Current dynamics

Nine months after the vote for secession from the EU, British Prime Minister Theresa May signed Wednesday a decree on the beginning of the British divorce proceedings with the European Union. The beginning of the two-year period of Brexit negotiations based on Article 50 of the Lisbon Agreement is laid. Now Great Britain will try to soften for itself the conditions of this process. Negotiations should begin within a few weeks; the most cautious forecast is until the end of the second quarter. The uncertainty of this process puts pressure on the pound.

On the other hand, Fed officials continue to signal that the US central bank is still prepared to continue raising rates this year. In their opinion, the Fed will raise the rate 2-3 times more this year.

Earlier in the week, the dollar appreciably weakened in the foreign exchange market after the Republicans withdrew from the Congress a bill on healthcare on Friday. This raised doubts about the Trump administration's ability to implement tax reforms and plans to stimulate the economy. However, published on Tuesday, data showed that consumer confidence in the US reached the highest level in 16 years. The dollar received support and was able to recover significantly in the foreign exchange market. Now, according to CME Group's data, the probability of a rate hike at the June Fed meeting is 53%.

It seems that market participants are not yet fully aware of the Fed's determination in this matter. As the June approach approaches, as the positive data from the United States come in, the dollar will gradually grow stronger in the foreign exchange market.

Tomorrow at 08:30 (GMT) will be published data on UK GDP for the 4th quarter. The country ranks first on the annual percentage growth of GDP among all the strongest economies of the world, and the share of the UK's GDP in the world GDP is about 4% (2nd place in Europe after Germany). GDP is considered an indicator of the overall state of the British economy. The growing trend of GDP is considered positive for GBP, and vice versa. An annual increase of 2.0% is expected. If GDP data turn out to be weak, this will directly affect the decision of the Bank of England to reduce the interest rate in the UK. And this will put downward pressure on the pound. The main factors that can force the Bank of England to lower the rate are a weak GDP growth, the labor market. However, the growing inflation in the country will have the opposite effect on the Bank of England in its decision to lower the interest rate. Positive macroeconomic reports of recent weeks suggest that the UK economy did not collapse after the referendum.

A strong GDP report will have the most positive impact on the pound's position and the British stock market.

Conversely, weak GDP will have a negative impact on the pound's quotes, including in the GBP / USD pair.

And today the attention of market participants will be focused on data on GDP and inflation indicators of the US for the 4th quarter. Strong GDP and inflation indexes can significantly reduce the doubts of market participants in the likelihood of a rate hike in the US already at the May or June meeting of the Fed.

Support and resistance levels

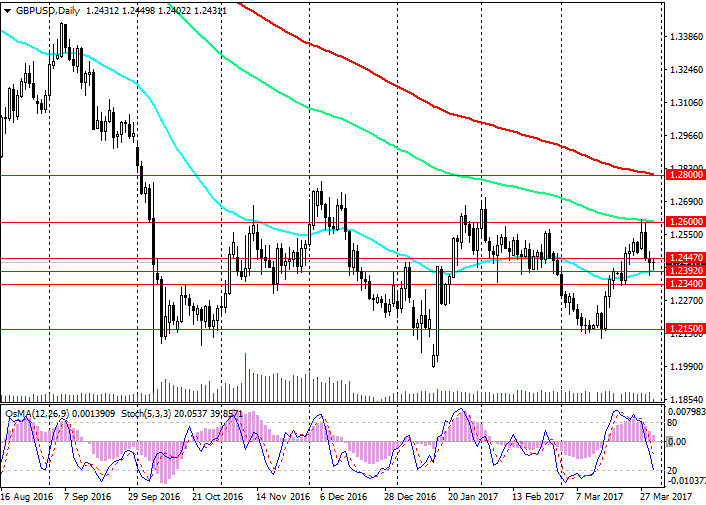

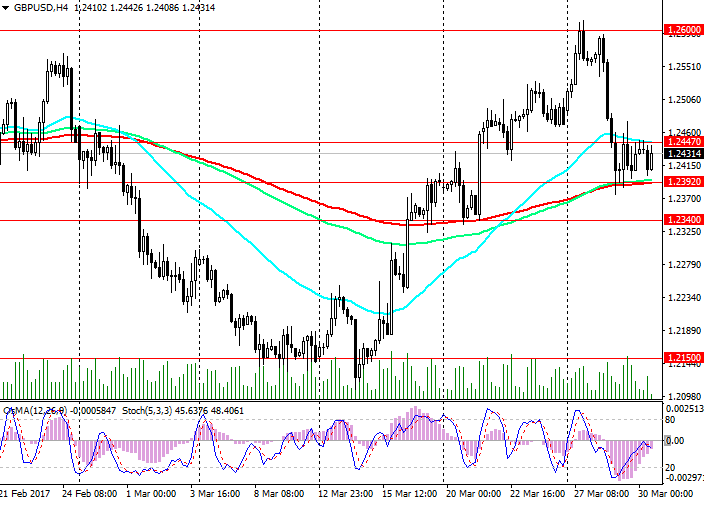

The pound continues to remain under pressure, and the GBP / USD pair is in a long-term downtrend since July 2014. Since yesterday, the GBP / USD pair has formed a short-term range between the support level of 1.2392 (EMA200 on the 4-hour chart) and resistance level 1.2447 (EMA200 on the 1-hour chart).

The pair GBP / USD growth in the period of 1-2 weeks is limited by resistance level 1.2600 (EMA144 on the daily chart).

Negative dynamics of the pair GBP / USD prevails. If the US GDP (published today) turns out to be strong, and the UK GDP (published tomorrow) will be weaker than the forecast (2.0%), then the GBP / USD pair will definitely break through the short-term support level 1.2392 and go towards the nearest support level 1.2150 (March lows) .

Indicators OsMA and Stochastics on the daily and 4-hour charts turned to the side of sellers.

The reverse scenario is related to breakdown of the short-term resistance level 1.2447 and further growth to the level of 1.2600.

The different focus of monetary policies in the US and the UK, the withdrawal from the EU are powerful fundamental factors that prevent the GBP / USD pair from recovering significantly. Negative fundamental background creates prerequisites for further decline in the pair GBP / USD, the negative dynamics of the pair GBP / USD is still predominant.

In case of breakdown of the local support level 1.2392, the pair GBP / USD decline will continue.

Support levels: 1.2392, 1.2340, 1.2150, 1.2000

Resistance levels: 1.2447, 1.2470, 1.2500, 1.2600, 1.2700, 1.2800

Trading Scenarios

Sell Stop 1.2380. Stop-Loss 1.2460. Take-Profit 1.2340, 1.2150, 1.2000

Buy Stop 1.2460. Stop-Loss 1.2380. Take-Profit 1.2470, 1.2500, 1.2600, 1.2700, 1.2800