GBP/USD to Stage Relief Rally on Hawkish BoE Inflation Report

28 October 2016, 19:57

0

111

GBP/USD to Stage Relief Rally on Hawkish BoE Inflation Report

Talking Points:

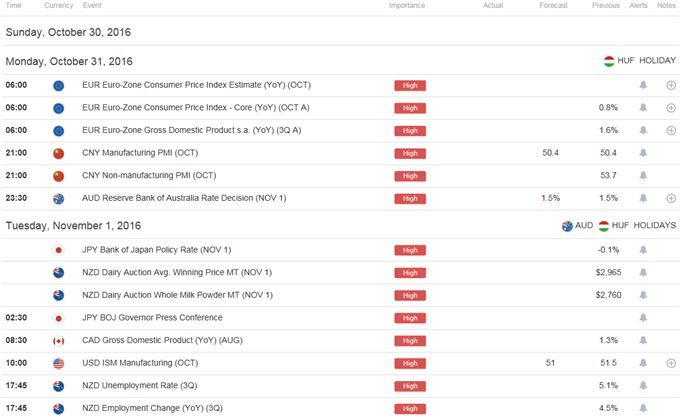

- Euro Rebound to Benefit From Robust Euro-Zone GDP, Sticky CPI.

- GBP/USD to Stage Relief Rally on Hawkish BoE Inflation Report.

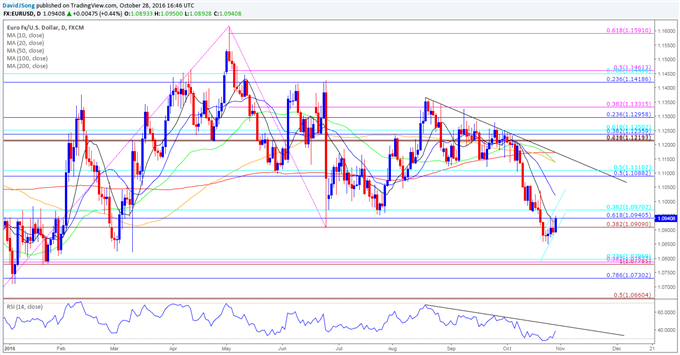

EUR/USD Daily

- The bear-flag formation in EUR/USD may continue to shape going into November as the Euro-Zone’s Gross Domestic Product (GDP) report is expected to show the growth rate expanding another annualized 1.6% in the third-quarter of 2016, while the core Consumer Price Index (CPI) is projected to hold steady at an annualized 0.8% in October; a series of positive developments may spark a bullish reaction in the single-currency, but the broader outlook remains tilted to the downside as price & the Relative Strength Index (RSI) preserve the bearish trends carried over from August.

- May see growing expectations for a meaningful announcement at the European Central Bank’s (ECB) December 8 policy meeting as the Governing Council looks poised to adjust the duration as well as the guidelines of the non-standard measures, but more of the same from PresidentMario Draghiand Co. may spark a ‘taper tantrum’ should the committee preserve the March 2017 deadline for the asset-purchase program.

- A closing price above 1.0940 (61.8% retracement) may push EUR/USD towards the top of the near-term channel, with aligns with the next topside region of interest coming in around 1.0970 (38.2% retracement).

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

GBP/USD | 1.2154 | 1.2189 | 1.2114 | 10 | 75 |

GBP/USD Daily

- GBP/USD may remain range-bound ahead of the Bank of England’s ‘Super Thursday’ event as Governor Mark Carney and Co. are scheduled to deliver the updated quarterly inflation report (QIR); the fresh projections may trigger a relief rally in the British Pound should the central bank highlight a growing risk of overshooting the 2% target for price growth.

- Even though the BoE warns ‘a majority of members expect to support a further cut in Bank Rate to its effective lower bound,’ the recent comments from Governor Carney suggest the Monetary Policy Committee (MPC) will preserve a wait-and-see approach going into 2017 as the marked depreciation in the exchange rate is expected to push the economy from ‘no inflation to some inflation.’

- Broader outlook for GBP/USD remains tilted to the downside, with near-term resistance coming in around 1.2360 (50% expansion); waiting for a close below 1.2100 (61.8% expansion) to open up the next downside region of interest coming in around 1.1680 (161.8% expansion) to 1.1730 (78.6% expansion).

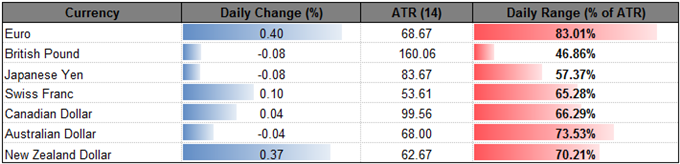

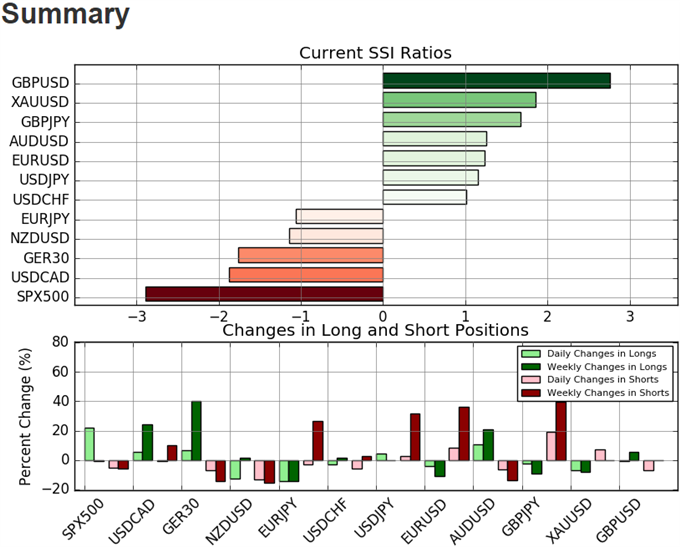

- The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long EUR/USD since October 10, with the ratio hitting a 2016-extreme of +1.93 during the previous week, while traders remains net-long GBP/USD even after the British Pound ‘flash crash.

- EUR/USD SSI sits at +1.18 as 54% of traders are long, with short positions 38.4% higher from the previous week as open interest stands 8.9% above the monthly average.

- GBP/USD SSI sits at +3.04 as 75% of traders are long, with long positions 7.6% higher from the previous week, while open interest stands 1.5% below the monthly average.

- EUR/USD sentiment may face a material shift in the days ahead as the retail crowd appears to be fading the near-term advance in the exchange rate.