OMEGA POINT GUIDE

DESCRIPTION:

The Omega Point indicator uses a complex multilayered system that is used by the top world traders which helps to determine the beginning of trends that are highly likely to last for a long time. The system uses several complex trend calculation modes, due to which the indicator adapts to the specifications of different currency pairs, and is suitable for both conservative and aggressive trading. The indicator makes the necessary calculations and shows important information about how the trade would have been executed if the trader had entered the market, thus the trader can always calculate what profit to expect.

RECOMMENDED PAIRS - Any volatile and trending pairs like: EUR/JPY, GBP/JPY, XAU/USD, AUD/CAD, EUR/AUD, GBP/AUD, GBP/CAD, GBP/NOK and so on.

RECOMMENDED TIMEFRAME - H1, but with the strength indicator, can also be used on the lower timeframes.

HOW DO YOU WORK WITH THE INDICATOR:

The indicator checks with the complex mathematical system and tries to find a best point of entry. As it finds a signal, it paints an arrow on a chart, and shows recommended take/stop levels.

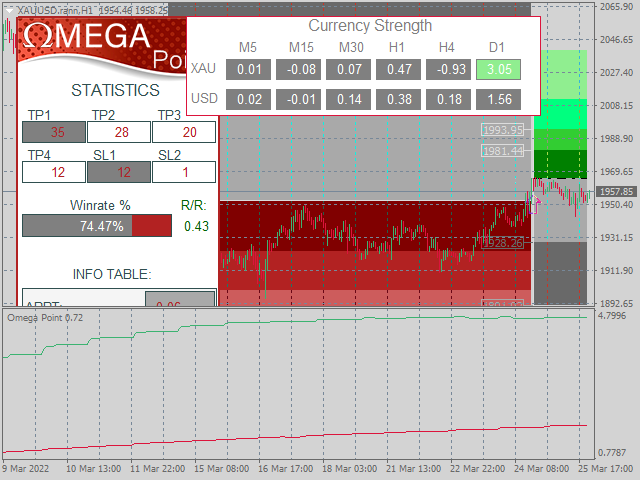

The indicator shows statistics on how the trades would be executed with different stop-levels and take-profit levels if you entered the market.

The take-levels and stop-levels are interactable (you can click on them), so you can easily check how a specific take-level will work with stop-loss 1 or 2.

It is also recommended to use the strength indicator to make better decisions.

On average, strength values range from -1.5 to 1.5. (-1.5 is weak, 1.5 is strong).

Sometimes there can be extremes like 3.0 (example with gold). This means that the currency is very strong in all pairs, so selling against it is not recommended.

So whenever there is a trade signal, check the panel for the statistics, like profit factor and APPT (do they show the positive values with the selected take-level and stop-level), check with the currency strength indicator, and then enter into a trade.

Modes:

Early trend catcher - Waits for a change of trend and finds the best points to entry at the start. Works good with almost every pair. and It's recommended to use with the strength indicator.

Confirmed trend continuer - Already looking for a good entry points in an already started trend movement. Gives more solid results than the 'Early trend catcher mode' , but since the signals are more late, it's gonna be hard to catch the whole movement.

Late scalping - looks for the last possible movements before reversal. Works great on the lower timeframes.

Indicator's sensitivity:

The more sensitive the indicator is the more entries it will produce. If the "Low" sensitivity looks for more conservative trades, the ''Very Sensitive'' mod searches for the more scalping trades.

Take/Stop levels volatility factors:

If it set to 'Automatic', then depending on the indicator's sensitivity it will automatically set the size of the stop/take levels.

Or you can set the size of the stop/take automatically by picking one of the sets (X1-X6).