USD/CAD: spread between oil prices and quotations of the Canadian dollar_24/03/2017

Current dynamics

After the Republicans proposed to postpone the vote in the US Congress on the health bill on Friday, the dollar adjusted and partially regained its positions in the foreign exchange market. It seems that the Republican Party has not yet received the support of the necessary number of congressmen in the preliminary negotiations. In view of this, it is likely that today, right up to the beginning of voting on the project (during the American trading session), the same picture can be repeated in the dynamics of the dollar. The US dollar has corrected after yesterday's decline and some market participants will want to re-enter short positions on it during today's European session. Nevertheless, with respect to the pair USD / CAD it is necessary to be careful when making sales of the US dollar against the Canadian dollar.

At 15:30, 16:30 and 16:45 (GMT + 3) a number of important macroeconomic indicators for the US and Canada are published, including the most important inflation indices - consumer price indices in Canada for February. The consumer price index is a key indicator of the level of inflation. The tendency of the Bank of Canada to tighten or mitigate monetary policy directly depends on it. The higher the value of the index, the higher the chances of raising the key rate in Canada and the higher the value of the Canadian dollar. According to the forecast, the index rose in February by 0.2% (+ 2.1% in annual terms). If the forecast is confirmed or the data will be better, the Canadian dollar will get support in the foreign exchange market.

It is worth, however, pay attention to the spread in the quotes of the Canadian dollar and oil prices. Despite a significant decline in oil prices in March (about 11.5%), the Canadian dollar avoided a fall in the pair USD / CAD. The reverse correlation of the pair USD / CAD with oil prices is approximately 92% and the Canadian dollar, remaining the commodity currency, is sensitive to oil quotes.

In case of a successful outcome of voting in the US Congress on the bill on changes in the US healthcare system, the pair USD / CAD can grow significantly.

Today, as well as yesterday, the highest volatility in the financial markets is expected, especially during the American trading session, which must be taken into account when making trading decisions.

Support and resistance levels

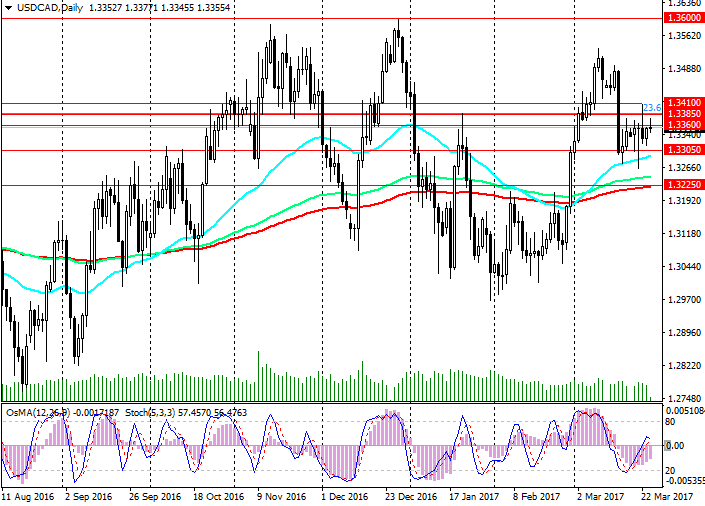

Since May 2011, the pair USD / CAD is in an upward long-term trend. At the beginning of 2016, having peaked near 1.4600, the pair USD / CAD adjusted sharply, falling to support level 1.2630 by May 2016 (Fibonacci level 38.2% correction to the pair's upward wave growth since May 2011). At the moment, the pair USD / CAD is trading near the most important level of 1.3385 (Fibonacci level of 23.6%). The pair USD / CAD keeps positive dynamics above support levels 1.3225 (EMA200 on the daily chart), 1.3305 (EMA200 on the 4-hour chart). The indicators OsMA and Stochastics on the 4-hour and daily charts are on the buyer’s side.

Fundamental factors (the difference in the direction of the monetary policies of the central banks of the US and Canada, falling oil prices) also contribute to the growth of the pair USD / CAD. Fixing the pair above the resistance levels 1.3385 (Fibonacci level 23.6%), 1.3410 (local highs) will create prerequisites for further growth of the pair in the medium term and return to the uptrend.

In the short term, a decline to support level 1.3305 (EMA200 on the 4-hour chart) is possible. The breakdown of the support level 1.3225 (EMA200 on the daily chart) will create risks for further reduction of the pair with a "long" target of 1.2630 (Fibonacci level of 38.2% and EMA144 on the weekly chart).

Support levels: 1.3305, 1.3280, 1.3225

Resistance levels: 1.3360, 1.3385, 1.3410

Trading Scenarios

Buy Stop 1.3380. Stop-Loss 1.3330. Take-Profit 1.3410, 1.3500, 1.3600

Sell Stop 1.3330. Stop-Loss 1.3380. Take-Profit 1.3305, 1.3280, 1.3225