One of the brightest minds in the industry is a highly-respected market technician named Tom Demark. He has spent more than 40 years developing, trading and teaching his techniques to institutional professionals around the world, and continues to be actively involved in the financial markets.

Anyone who has lived through a waterfall market decline has got to wonder how people would have the nerve to try to catch the falling knife. So did Tom Demark. In the late 1970s he devised some indicators called TD Sequential and TD Combo, which successfully indicated in the area in which the market was sufficiently oversold for one expect a bottom to form or overbought for one to expect a top.

DeMark INDICATORS - Jason Perl. A great book about Demark indicators easy to read and understand. The theory is presented in a way which is very easy to understand. To guide you through the process and ensure your maximum success, I uploaded the book free of charge. The e-book will provide you all information and strategies required to apply the indicators effectively in any market.

On the other hand, this post is intended to be a quick reference for Td Sequential and TD Combo so we do not need to look for the rules each time in the book.

TD Sequential Trading Methodology

TD Sequential indicator consist of two components. TD Setup is the first one and it is a prerequisite for the TD Countdown – the second component.

1.TD Setup

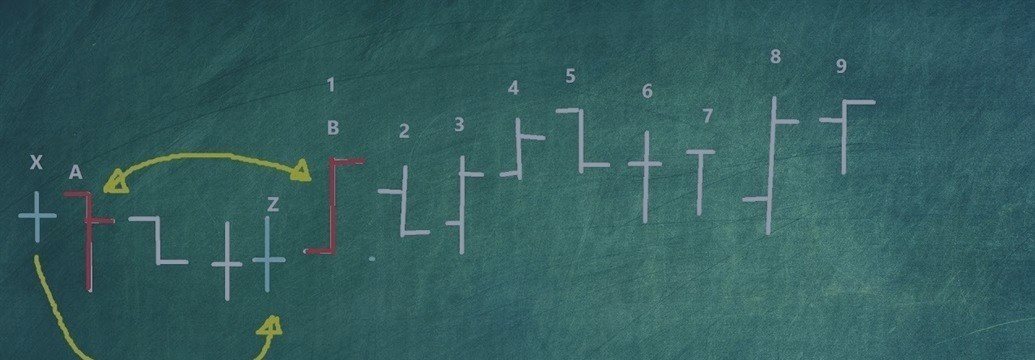

TD Setup compares the current close with the corresponding close four bars earlier. There must be nine consecutive closes higher/lower than the close four bars earlier.

TD Buy Setup - prerequisite is a bearish price flip, which indicates a switch from positive to negative momentum.

– After a bearish price flip, there must be nine consecutive closes, each one less than the corresponding close four bars earlier.

– Cancellation - If at any point a bar closes higher than the close four bars earlier the setup is canceled and we are waiting for another price flip

- Setup perfection – the low of bars 8 or 9 should be lower than the low of bar 6 and bar 7 (if not satisfied expect new low/retest of the low).

**TD Sell setup is the opposite of the above.

2.TD Countdown - after a setup is finished the countdown can begin from bar 9 of the setup.

TD Countdown compares the current close with the low/high two bars earlier and you count 13 bars. Unlike the Setup, the Countdown doesn’t have to be a sequence of 13 consecutive price bars. If it is interrupted you just do not count the bars and when it resumes you continue counting further.

TD Buy Countdown starts after the finish of a buy setup. The close of bar 9 should be less than the low two bars earlier. If satisfied bar 9 of the setup becomes bar 1 of the countdown. If the condition is not met than bar 1 of the countdown is postponed until the conditions is satisfied and you continue to count until there are a total of thirteen closes, each one less than, or equal to, the low two bars earlier.

Countdown qualifier - The low of Countdown bar thirteen must be less than, or equal to, the close of Countdown bar eight.

Countdown cancellation:

- A sell Setup appears. The price has rallied in the opposite direction and the market dynamic has changed.

- Close above the highest high for the current buy Setup (break of TDST for the current Setup)

- Recycle occurs ( new Setup in the same direction and recycle activated

**TD Sell Countdown is the opposite of the above.

TD Combo Trading Methodology

1.TD Combo

TD Combo is better when you have sharp directional moves, because it requires only thirteen price bars from start to finish compared to TD Sequential which needs at least 22 bars. The criteria for a Setup within TD Combo are the same with those required for a Setup within TD Sequential. The difference is that the count starts at bar 1 of the setup and not from bar 9 and TD Combo requires four conditions to be satisfied simultaneously.

Requirements for a TD Combo Buy Countdown

- Close lower or equal than the low 2 trading days earlier.

- The low of a countdown day should be less than the previous "trading day‘s" low

- The close of a countdown day should be less than the previous "trading day‘s" close

- The close of a countdowns day should be less than the previous "countdowns day‘s" close

- Bars 11,12,13 each one should just close successively lower and the other rules above are not applied

** TD Combo Sell is the opposite of the above.

Below is a recording of CQG’s live webinar to learn how experienced institutional investors integrate the DeMark Indicators into their trading process to time and anticipate changing market trends.

Demark indicators are also available in CQG platform and you need to pay 500 usd per month for demark indicators + 595 usd per month for the CQG platform. => https://www.cqg.com/products/product-comparison

Jim Cramer goes Off the Charts to explain the DeMark Indicators 3-24-20

March 24, 2020

CNBC "Mad Money" host Jim Cramer explains the DeMark Indicators in this week's Off the Charts segment.