REVIEW OF FUNDAMENTAL EVENTS for 09/09/2020 EURUSD, GBPUSD, AUDUSD, USDJPY, XAUUSD

The European currency shows the flat dynamics of trading against the US dollar during today's morning session, having updated local minimums at the opening since August 21. The euro is falling ahead of the ECB meeting, at which the regulator is expected to discuss new measures to support the region's economy. In addition, the ECB is expected to comment on the sharp strengthening of the euro, as well as on targeting inflation levels, especially after the Fed changed its approach to calculating inflation targets. Macroeconomic statistics from Europe released on Tuesday were mixed. Thus, the employment rate in the eurozone in the 2nd quarter of 2020 decreased by 2.9% qoq after a decline of 2.8% qoq a quarter earlier. At the same time, the GDP of the eurozone (according to revised estimates) in the second quarter decreased by 11.8% qoq, while the forecast of a decrease by 12.1% qoq. In annual terms, the rate of decline in the region's economy was revised from -15% YoY to -14.7% YoY.

GBP / USD

AUD / USD

The Australian dollar is trading mixed against the US currency in trading this morning, consolidating near new local lows since August 26. The instrument's positions on Wednesday were supported by good macroeconomic statistics from Australia, while the pair is still under pressure amid attempts by the US dollar to recover. In addition, the Australian currency reacts negatively to the increased prospects for the introduction of negative interest rates after the controversial statements from the RBA last weekend. Anyway, the consumer confidence index in Australia in September from Westpac rose by 18% after falling by 9.5% in August. The volume of issued mortgage loans in July also increased significantly by 10.7% mom after increasing by 7.7% mom in the last month. Analysts expected the indicator to slow down to + 3.1% m / m.

