NZD/USD: market expectations in connection with the meetings of the Fed and the RBNZ

On Wednesday, the two largest world central banks will hold meetings and decide on the interest rate. The Federal Reserve's decision on the interest rate will be published at 18:00 (GMT). It is widely expected that the rate will be increased by 0.25% to 2.25%, and this increase is already included in the price. Investors are more interested in the press conference and the opinion of Federal Reserve Chairman Powell on the prospects for monetary policy for 2019.

If Powell signals about the possibility of a faster increase in the interest rate, this will cause the dollar to strengthen and the US stock markets fall. Any hint of Powell that the Fed can pause, will bring down the dollar.

On the part of the RB of New Zealand, investors do not expect a change in the current monetary policy, despite strong macro data published last week. As the Bureau of Statistics of New Zealand reported, the country's GDP grew by 1.0% in the second quarter or by 2.8% in annual terms (the forecast was + 0.8% and + 2.5%, respectively). The pace of economic growth exceeded the expectations of the central bank by two times.

Moreover, the comments of the bank may indicate the possibility of lowering interest rates if economic growth does not accelerate. Probably, the head of RBNZ Adrian Orr will once again confirm the bank's desire to pursue a soft monetary policy, which will lead to pressure on the New Zealand currency. In any case, the volatility in the New Zealand dollar trade is expected to grow during the RBNZ press conference, which will begin on Wednesday at 22:00 (GMT).

The different focus of monetary policy in the US and New Zealand will further increase the difference between interest rates in the US and New Zealand. And this is the main fundamental factor for further reduction of NZD / USD. The main global trend of the pair NZD / USD, is still bearish.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Trading scenarios

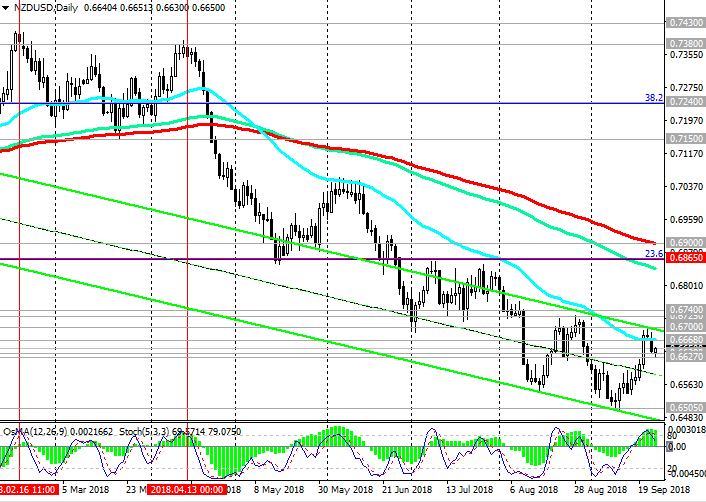

On Thursday, the NZD / USD attempted a breakdown of a strong resistance level of 0.6668 (EMA50 on the daily chart). Nevertheless, the breakdown of this level turned out to be false, and NZD / USD again declines, heading down the descending channel on the daily chart. Its lower limit passes below the local support level of 0.6505 (the lows of the year and September).

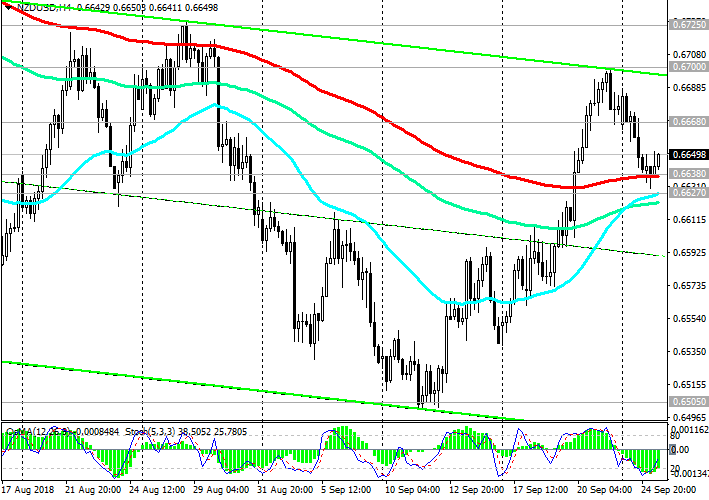

A confirmation of the resumption of the main scenario is the breakdown of the short-term support levels 0.6638 (EMA200 on the 4-hour chart), 0.6627 (EMA200 on the 1-hour chart).

A signal for the development of an upward correction may be a breakdown of the local resistance level of 0.6700. The correction target can be resistance levels of 0.6725, 0.6740. Long-term growth targets are resistance levels of 0.6865 (Fibonacci level 23.6% of the upward correction to the global wave of the pair's decline from the level of 0.8800, which began in July 2014; the minimums of the wave are near 0.6260), 0.6900 (EMA200 on the daily chart).

Nevertheless, short positions are preferable.

Support levels: 0.6638, 0.6627, 0.6600, 0.6585, 0.6505, 0.6410

Resistance levels: 0.6700, 0.6725, 0.6740, 0.6800, 0.6865, 0.6900

Trading Scenarios

Sell Stop 0.6625. Stop-Loss 0.6670. Take-Profit 0.6600, 0.6585, 0.6505, 0.6410

Buy Stop 0.6670. Stop-Loss 0.6625. Take-Profit 0.6700, 0.6725, 0.6740, 0.6800, 0.6865, 0.6900

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com