Mass arrests in Saudi Arabia, including members of the royal family, a missile attack on this country by Yemeni rebels, as well as the appearance of risks of slipping in the implementation of the plans of the presidential administration for tax reform, provoked purchase of gold as a safe haven.

December gold futures on COMEX finished trading on Wednesday with an increase of 0.6%, at $ 1,283.70 per troy ounce.

Reports in the press that the US Republican Party can make changes to its tax reform plan or postpone it for a year, provoked a decline in quotations of the dollar. Some economists believe that tax reform can spur the growth of the US economy and allow the Federal Reserve to raise interest rates at a faster pace. Expectations for raising rates tend to put pressure on gold, which can not compete with more profitable assets with rising borrowing costs.

Under conditions of a soft monetary policy in the US and against the backdrop of geopolitical or economic uncertainty, the price of gold, as a rule, is growing.

As a result, gold prices on Wednesday closed at 2-week highs, and with the opening of today's trading day quotes on it are rising again.

So, the spot price for gold at the beginning of today's European session is near the mark of 1284.00 dollars per troy ounce.

Of the news for today, we are waiting for publication at 13:30 (GMT) of weekly data on the labor market (number of applications for unemployment benefits) for the United States. According to the forecast, a slight increase in the indicator is expected - up to 231,000 versus 229,000 for the previous period. However, this figure remains below 300,000 for almost 140 consecutive weeks, which is the longest period since 1970. The consistently low level of applications for unemployment benefits is one of the signs of a strong US labor market.

The stable state of the labor market in the US and the low level of unemployment (just above 4%) is a powerful argument for the Fed in considering the possibility of tightening monetary policy in the US. And this is a downward factor for the price of gold.

According to the CME Group, the probability of a rate hike in December is taken into account by investors in about 97%.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

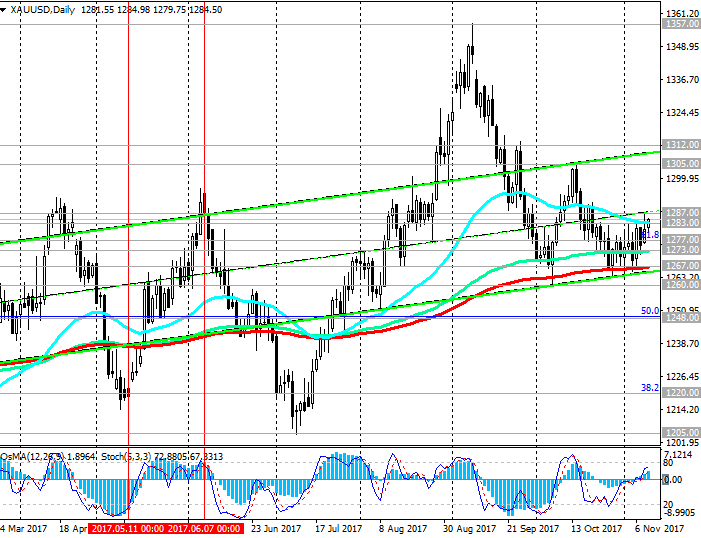

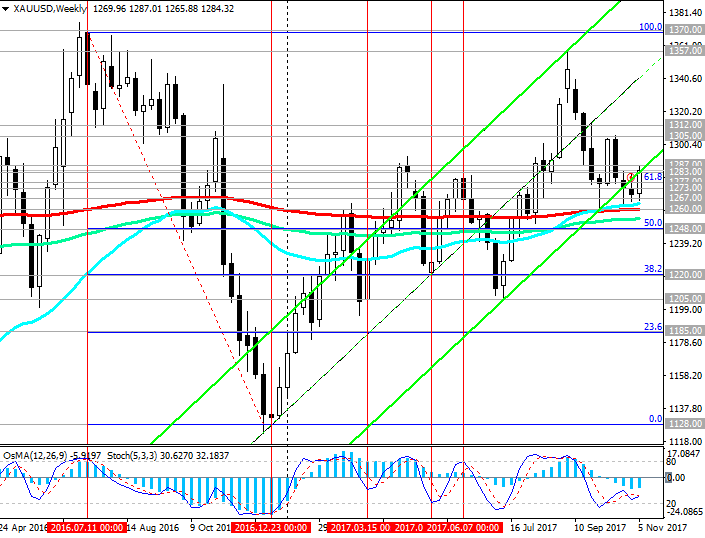

With the opening of today, the XAU/USD is growing, making an attempt to gain a foothold above the short-term resistance level at 1283.00 (EMA50 on the daily chart, EMA200 on the 4-hour chart). Through the mark of 1283.00 also passes the lower limit of the ascending channel on the weekly chart.

If the price is fixed above the local resistance level of 1287.00 (weekly highs), risk of the returning XAU/USD to the upward channel on the weekly chart, the upper limit of which runs near the resistance level of 1370.00 (the beginning of the wave of decline since July 2016 and the Fibonacci level of 100%) grows.

The reverse scenario involves a breakdown of the support level of 1277.00 (Fibonacci level 61.8% correction to the drop in the wave from July 2016 and EMA200 on the 1-hour chart) and a decline to support levels of 1267.00 (EMA200 on the daily chart), 1260.00 (EMA200 on the weekly chart).

The breakdown of the support level of 1248.00 (the Fibonacci level of 50%) raises the risk of the XAU/USD returning to the downtrend.

Indicators OsMA and Stochastics on the weekly, monthly charts went to the side of sellers.

Support levels: 1277.00, 1273.00, 1267.00, 1260.00, 1248.00

Resistance levels: 1283.00, 1287.00, 1290.00, 1305.00, 1312.00, 1340.00, 1350.00, 1357.00

Trading Scenarios

Sell Stop 1281.00. Stop-Loss 1286.00. Take-Profit 1277.00, 1273.00, 1267.00, 1260.00, 1248.00

Buy Stop 1286.00. Stop-Loss 1281.00. Take-Profit 1290.00, 1305.00, 1312.00, 1340.00, 1350.00, 1357.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com