Yesterday, the dollar was able to recover part of the losses incurred the day before. Yesterday's statements by the US Treasury Secretary Steven Mnuchin have returned optimism to investors who are betting on the growth of the dollar, on the expectation that the US government will still be able to implement its fiscal policy. Stephen Mnuchin said in his speech that the tax reform plan will appear "very, very soon" and it will be "decisive, substantial and will be the main priority for President Trump."

This year the dollar lost about 3.4% after its large-scale growth on expectations that Donald Trump will hold the promised measures to stimulate the US economy. The delay in the implementation of economic policy Trump has sown doubts about the possibility of carrying out reforms in the United States. The statements made by Munchin "rejuvenated" the dollar.

Intensification of protectionist measures by the Trump administration can still improve macroeconomic performance in the US and accelerate the recovery of the dollar.

The policy of the Fed, aimed at tightening monetary policy and reducing its budget, will help accelerate the growth of the dollar in the medium term.

Today, the financial markets are languid dynamics. The activity of traders in the run-up to the first round of elections in France is low. If Marin Le Pen wins, which promised to withdraw France from the European Union, then the euro could literally collapse in the foreign exchange market.

The bets are very high. Uncertainty in the outcome of the elections, of course, leaves an imprint on the dynamics of financial markets and the EUR / USD pair. In any case, the probability is high that on Monday in pairs with the euro and in the European indices there will be a gap, and in any direction.

Against the backdrop of such a strong fundamental factor, technical analysis fades into the background.

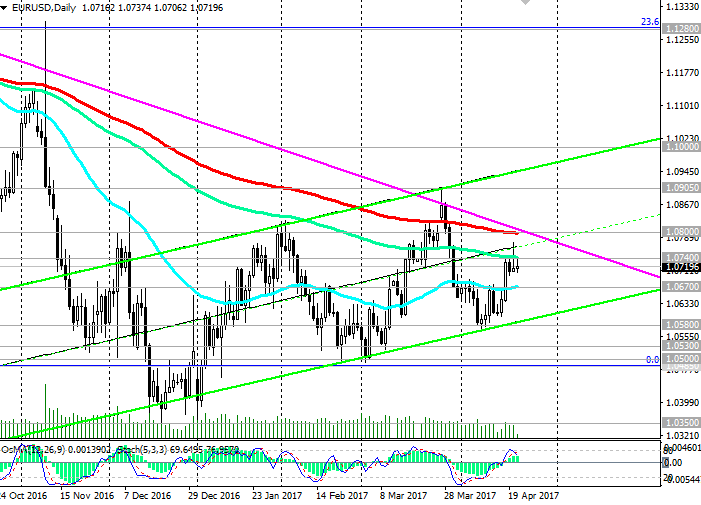

The EUR / USD remains under pressure while it is below the key resistance levels of 1.0800, 1.0740 (200-period and 144-period moving averages on the daily chart). Support for the EUR / USD pair is the levels of 1.0635 (bottom line of the uplink on the daily chart), 1.0670 (50-period and 200-period moving average on the 4-hour chart).

Those who want to conduct risky trading operations are given an excellent opportunity to do it today. On Monday, you can earn a lot, but also lose.

Support levels: 1.0700, 1.0670, 1.0635, 1.0580, 1.0530, 1.0500, 1.0485

Resistance levels: 1.0740, 1.0800, 1.0905