USD/CAD at Risk for Further Losses on Wait-and-See BoC

Talking Points

- USD/CAD risks further losses heading into BoC

- Broader focus remains lower sub-1.3254

- Updated targets & invalidation levels

USD/CAD 240min

Technical Outlook: Heading into the Bank of Canada (BoC) interest rate decision tomorrow the Loonie looks poised for further gains with the USDCAD holding within the confines of a descending pitchfork formation extending off the September & October highs. Note that we’ve been marking strong bearish divergence in daily momentum for some time now with the exchange rate posting an outside-day reversal off the monthly highs last week. An objective break below the monthly open yesterday shifts the focus lower with the median-line extending off the 9/14 high catching the decline earlier today.

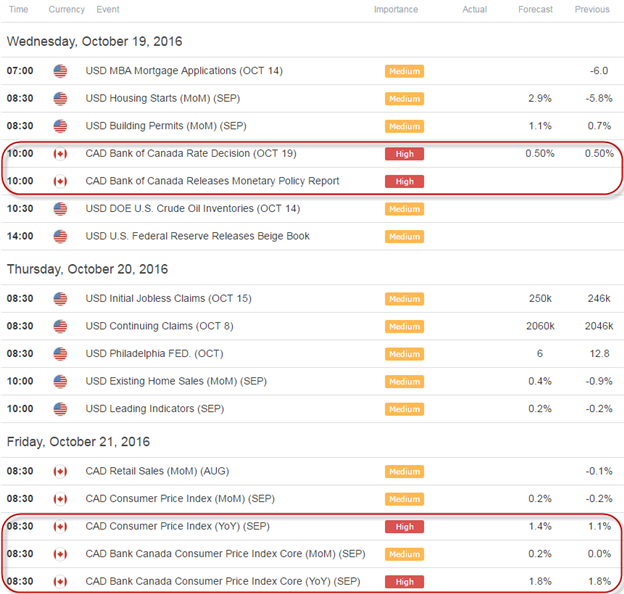

The BoC is expected to retain its current policy in October as the central bank leans on fiscal authorities to boost economic activity. From a trading standpoint, heading into the release we’ll favor selling rallies while below immediate resistance at 1.3140/48 with our broader bearish invalidation level up at 1.3254. A break lower eyes subsequent support targets at 1.3025/29, 1.2987 & the highlighted median-line confluence at ~1.2950. For the complete setup and to continue tracking this trade & more throughout the week- Subscribe to SB Trade Desk.

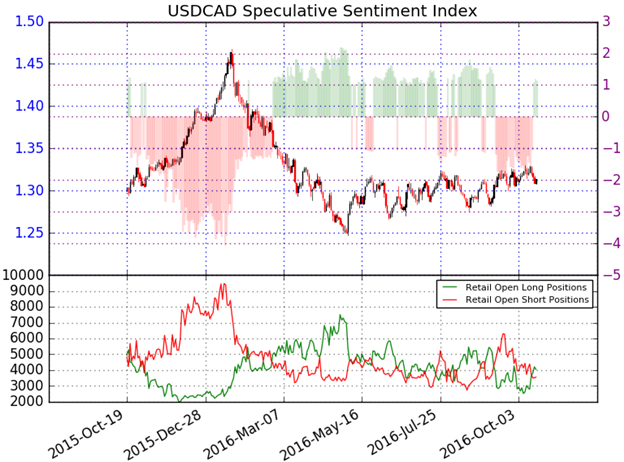

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net longUSDCAD- the ratio stands at +1.15 (53% of traders are long)- weak bearish reading

- Long positions are 37.6% above levels seen last week while short positions are 16.87% lower over the same time period.

- Open interest is 4.9% below its monthly average

- The retail crowd shifted to net long on October 14th as the pair was in the midst of posting an outside-day reversal off the monthly highs. Current positioning suggests the near-term risk remains weighted to the downside.