0.7175, 0.7161, 0.7148 (for more details, see "AUD / USD: technical analysis and trading recommendations for 06/03/2022").

Meanwhile, a Reuters poll of economists showed that they expect the RBA to raise interest rates again at its June 7 meeting by 25 basis points, to 0.60% from the current 0.35%, an increase that they believe is already included in AUD prices and quotes. Therefore, if such a decision is made, the Australian dollar is likely to react slightly to it. The AUD could appreciate sharply and the AUD/USD pair could continue to rise if the interest rate is raised by 40 or 50 basis points. The probability of such an increase is estimated by market participants at 50%.

*) about the features of trading the AUD/USD pair, see also the article "AUD/USD: currency pair (characteristics, recommendations)".

Support levels: 0.7240, 0.7175, 0.7161, 0.7148, 0.7085, 0.7064, 0.7037, 0.7000, 0.6970, 0.6835, 0.6800, 0.6450

Resistance levels: 0.7265, 0.7310, 0.7400, 0.7440, 0.7510, 0.7555, 0.7600, 0.7650

*) See also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

***) Promotion in InstaForex "Happy deposit": do not miss the opportunity to get your $9000. Promotion Terms HERE!

Source: InstaForex