(16 FEBRUARY 2019)WEEKLY MARKET OUTLOOK 2 :Crude Oil Surging amid OPEC+ Deepening Cuts

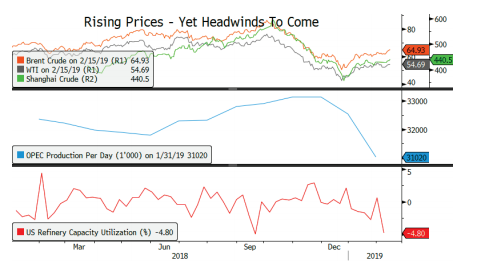

It seems that oil traders stay optimistic about the outlook of oil prices. The rise in EIA crude inventories data seems to have become average, as attention turns to OPEC+ members which have decided to tighten oil supply further, allowing all three crude oil futures Brent, WTI and Shanghai to rise by +5%, +4.30% and +3% respectively, their highest range since 3 months. However, a comeback of growth slowdown concerns could counterbalance recent oil gains while foggy SinoAmerican trade talks remain. Indeed, the recent headlines have been supporting crude prices since US sanctions against Venezuela’s oil giant PDVSA causes supply shortages while US refineries whose configuration requires a combination of both light and heavy crudes in order to produce gasoline and diesel efficiently, poses short-term issues. Furthermore, December pledge from OPEC + to cut oil output by a joint 1.2 million bpd is taking effect. Saudi Arabia remains the largest contributor in output reduction, estimated at 450’000 bpd while the technical issue faced in its offshore Safaniyah oil field, whose production can reach up to 1.5 million bpd, should be fixed along March, thus helping oil prices. Russian vow to decrease production by a total of 228’000 bpd by May 2019 (currently estimated at 140’000) should also support prices looking forward.

Yet, although total OPEC cut in January of 1.53 million bpd should deepen thanks to Saudi Arabia’s plan to remove an additional 500’000 by March, making up to 80% of OPEC+ initial reduction agreement, it appears that the macroeconomic outlook remains bearish in the medium-term. Weakening economic growth in the US, EU and Asia in association with a continued rise in US output beyond 12 bpd by the end of 2019 should maintain brent crude prices in a range of 60 – 70 in the coming months.

By Vincent Mivelaz