XAU/USD: gold continues to fall in price against the background of dollar strengthening

The dollar continues to strengthen in the foreign exchange market, and gold - to decline in price amid news and talk about the appointment of President Donald Trump the new chairman of the Fed.

Among the candidates for this post is Stanford University economist John Taylor, who is more inclined to tighten monetary policy than current chairman Janet Yellen. Yes, and Janet Yellen herself can count on the extension of her powers after the end of January when 4-year term of her stay at the head of the Fed expires.

If Trump suggests Janet Yellen to remain in office for a second term, it will also become a positive factor for the dollar, as Yellen consistently advocates a phased tightening of monetary policy.

Many economists believe that if the new FRS chairman is appointed, monetary policy in the US will become even more rigid. According to CME Group, the probability of a rate hike in December is taken into account by investors in more than 90%.

The index of the dollar WSJ recently added 0.22% to 87.19, while over the past week it grew by 0.77%. The ICE dollar index climbed 0.6%, to a maximum since October 6, 93.70.

The growth of the dollar is also promoted by the draft budget approved last Friday in the US Congress. "Adoption of the budget is critical for tax reform that will strengthen our economy after several years of stagnation under the previous administration," said Mitch McConnell, leader of the Republican majority in the Senate.

Waiting for tax cuts in the new economic policy of the administration of the US President Donald Trump contributes to the growth of the dollar and US stock indices, and, accordingly, the fall in gold prices.

On Friday, December gold futures on COMEX closed with a decrease of 0.7%, at 1280.50 dollars per troy ounce. The prices for gold fell on the results of five of the last six weeks.

In the future, investors will also explore new US economic data. Low inflation can change the approach of the central bank in relation to interest rates and again support the price of gold. Traders also monitor the development of geopolitical tensions, which can support gold, popular as a safe haven in periods of uncertainty. With the growth of borrowing costs, gold competes worse with more profitable assets, for example, treasury bonds, and is declining, but the demand for gold is growing with the aggravation of geopolitical tensions. Usually, against the backdrop of growing geopolitical or financial uncertainty, the price of gold, as an asset-shelter, is growing.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

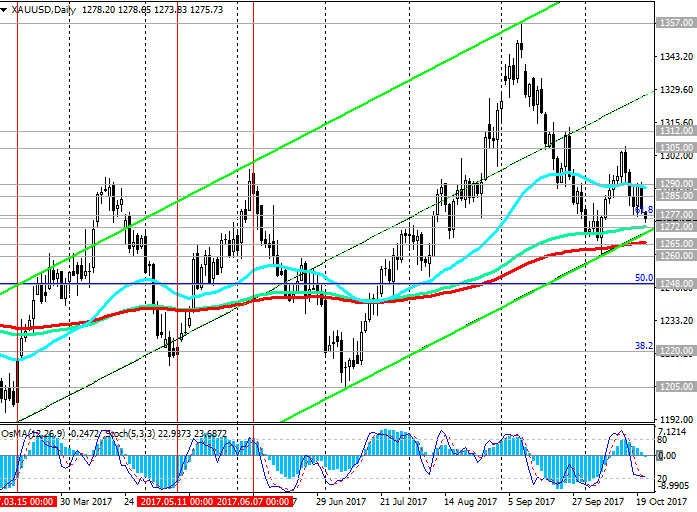

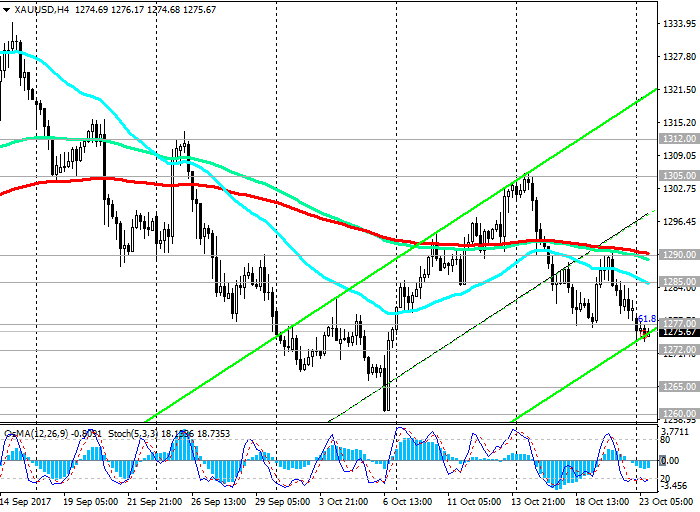

Since the opening of today, the pair XAU / USD is declining, and at the beginning of the European session is trading near the support level of 1277.00 (Fibonacci level 61.8% correction to the wave of decline since July 2016).

Indicators OsMA and Stochastics on the 4-hour, daily, weekly charts went to the side of sellers.

The pair XAU / USD broke short-term support levels of 1290.00 (EMA200, EMA144 on the 4-hour chart), 1285.00 (EMA200, EMA144 on the 1-hour chart) and develops the descending dynamics, decreasing to the support levels of 1272.00 (EMA144 and the lower border of the ascending channel on the day graph), 1265.00 (EMA200 on the daily chart), 1260.00 (EMA200 on the weekly chart). The breakdown of the support level of 1248.00 (the Fibonacci level of 50%) raises the risk of the pair XAU / USD returning to the downtrend.

The signal for the resumption of growth of XAU / USD will be a breakdown of the resistance level of 1290.00. Breakdown of local resistance levels at 1305.00, 1312.00 will confirm the return of the bullish trend within the upward channels on the daily and weekly charts, the upper limit of which runs near the resistance level of 1370.00 (the beginning of the wave of decline since July 2016 and the Fibonacci level of 100%).

Support levels: 1272.00, 1265.00, 1260.00, 1248.00

Resistance levels: 1285.00, 1290.00, 1305.00, 1312.00, 1340.00, 1350.00, 1357.00

Trading Scenarios

Sell in the market. Stop-Loss 1282.00. Take-Profit 1272.00, 1265.00, 1260.00, 1248.00

Buy Stop 1292.00. Stop-Loss 1282.00. Take-Profit 1305.00, 1312.00, 1340.00, 1350.00, 1357.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com