The victory of Macron in the first round of the presidential elections in France reduced investors' anxiety over the possible victory of the far-right candidate Marin Le Pen in the French elections. As you know, Marin Le Pen acts with a radical program on migration, as well as the continued presence of France within the European Union and NATO.

If Macron succeeds in winning in the second round, this will be the second defeat of the supporters of secession from the European Union after the Netherlands. And this, in turn, will revive the propensity of investors to buy risky assets and lower prices for precious metals.

So, the June gold futures on COMEX fell yesterday in the price to the level of 1277.50 dollars per troy ounce, the lowest closing level since April 7, showing the strongest daily decline since March 10.

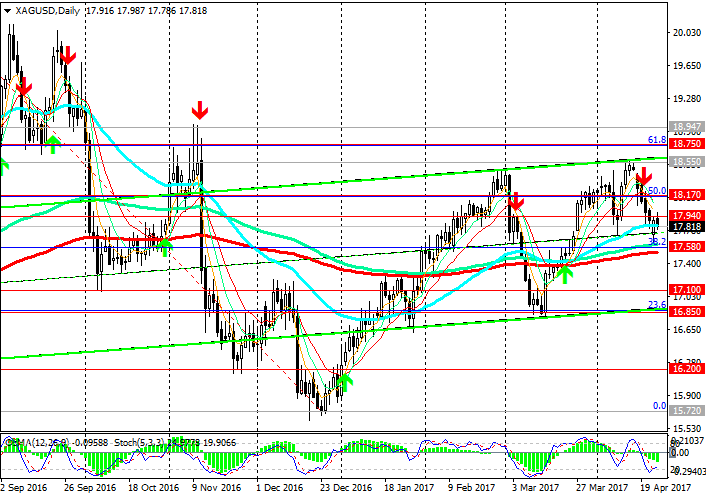

The spot price for silver is also declining today, continuing the series of falls from recent monthly and annual highs near the level of 18.55 dollars per troy ounce. The decrease from this level was already 4.2%.

And yet, on the eve of the second round of the presidential elections in France (the vote will be held on May 7), the weakening of the US dollar, the continuing geopolitical uncertainty will contribute to the preservation of demand for precious metals.

Investors are also concerned about the uncertainty regarding the timing of the start of the tax reform of US President Donald Trump, although the plan for reform Trump promised to present this week.

If the Fed starts implementing a plan to reduce its budget and increase the interest rate, as well as the first positive results in the implementation of the new economic policy in the US, the dollar will receive a powerful impetus to resume large-scale growth. This will lead to lower prices for precious metals, including silver.

Today we are waiting for data from the USA. At 14:00 (GMT), the US consumer confidence level for March is published, as well as data on sales of new housing in the US in March. These data are an important indicator of consumer confidence in the growth of the economy and the US real estate market. The increase in sales of houses also contributes to stimulating the accompanying spheres of industry, services, and the labor market. A high result strengthens the US dollar, low - weakens. Forecast: the level of consumer confidence will come out with a value of 123.7 (compared to 125.6 in February), sales of new homes in March decreased by 0.5%. If the forecast is confirmed or is worse, the dollar will react with a decline.

In any case, during the publication of data, the volatility in the dollar is expected to grow, including in the pair XAG / USD.

Support and resistance levels

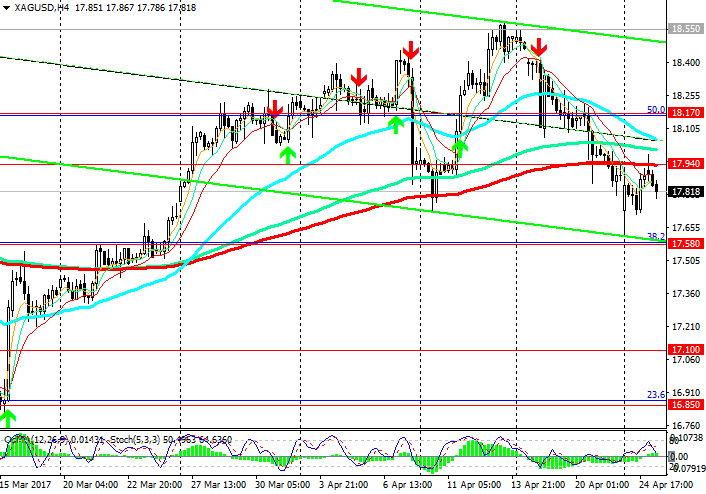

The pair XAG / USD continues the almost non-stop decline for the seventh consecutive session.

The XAG / USD pair broke through the important support levels of 18.17 (the Fibonacci level of 50% of corrective growth to the fall of the pair since August 2016 and the level of 20.59), 17.94 (EMA200 on the 4-hour chart) and continues to decline to an important support level of 17.58 (EMA200 on the daily chart And the Fibonacci level of 38.2%).

Indicators OsMA and Stochastics on the 4-hour, daily, weekly charts went to the side of sellers.

The break at the level of 17.58 raises the risk of further reduction of the pair XAG / USD and its return to a downtrend with a long-term target of 15.72 (the low of 2016).

You can return to consideration of long positions after fixing the pair above the level of 17.94.

Support levels: 17.58, 17.10, 16.85, 16.20, 15.72

Levels of resistance: 17.94, 18.17, 18.55, 18.75

Trading Scenarios

Sell Stop 17.77. Stop-Loss 17.92. Take-Profit 17.58, 17.10, 16.85, 16.20, 15.72

Buy Stop 17.92. Stop-Loss 17.77. Take-Profit 18.00, 18.17, 18.55, 18.75

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics