Brent: the plan to reduce the excess supply is not working.

On Monday in St. Petersburg is a meeting of some members of OPEC and countries outside the cartel. Saudi Energy Minister Khaled Al-Falih and Russian Energy Minister Alexander Novak will chair this meeting. The risk of failure of a deal to reduce oil production is in full swing, although, according to the Saudi Energy Minister, the degree of observance of quotas for oil production in the history of OPEC is a record, and the total degree of compliance with oil production quotas for 6 months was 98%. It was assumed that the agreement would reduce world oil production by almost 1.8 million barrels a day and lead to a reduction in excess supply in the market. In recent days, there has been some recovery in prices against the weakening dollar. However, oil prices remain steadily low due to the continued oversupply.

It seems that the oil cartel still does not know how to deal with the US extraction, which remains outside the control of OPEC. Producers of oil shale in the US took advantage of the situation and, lowering the cost, increased production.

Quotations of Brent crude oil fell 2.5% to $ 48.06 per barrel on Friday, due to doubts about OPEC's ability to restore balance on the market.

According to the report of the oilfield service company Baker Hughes, presented on Friday, which is an important indicator of the activity of the oil sector of the US economy and significantly affects the quotes of oil prices, the number of active drilling platforms in the US is 764 units. The US increased production by 750,000 barrels a day to 9.3 million barrels a day, the highest since summer 2015. In fact, by the efforts of the US alone, more than a third of the reduced production was offset. According to OPEC representatives, one should not expect that some important actions will be taken Monday, although Nigeria, which, being a member of OPEC, remained outside the framework of the agreement, agreed to limit oil production to the level of 1.8 million barrels a day. Negotiations on limiting production in Libya and Nigeria are still underway.

It is likely that without additional measures, OPEC will not be able to reverse the situation with an excessive supply of oil. And against this background, oil prices will be subject to further decline. As long as the dollar stabilizes in the foreign exchange market, the pressure on oil prices will increase.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

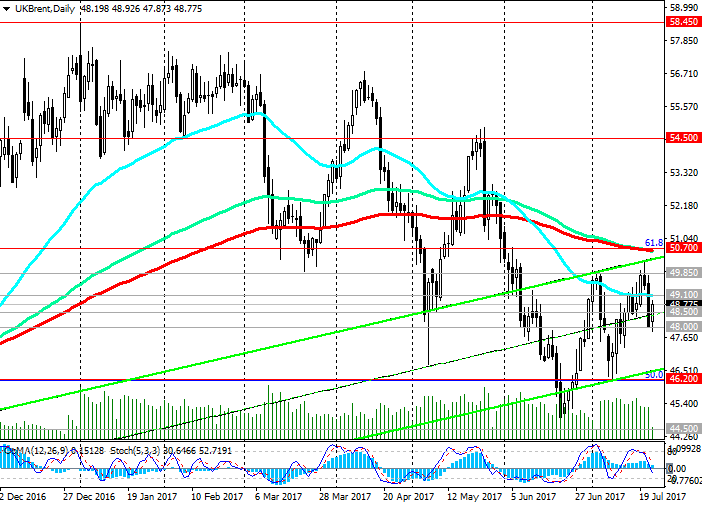

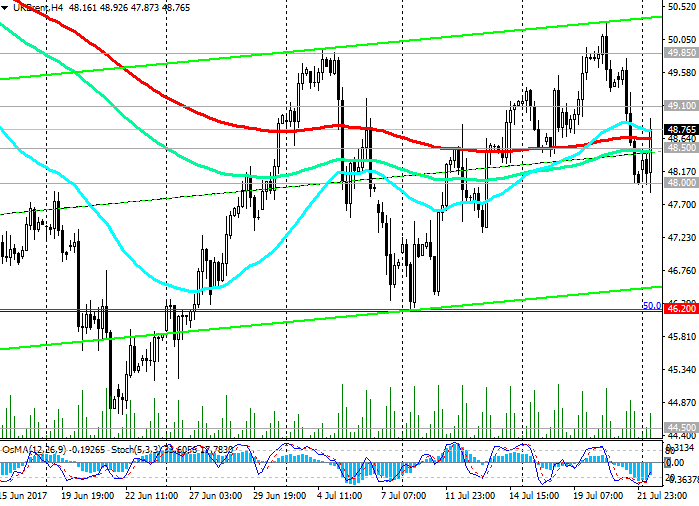

The price of Brent crude continues, meanwhile, to move in the uplink on the daily chart near the important support level of 48.50 (EMA200 on the 4-hour chart).

Indicators OsMA and Stochastics on the 1-hour, 4-hour charts turned to long positions. If the price can consolidate above the short-term resistance level 49.10 (EMA50 on the daily chart), its growth may continue to the resistance level of 50.70 (EMA200, EMA144 on the daily chart, and the Fibonacci level of 61.8% correction to the decline from the level of 65.30 from June 2015 Year to the absolute minimums of 2016 near the mark of 27.00). Nevertheless, while the price is below the level of 50.70, the negative dynamics prevails. In case of breakdown of the 48.00 support level and renewal of the decline, the targets will be support levels of 47.70, 46.20 (50% Fibonacci level), 44.50 (year lows). The more distant goal is the level 41.70 (the Fibonacci level of 38.2% and the lower boundary of the descending channel on the weekly chart).

Only in the case of fixing the price above the level of 50.70 can we again consider medium-term long positions.

Support levels: 48.50, 48.00, 47.70, 46.20, 45.50, 44.50, 41.70

Levels of resistance: 49.10, 49.85, 50.70, 51.00

Trading scenarios

Sell Stop 48.40. Stop-Loss 49.20. Take-Profit 48.00, 47.70, 46.20, 45.50, 44.50, 41.70

Buy Stop 49.20. Stop-Loss 48.40. Take-Profit 49.60, 50.00, 50.70, 51.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com