Aussie Threatens Monthly Opening Range; Outlook Hinges on Employment

15 February 2017, 17:52

0

162

Aussie Threatens Monthly Opening Range; Outlook Hinges on Employment

Talking Points:

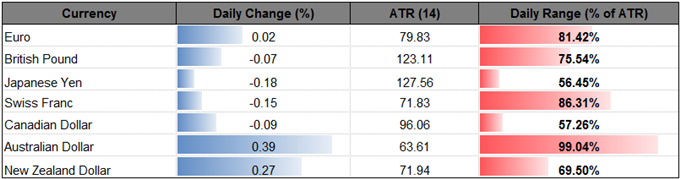

- AUD/USD Threatens Monthly Opening Range; Outlook Hinges on Australia Employment.

- USD/JPY Preserves Bull-Flag, Rallies to Fresh Monthly Highs Even as Risk Appetite Wavers.

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

AUD/USD | 0.7693 | 0.7700 | 0.7637 | 30 | 63 |

AUD/USD Daily

- AUD/USD may retain the range-bound conditions from earlier this month especially as the Relative Strength Index (RSI) deviates with price and slips back from overbought territory; even though the aussie-dollar appears to be breaking out of a bull-flag formation, the near-term formation may not produce a similar reaction to the advance from late-January as oscillator appears to be staring a bearish sequence.

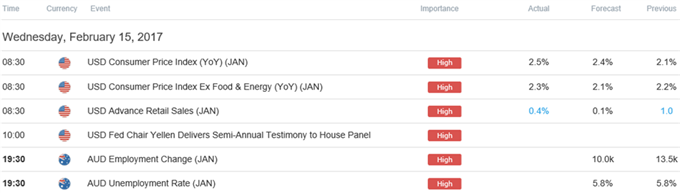

- The pickup in the U.S. Consumer Price Index (CPI) accompanied by the larger-than-expected advance in Advance Retail Sales should keep the Federal Open Market Committee (FOMC) on course to raise the benchmark interest rate in 2017, but Chair Janet Yellen appears to be in no rush to implement higher borrowing-costs as the central bank head argues ‘inflation moved up over the past year, mainly because of the diminishing effects of the earlier declines in energy prices and import prices;’ in turn, Fed officials may continue to tame interest rate expectations during the first-half of the year as ‘considerable uncertainty attends the economic outlook.’

- With that said, a 10.0K expansion in Australia Employment may spur a more meaningful test of the monthly opening rate as the ongoing improvement in the labor market encourages the Reserve Bank of Australia (RBA) to move away from its easing-cycle, with a break of the monthly high raising the risk for a move towards 0.7730 (61.8% retracement) to 0.7770 (61.8% expansion).

- Nevertheless, AUD/USD may continue to track the broad range from the second-half of 2016 as the rally from earlier this year appears to be getting exhausted, with the U.S. dollar at risk of staging a larger advance over the coming weeks/months as Fed Fund Futures continue to price a greater than 60% probability for a June rate-hike; near-term support comes in around 0.7590 (100% expansion) to 0.7600 (23.6% retracement), with a break/close below the Fibonacci overlap opening the next downside region of interest around 0.7500 (50% retracement) to 0.7530 (38.2% expansion).

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

USD/JPY | 114.47 | 114.96 | 114.24 | 21 | 72 |

USD/JPY Daily

- The near-term outlook for USD/JPY remains constructive as the pair extends the recent series of higher highs, while the RSI breaks out of the bearish formation carried over from December; nevertheless, the pair may continue to operate within the bull-flag formation carried over from late-2016 as risk appetite wavers, with global benchmark equity indices struggling to hold their ground.

- The deviating paths for monetary policy may heighten the bullish sentiment surrounding the dollar-yen exchange rate as Bank of Japan (BoJ) Governor Haruhiko Kuroda pledges to pursue ‘powerful’ easing until the central bank achieves its 2% target for inflation, but waning expectations for a March Fed rate-hike may generate range-bound conditions as the central bank still ‘expects the evolution of the economy to warrant further gradual increases in the federal funds rate;’ will keep a close eye on the fresh rhetoric coming out of the committee as Philadelphia Fed President Patrick Harker and New York Fed President William Dudley, both 2017 FOMC voting-members, are scheduled to speak over the next 24-hours of trade.

- A closing price above the Fibonacci overlap around 114.00 (23.6% retracement) to 114.30 (23.6% retracement) may open up the next topside target around 116.00 (78.6% expansion) to 116.30 (23.6% retracement) followed by 117.60 (23.6% retracement) to 117.70 (61.8% expansion).