1

184

GBP/USD ’Flash Crash’ Range in Play Ahead of U.K. CPI

Talking Points:

-NZD/USDBreaks Near-Term Range; Eyes December High.

-GBP/USD‘Flash Crash’ Range in Play; BoE Warns of ‘Notable’ Inflation Ahead of U.K. CPI.

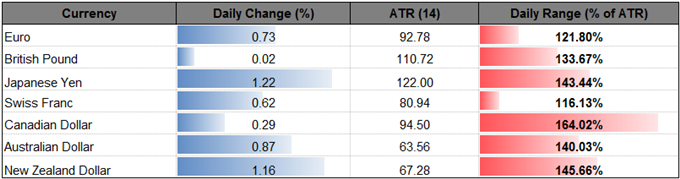

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

NZD/USD | 0.7137 | 0.7145 | 0.7047 | 82 | 98 |

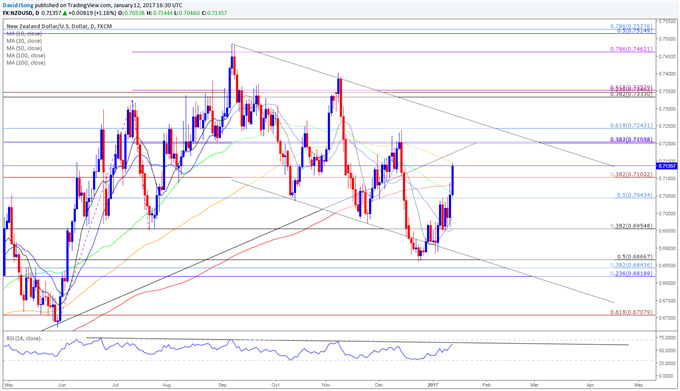

NZD/USD Daily

- NZD/USD may stage a larger recovery and work its way back towards the December high (0.7239) as the pair breaks out of a narrow range and starts to carve a near-term series of higher highs & lows; nevertheless, broader outlook remains tilted to the downside as price and the Relative Strength Index (RSI) continue to operate within the downward trends carried over from the previous year.

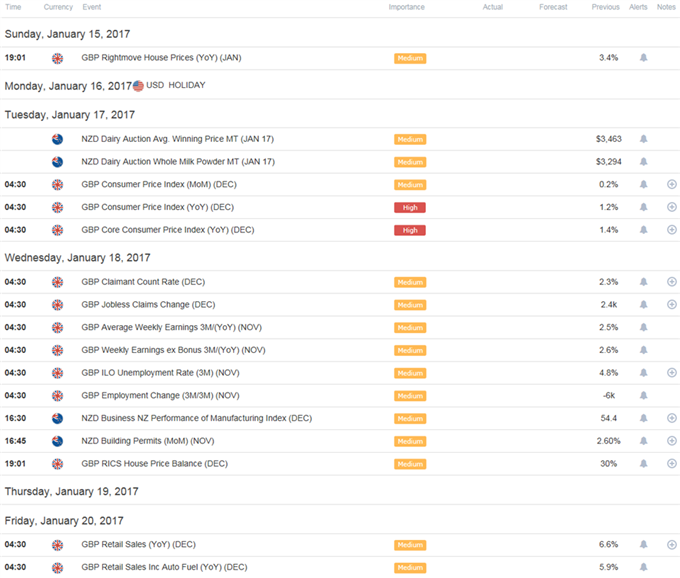

- New Zealand’s 4Q Consumer Price Index (CPI) due out on January 25 may heavily influence the monetary policy outlook as the Reserve Bank of New Zealand (RBNZ) appears to be changing its tune following the rate-cut in November, with Governor Graeme Wheeler now arguing the ‘annual inflation is expected to rise from the December quarter, reflecting the policy stimulus to date, the strength of the domestic economy, and reduced drag from tradables inflation;’ however, another headline reading of 0.4% may dampen the appeal of the New Zealand dollar as ‘numerous uncertainties remain, particularly in respect of the international outlook, and policy may need to adjust accordingly.’

- A close above the 0.7100 (38.2% expansion) handle shifts the focus to the next topside region of interest around 0.7200 (38.2% retracement), followed by the December high (0.7239), which lines up with the 0.7240 (61.8% retracement) target.

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

GBP/USD | 1.2216 | 1.2317 | 1.2169 | 3 | 148 |

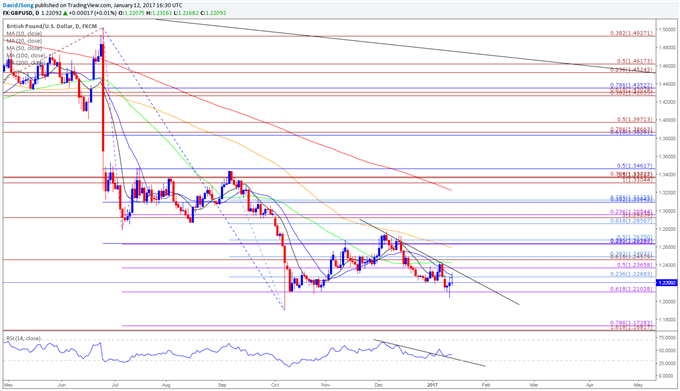

GBP/USD Daily

- With the ‘Brexit’ deadline just weeks away, uncertainties surrounding the U.K.’s departure may continue to foster a bearish outlook for theBritish Pound, but GBP/USD looks poised for a larger rebound over the near-term amid the ongoing failed attempts to close below the 1.2100 (61.8% expansion) handle; a bullish RSI trigger has also emerged to start 2017, with the pair at risk of testing the downward trend carried over from December especially as the momentum indicator appears to be diverging with price.

- With Bank of England (BoE) GovernorMark Carneywarning of a ‘notable’ increase in inflation, the U.K. Consumer Price Index (CPI) on tap for the week ahead may sap the bearish sentiment surrounding the sterling should the report highlight stronger-than-expected price growth; may encourage the central bank to adopt a more hawkish tone at the next interest rate decision on February 2 as recent data prints coming out of the real economy are ‘consistent with some further update’ to the economic outlook.

- May see GBP/USD largely preserve the British Pound ‘Flash Crash’ range over the remainder of the week, with a close above 1.2270 (23.6% retracement) raising the risk for a move back towards trendline resistance, which lines up with the next topside objective around 1.2370 (50% expansion).