Today is the last trading day of the outgoing year, and the dollar remains the focus of investors' attention, demonstrating a large-scale decline. This year became worst in a decade for the index of the dollar WSJ, dropping from the beginning of the year by 7.3%.

Euro since the beginning of the year has strengthened to the dollar by 13.6%, which was the maximum growth since 2003. The British pound in 2017 rose to the dollar by 9.1%, and this happens despite the still unclear prospects for negotiations of the UK with the EU over Brexit.

In December, finally, the US Senate fully approved tax reform, which envisages an unprecedented tax cut from US corporations from 35% to 21% (previously 20% was assumed). Reform, according to its supporters, should support the growth of the US economy. It will also accelerate inflation, which will allow the Fed to accelerate the pace of tightening policies in 2018.

And, nevertheless, investors are actively selling the dollar, the fall of which does stop neither positive US macro statistics, nor adoption of new tax legislation in the US, nor the Fed's actions to tighten monetary policy. As you know, the Fed raised interest rates three times in 2017, and three more increases are scheduled for 2018.

Probably, the focus of investors' attention in 2018 will be the dynamics of wages in the US. Most taxes will be reduced from January, and by February many workers will take higher salaries. If wages are growing steadily, then, while maintaining the stability of the economy and the US labor market, interest rates can rise faster than market participants suggest.

It is possible that the actions of the Fed will still be able to reverse the situation in the new year with a deteriorating attitude toward the dollar. The reason for the reversal of the market and the bearish trend of the dollar may be the repatriation of profits earned abroad by US companies. As is known, within the framework of the tax reform, a one-time privilege for the repatriation of profits and capital to the United States is envisaged. If in the next few months US companies begin to return money to the United States, earned in other countries, it will cause an increase in demand for the dollar.

In recent months, unexpected movements and fluctuations in exchange rates have occurred on the market. Also, we should not discount the earlier statements of Donald Trump about the need for a weak dollar, including in order to increase the competitiveness of American goods abroad.

Thus, the intrigue around the dollar and its dynamics in the new year persists.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

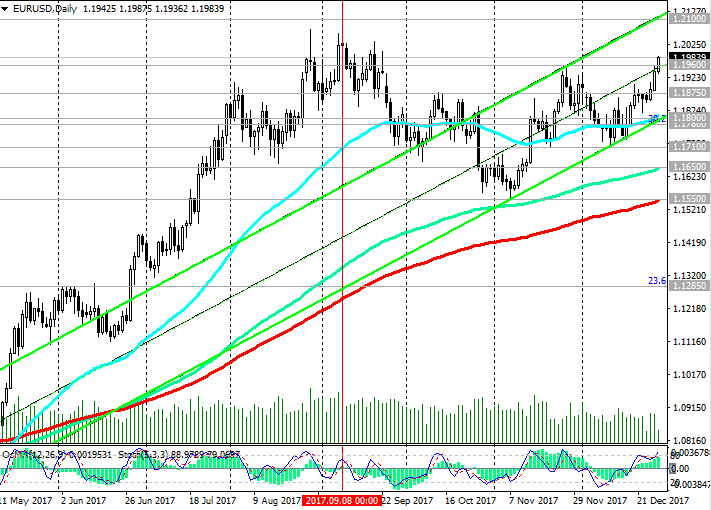

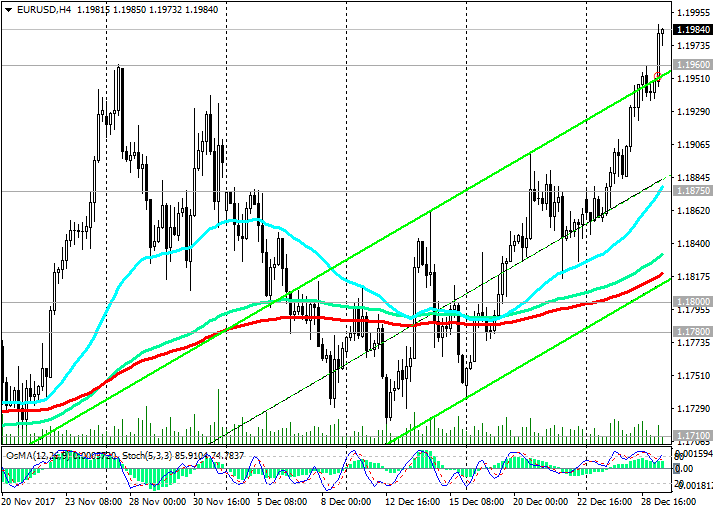

The pair EUR / USD remains positive dynamics, trading in the ascending channels on the daily and weekly charts.

Indicators OsMA and Stochastics on the 4-hour, daily, weekly charts recommend long positions.

At the beginning of the European session, the pair EUR / USD broke through the resistance level at 1.1960 (November highs) and continues to rise towards the upper border of the rising channel on the daily chart and 1.2100 mark.

You can return to consideration of short positions only after the breakthrough of the short-term support level 1.1875 (EMA200 on the 1-hour chart). And only after the price returns to the zone below the support levels 1.1800 (EMA50 and the bottom line of the upward channel on the daily chart), 1.1780 (Fibonacci level 38.2% of corrective growth from the lows reached in March 2015 in the last wave of global decline from 1.3900) you can return to consideration of short (already mid-term) positions with targets at support level 1.1550 (EMA200 on the daily chart).

So far, long positions are preferable.

Support levels: 1.1960, 1.1900, 1.1875, 1.1850, 1.1800, 1.1780, 1.1710, 1.1650, 1.1540

Resistance levels: 1.2000, 1.2100, 1.2180, 1.2320, 1.2430

Trading Scenarios

Sell Stop 1.1930. Stop-Loss. Take-Profit 1.1900, 1.1875, 1.1850, 1.1800, 1.1780, 1.1710, 1.1650, 1.1550

Buy in the market. Stop-Loss 1.1930. Take-Profit 1.2000, 1.2050, 1.2100, 1.2180, 1.2320, 1.2430

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com