How to trade with FX Volume

Below you'll find detailed illustration of how to work with FX Volume and how to use the information it provides.

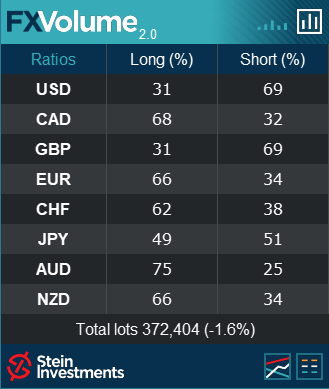

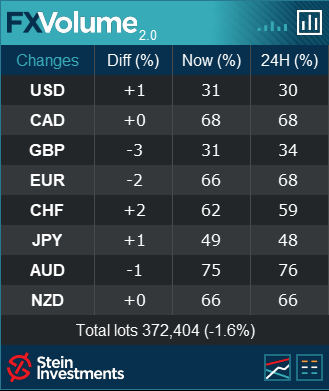

The Long/Short Ratio displays the overall trading positions

from a Broker's point of view.

For example, we do have 100'000 lots currently open in USD and the USD long/short ratio is 31/69.

This means 31'000 lots are open in USD BUY positions and 69'000 lots are open in USD SELL positions.

THIS IS REAL RETAIL BROKER DATA and we display all information FROM A BROKER POINT OF VIEW.

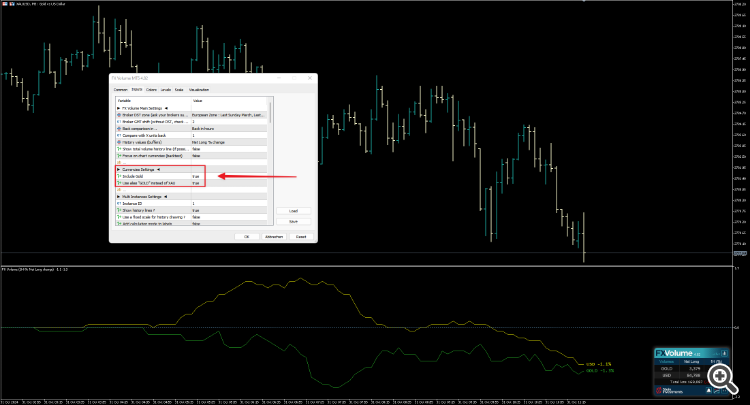

And what is this Changes view about?

The "24H" and "Now" values are a comparison of two values.

"Now" is the current real-time long ratio while "24H" displays the long ratio 24 hours ago

(this value can be changed in the settings).

The reason for this comparison is that we want to know how the long ratio of a single currency

evolved within a specific time period.

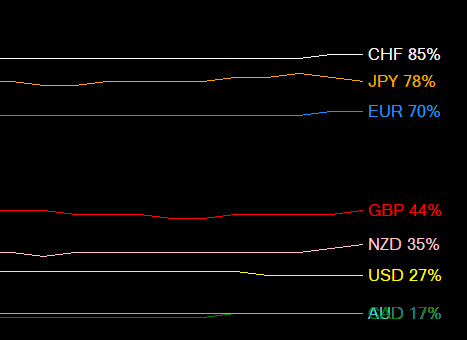

Of course, you'll see the historical changes in all details at the drawn history lines as well.

All this is significant to determine whether a currency is getting stronger or weaker

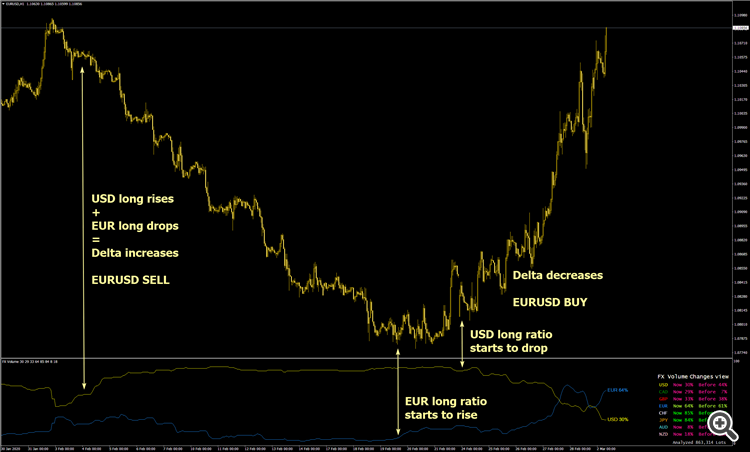

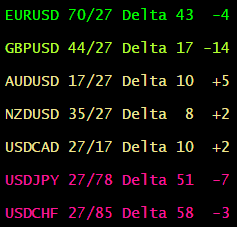

And what about the significance of the + & - Delta's in the symbol list?

The Delta between two currencies is either neutral, decreasing or increasing.

A neutral or unchanged Delta indicates a sideways move because there is no significant change in the long/short ratio of the trading volume of the underlying currencies.

An increasing Delta indicates an establishing or strengthening trend move because either one currency is getting stronger or the other one is getting weaker or both move

A decreasing Delta indicates the end of a trend move or at least weakening/unstable trading conditions for trend traders.

And what about the analyzed volume seen in the footer of the panel?

![]()

The analyzed lots show the total volume at the retail brokers we currently analyze in our data center.

This week we started with over 1'030'000 lots of trading volume which dropped by more than 55% so far.

My observation so far was: If the total volume is decreasingwe see unstable trading conditions and

mostly sideways move because people close their trades and money is flooding out of the market.

If the total volume rises trust is coming back, people open new trading positions

and we see stable trend moves like last Thursday and Friday.

Interesting, isn't it?

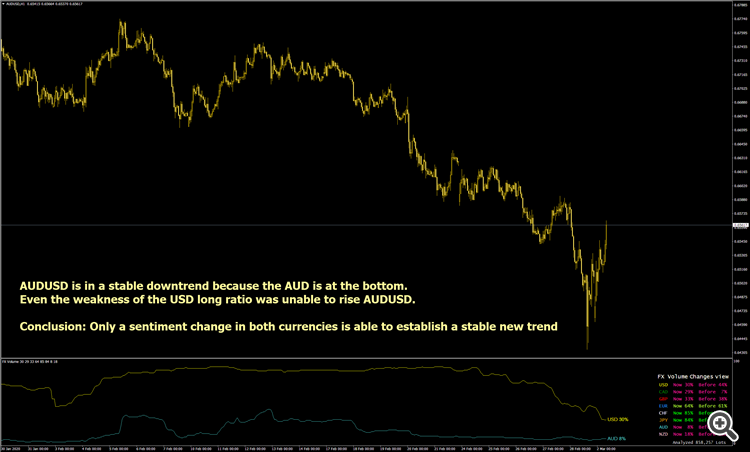

Below you'll find some trading charts with further information.

So please enlarge the screenshot below by clicking on it to see it in full size.

Example on EURUSD

Example on AUDUSD

Example on USDCHF

You want to know more about FX Volume?

Click on the logo to access it's product page