"The stability of exchange rates is important, and their rapid changes are undesirable", Japan's Deputy Finance Minister Masato Kanda said recently, echoing statements made back in March by a government spokesman and finance minister.

BoJ Governor Kuroda also said today that the yen's fall was "somewhat rapid", which could be seen as a strong warning.

At the same time, many economists are warning of growing recession risks in the US due to a string of supply shocks, while the Fed raises rates to curb inflation.

The risk of a slowdown in business activity, along with dangerously high inflation, which reached 7.9% in February, poses a difficult task for the Fed. The central bank is trying to cool the economy by slowing down inflation, but not allowing spending cuts and rising unemployment.

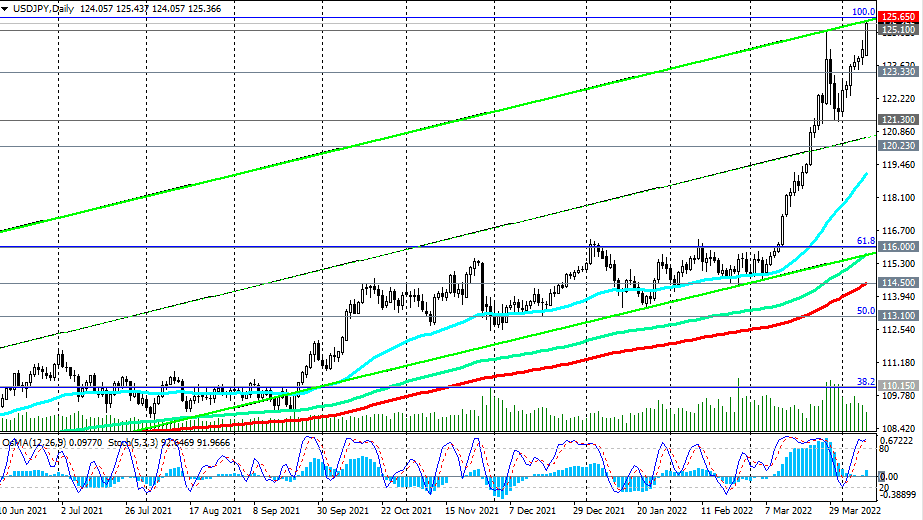

Returning to the USD/JPY pair, we can assume its further growth in the short and medium term. So far, investors still prefer the dollar, while geopolitical tensions persist in the world (outside the US). Thus, last Friday the DXY dollar index updated a 2-year high at 100.19, and many economists agree that a breakdown of the psychologically significant level of 100.00 will accelerate the further growth of DXY, and the dollar will continue to strengthen.

Today, USD/JPY is up sharply, posting a 6-week run in a row to break above 125.10 (the high of last month and August 2015). The discrepancy between the monetary policy of the Fed and the Bank of Japan is likely to increase, creating preconditions for further growth of USD/JPY. In this case, the pair will head towards multi-year highs near 135.00, reached in January 2002.

Support levels: 125.10, 124.40, 123.33, 121.30, 120.23, 116.00, 114.50, 113.10, 110.15

Resistance levels: 125.65

*) see also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex