USD/JPY: the difference in the interest rate outlook in the US and Japan

The undoubted focus of traders today is the Fed's decision on interest rates in the USA (published in the 22:00 GMT + 3). At 22:30 will begin the press conference the Fed. The Fed chief Janet Yellen will light up the future plans of the financial regulator in relation to the US monetary policy. Also at the press- conference forecasts for inflation, employment, economic growth and the dynamics of interest rates in the United States will be given.

The probability of today's increase is close to 97%, according to CME Groups. Expected surge in volatility in all financial markets during and after the publication of the Fed decision. Prior to these events as investors are likely to take a wait and see position. The likely rise in interest rates was almost fully priced in. The recent rise in the yield of government bonds and the US dollar strengthening could lead to a decrease in economic activity and reduce the likelihood of a further increase in US interest rates. Wall Street Journal dollar index, which shows the value of the dollar against a basket of 16 other major currencies, rose 5.3% over the past 3 months. Nevertheless, investors expect the Fed will signal about the two rate hikes in 2017 and three promotions in 2018 and 2019.

As a result of positive developments in the markets after the election of Donald Trump, the US president was also strong growth in the Japanese stock market. Investors come from a safe asset and the yen to invest in riskier assets and stock market instruments. The Japanese stock index Nikkei Stock Average finished today's trading in Asia with another increase by 0.02% to 19,253.61 points.

According to data published in the media, the mood in Japanese business circles in the 4th quarter improved for the first time this year. Japan's large manufacturer’s sentiment index rose to 10 from six in the previous quarter. The growth index Tankan large manufacturer’s sentiment marked the first time in six quarters. The index reached a peak in the 3rd quarter for four quarters.

Now, in addition to the Fed's actions, and the new president of the United States, Japan, investors will be watching the actions of the Bank of Japan. Earlier, Kuroda has repeatedly stated that WB was ready to "the most decisive measures when necessary" in the case of strengthening of the yen and falling Japanese stock market.

So far, the difference in interest rates and prospects of it’s tightening in the US and Japan in easing stimulates the growth of the pair USD / JPY.

Technical analysis

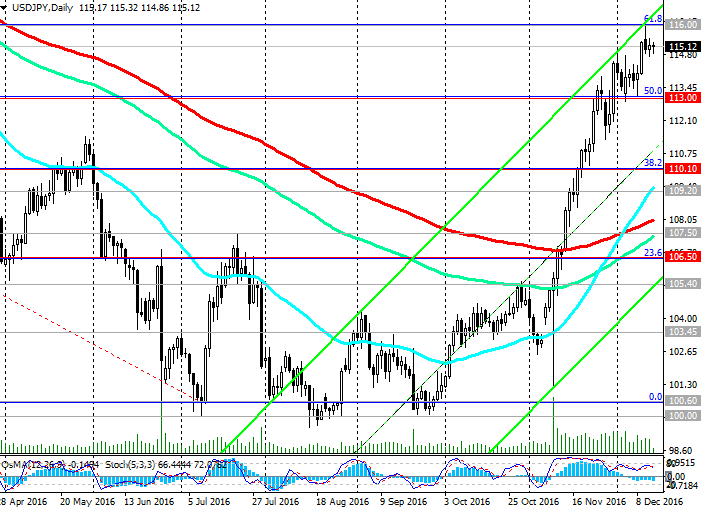

After the election of a new president in the United States USD / JPY pair rose by 10%, or more than 1,000 points. With the opening of this week, and today's trading day, the pair stopped growing near the mark of 116.00, and now the pair USD / JPY is trading near the 115.00 mark. On the weekly chart the pair is at the upper boundary of the rising channel, as well as near the level of 116.0 (61.8% Fibonacci correction level to reduce vapors from June 2015 with the level of 125.65). Breakdown level of 113.00 (50.0% Fibonacci level) says about the end of a downward correction, and the resumption of the upward trend of the pair. Overall the positive dynamics of the dollar and the USD / JPY pair is stored.

If the Fed's comments will sound harsh notes on future plans for the US monetary policy, the dollar will continue to rise in the foreign exchange market and in the pair USD / JPY. If the Fed will not raise rates today, the dollar will collapse in the currency market.

In the case of break and consolidation above 116.00 level road for the further growth of the pair USD / JPY opened.

The reverse scenario is the breakthrough the support level of 113.00 and a further decline to the levels of 110.10 (38.2% Fibonacci level), 109.20 (EMA144), 170.50 (EMA200 on the daily chart).

In the case of the breakdown of the support level 106.50 (Fibonacci level of 23.6%) and the development scenarios to reduce the USD / JPY pair is heading to the still recent year's low and a 100.00 96.50 (October 2013 lows).

Support levels: 113.00, 110.10, 109.20, 107.50, 106.50

Resistance Levels: 116.00, 117.80, 121.30

Trading recommendations

Buy Stop 116.10. Stop Loss 115.40. Take-Profit 117.00, 117.80, 120.00, 121.30

Sell Stop 114.70. Stop Loss 115.40. Take-Profit 114.00, 113.00, 110.10, 109.20, 107.50, 106.50

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.