Randal Quarles, deputy chairman of the US Federal Reserve System for Supervision of the Banking Sector, said Wednesday that he was worried about the negative impact of events taking place abroad. “Global risks are probably the most significant”, said Quarles, pointing in particular to the slowdown in China’s GDP growth. Chinese imports occupy the lion’s share of New Zealand exports.

The slowdown of the world and Chinese economies have the most negative impact on commodity prices, as well as on commodity currencies, including the New Zealand dollar.

On Thursday, the NZD declines after the publication on the eve of the weaker-than-expected data from the New Zealand labor market. According to the Statistics Bureau of New Zealand, unemployment in the country increased in the 4th quarter of 2018 (4.3% versus 4.0% in the 3rd quarter and 4.1%, as expected, according to the forecast).

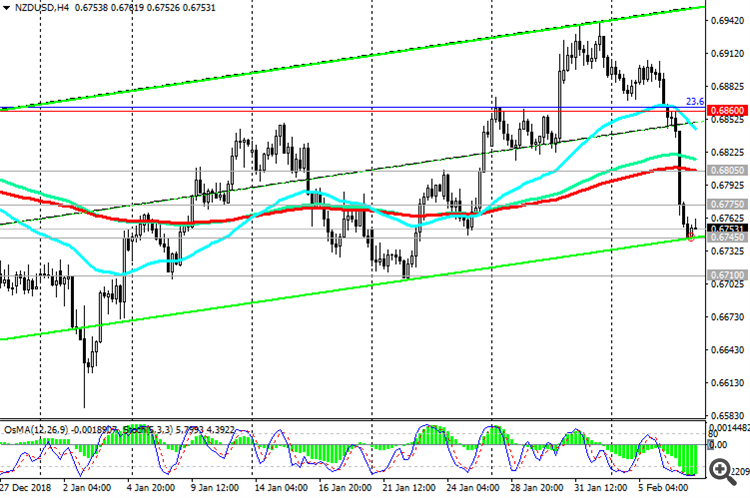

At the beginning of the US trading session, NZD / USD is trading below key levels of 0.6805 (ЕМА200 on the daily chart), 0.6775 (ЕМА144 on the daily chart), near 0.6745, through which the bottom line of the ascending channel passes on the 4-hour chart. In the event of a breakdown of the support level of 0.6745, NZD / USD will go to the nearest local support level of 0.6710, a breakdown of which will mean the return of NZD / USD to a bearish trend.

Only after NZD / USD returns to the zone above the resistance level of 0.6805, will it be possible to return to NZD / USD purchases again.

Probably, before the RBNZ meeting on monetary policy, which will take place on February 12, the New Zealand dollar will remain under pressure, given the overall negative external macroeconomic background. If the RBNZ signals a propensity to reduce the rate, the New Zealand dollar may decline significantly.

If the Fed again announces the possibility of a rate hike this year, the negative fundamental background for the New Zealand dollar in its dynamics against the US dollar will increase significantly.

Resistance Levels: 0.6745, 0.6710, 0.6655, 0.6515, 0.6430

Support Levels: 0.6775, 0.6805, 0.6860, 0.6970, 0.7080

Author signals - https://www.mql5.com/en/signals/author/edayprofit

Trading recommendations

Sell Stop 0.6735. Stop Loss 0.6785. Take-Profit 0.6710, 0.6655, 0.6515, 0.6430

Buy Stop 0.6785. Stop Loss 0.6735. Take-Profit 0.6805, 0.6860, 0.6970, 0.7080