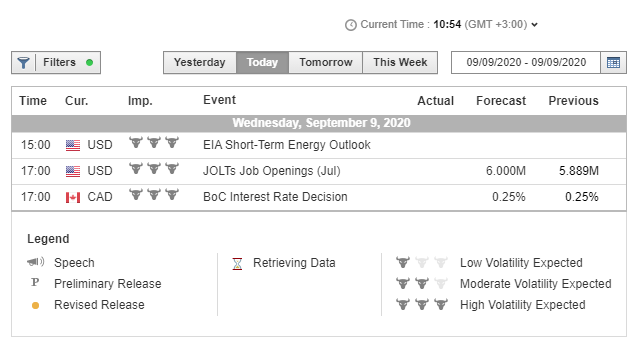

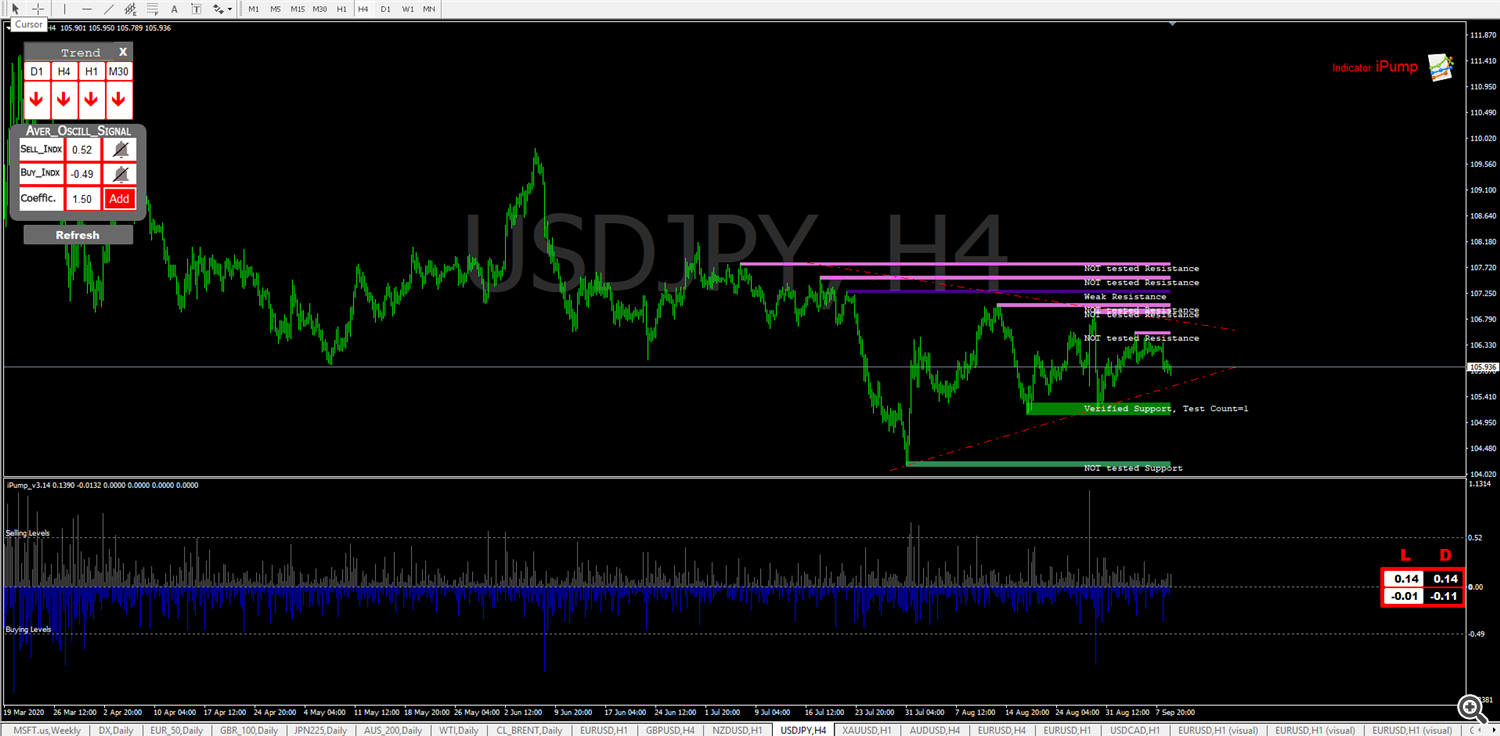

USD / JPY

The US dollar is falling against the Japanese yen in today's trading, developing a bearish signal, formed in the market after five trading sessions of uncertain growth. The instrument loses about 0.10% and is testing the level of 106.00 for a breakdown downward. American bulls are weakening at the beginning of the week, but there is still potential for their further strengthening. In turn, the Japanese yen is under the influence of controversial macroeconomic publications from Japan. Yesterday, investors reacted positively to the appearance of updated data on Japan's GDP dynamics for Q2 2020, which turned out to be better than market expectations. According to the new data, the indicator fell by 7.9% q / q and 28.1% y / y, while analysts expected a decline of 8.1% q / q and 28.6% y / y. At the same time, the Japanese economy showed a sharp decline in household spending by 7.6% y / y in July, which was more than twice worse than market forecasts.

XAU / USD

Gold prices are stable during today's Asian trading session, holding around 1930.00. On the eve of the quotes showed an active decline, updating their two-week lows, but by the close of the session the instrument managed to recover almost completely. Gold is supported by the forthcoming meeting of the ECB on Thursday, following which we can expect hints of further stimulation of the European economy and, possibly, a revision of inflation target levels. The next Fed meeting will take place next week, but the American regulator has already said its word. Additional support for "safe" gold is provided by another round of aggravation in relations between the United States and China, after Donald Trump announced his intention to "finally break the dependence of the US economy on China" in the event of his re-election.

And at this the review came to an end. I wish you profitable trades, remember that your success should not depend on any one trade, you need to try to be in the black at the distance, and for this it is enough to earn only 3 out of 10 trades, how? - your reward to risk ratio should be more than one to three. Therefore, always remember about the 📈

risk (use forex calculator), consider it correctly and then your trading will be successful! Wish you a successful trading day your SeniorTrader.

In order not to miss the following market overview, as well as to be aware of the news of the project SeniorTrder Subscribe to our telegram channel 👉Telegram Channnel https://t.me/SeniorTrader_Channel

Tools that I use in trading

The iPump indicator was used for this analysis

https://www.mql5.com/en/market/product/39895

Indicator defining the trend, levels, overbought / oversold

EA Pump and Dump Pro

https://www.mql5.com/en/market/product/51395

https://www.mql5.com/en/market/product/51395

Multifunctional robot (averaging/piramiding/strategy for overclocking a deposit)

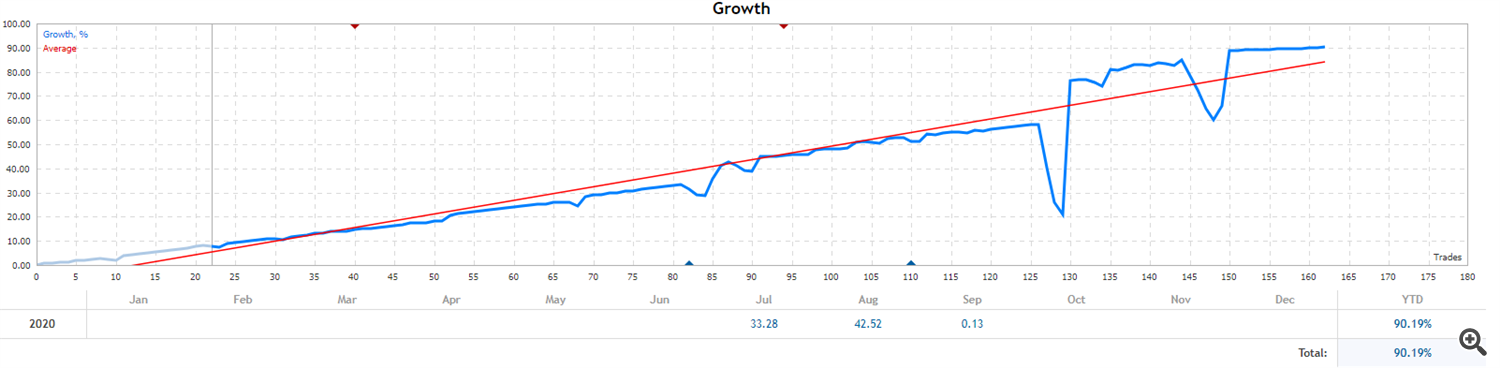

EA Long Term Strategy

https://www.mql5.com/en/market/product/35069

Trading strategy in the EA Long Term Strategy (fix stop loss, safe strategy)

#EURUSD #GBPUSD #NZDUSD #USDJPY #XAUUSD 09.09.2020analysis