Pound May Rise on Carney Comments, US Dollar Eyes Trump Presser

Pound May Rise on Carney Comments, US Dollar Eyes Trump Presser

Talking Points:

- Pound may rise as BOE’s Carney keeps open mind on rate hikes

- US Dollar looks to Trump presser for economic policy specifics

- Yen down as Japan’s stocks rise, Aussie Dollar gains with yields

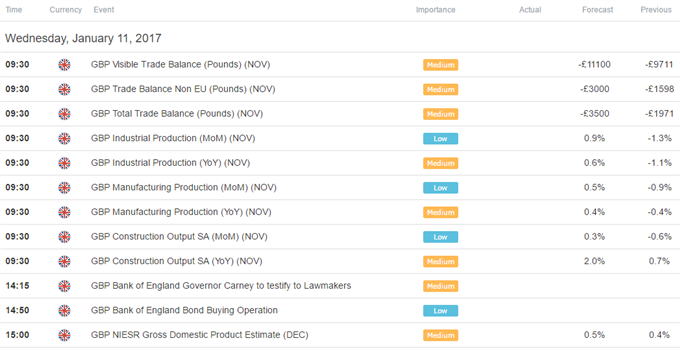

Testimony from Bank of England Governor Mark Carney before Parliament’s Treasury Select Committee is in focus in European trading hours. Realized and expected UK inflation are on the rise and Carney will probably get grilled about why this does not warrant tightening. This may translate into a conversation about the negative effects of Brexit-related uncertainty.

Brexiteer MPs are vocal members of the committee and have a long history of challenging Carney, who openly cautioned that exiting the EU would probably hurt economic growth ahead of the fateful referendum last year. Similar pressure this time around may see him reiterate that the BOE is prepared to pull back on stimulus if price growth appears more than transitory, which might boost the British Pound.

Later in the day, the spotlight will turn to President-elect Donald Trump as he holds his first formal press conference in almost six months. Traders will look for details on economic plans that has been expected to ramp up inflation and speed up the pace of Fed interest rate hikes, driving the US Dollar to 14-year highs. This so-called “Trump trade” has struggled lately amid uncertainty about policy specifics.

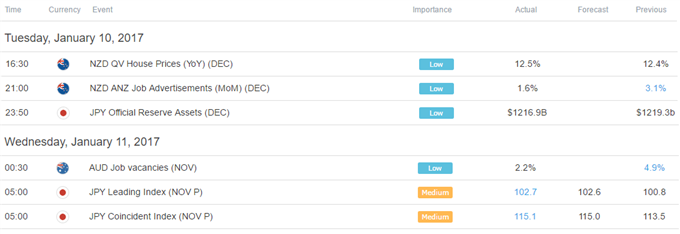

The Yen underperformed as Japanese shares advanced in overnight trade, pressuring the perennially anti-risk currency. The Australian Dollar outperformed against a backdrop of rising local bond yields, hinting that a modest intraday improvement in the RBA policy outlook may have accounted for gains. Still, the priced-in outlook implied in OIS rates shows markets do not expect a rate hike in the next 12 months.

Asia Session

European Session