NZD/USD Remains Capped Ahead of NZ 4Q CPI; Fed Fund Futures Pick Up

20 January 2017, 20:45

1

103

NZD/USD Remains Capped Ahead of NZ 4Q CPI; Fed Fund Futures Pick Up

Talking Points:

- EUR/USD Consolidates Ahead of December High (1.0873); ECB Survey Undermines Dovish Outlook.

- NZD/USD Remains Capped Ahead of NZ 4Q CPI; Fed Fund Futures Pick Up Following Yellen Comments.

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

EUR/USD | 1.0678 | 1.0694 | 1.0625 | 14 | 69 |

EUR/USD Daily

- The recent advance in EUR/USD appears to be getting exhausted as the European Central Bank (ECB) continued to endorse a dovish outlook at its first policy meeting for 2017, and the pair may struggle to hold its ground ahead of the Federal Reserve’s interest rate decision on February 1 as Chair Janet Yellen and Co. appear to be on course to further normalize monetary policy over the coming months; with the broader outlook tilted to the downside, will keep a close eye on the Relative Strength Index (RSI) for confirmation as it appears to be responding to bearish formation carried over from 2015.

- Even though the ECB’s survey of professional forecasters highlighted an improved outlook for the euro-area, current projections still show inflation running below the 2% target through 2019, and President Mario Draghi and Co. may boost their efforts to ward off a ‘taper tantrum’ as the Governing Council remains on course to narrow its asset-purchases to EUR 60B/month starting in April; at the same time, the U.S. 4Q Gross Domestic Product (GDP) report due out next week may sway interest rate expectations as the economy is expected to grow an annualized 2.1% following the 3.5% expansion during the three-months through September.

- EUR/USD may continue to consolidate over the coming days as it struggles to make a more meaningful run at the December high (1.0873), with a move/close below 1.0600 (23.6% expansion) opening up the next downside around 1.0470 (38.2% expansion) to 1.0500 (50% expansion).

Currency Last High Low Daily Change (pip) Daily Range (pip) NZD/USD 0.7150 0.7225 0.7129 40 96

NZD/USD Daily

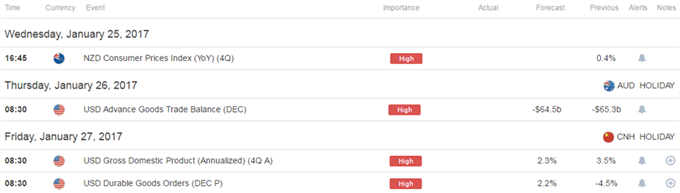

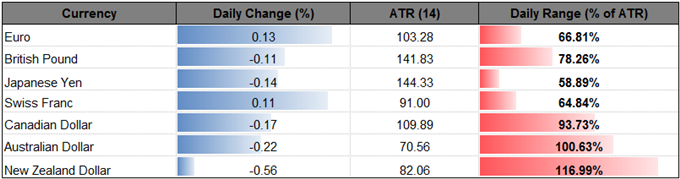

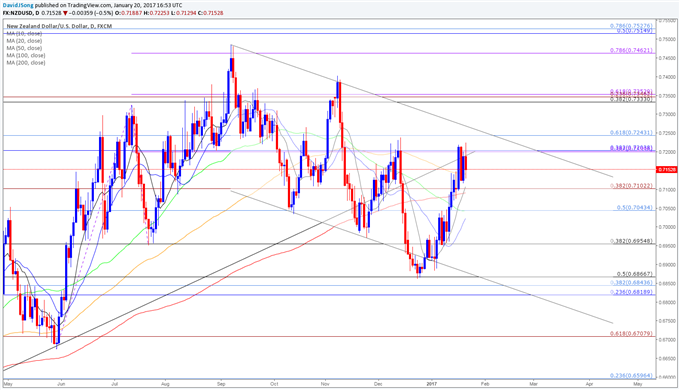

- Even though NZD/USD fails to extend the recent series of lower highs & lows, the pair appears to have made another failed run at the December high (0.7239) as it quickly pulls back from a fresh weekly high of 0.7224; may see range-bound conditions persist going into the week ahead as market attention turns to New Zealand’s 4Q Consumer Price Index (CPI), which is projected to increase an annualized 1.3%, but the RSI appears to be flashing a bearish trigger as it struggles to preserve the bullish formation carried over from the previous month.

- Fed Fund Futures have picked up following the fresh comments from Chair Yellen, with market participants now pricing a greater than 70% probability for a June rate-hike as the Federal Open Market Committee (FOMC) is ‘closing in’ on its dual mandate; the monetary policy outlook may continue to foster a long-term bearish outlook for NZD/USD, but the Reserve Bank of New Zealand (RBNZ) may have limited room to implement lower borrowing-costs as the region faces heightening price pressures accompanied by the widening trade deficit .

- With the near-term advance capped around 0.7240 (61.8% retracement), NZD/USD may continue to give back the advance from earlier this month, with a break/close below 0.7040 (50% retracement) opening up the next downside area of interest around 0.6950 (38.2% retracement).