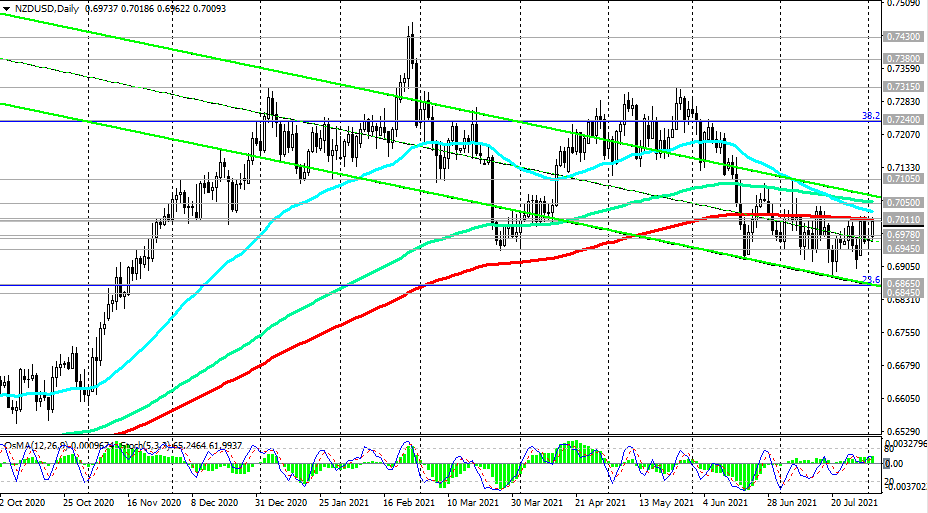

Having received support from the RBNZ, which announced its intention to tighten mortgage lending standards from October 1, the NZD / USD pair rose quite sharply during today's Asian session, making another attempt to break through the key resistance level of 0.7015.

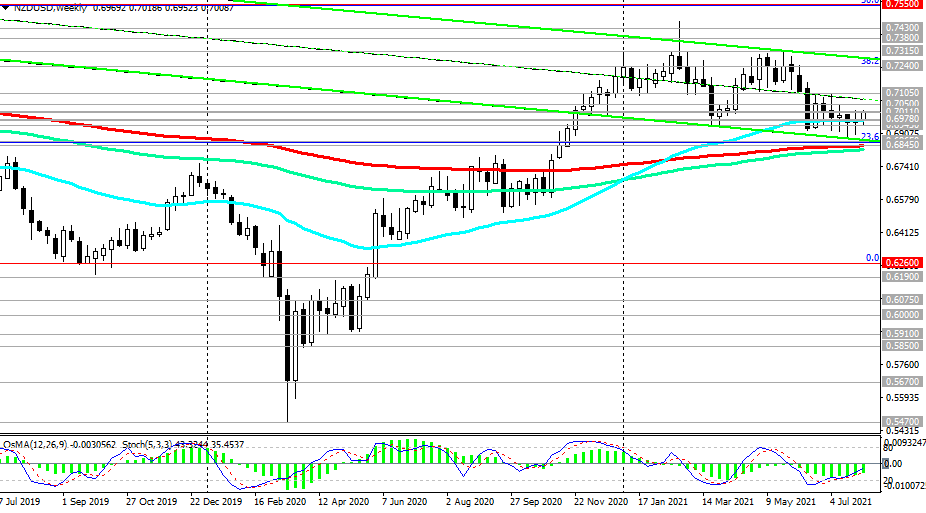

The price has broken through the important short-term resistance levels 0.6978, 0.7011, and the technical indicators OsMA and Stochastic on the 1-hour, 4-hour, daily, weekly NZD / USD charts signal long positions.

In the alternative scenario, and after the breakdown of the support level at 0.6978, NZD / USD will resume decline towards the lower border of the descending channels on the daily and weekly charts, passing near the marks of 0.6865, 0.6845. Key long-term support levels are also located at these marks. Their breakout could finally push the NZD / USD into a bear market zone and return it to the global downtrend that began in July 2014 (see also "Fundamental Analysis and Recommendations")

Sell Stop 0.6990. Stop-Loss 0.7020. Take-Profit 0.6978, 0.6970, 0.6945, 0.6900, 0.6865, 0.6845

Buy Stop 0.7020. Stop-Loss 0.6990. Take-Profit 0.7050, 0.7105, 0.7240, 0.7315, 0.7380, 0.7430, 0.7550, 0.7600

*) NZD/USD: Current Fundamental Analysis and Market Expectations

**) the most up-to-date "hot" analytics and trading recommendations (including entries into trades "by-the-market") - https://t.me/fxrealtrading