Overview and Dynamics

After the beginning of the month gold has fallen sharply in price, now there is a slight (0.5%) of its growth. The rise in gold prices is accompanied by a decline in the dollar in the foreign exchange market, which takes place in turn, on profit taking on long dollar positions.

According to CME Group's latest data, in the United States the likelihood of a rate hike is estimated at 69% in December. However, for the most part, it already accounted for in the dollar quotes. It is time for the short-term correction and short positions on it. Nevertheless, we should not forget that it is just, and that is, short-term correction to strengthen the dollar.

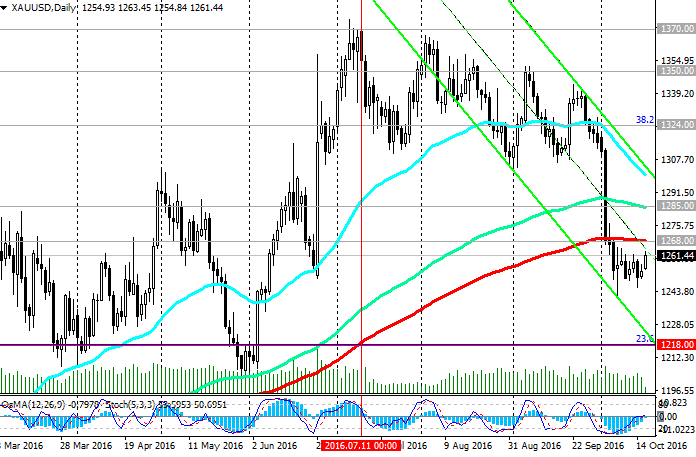

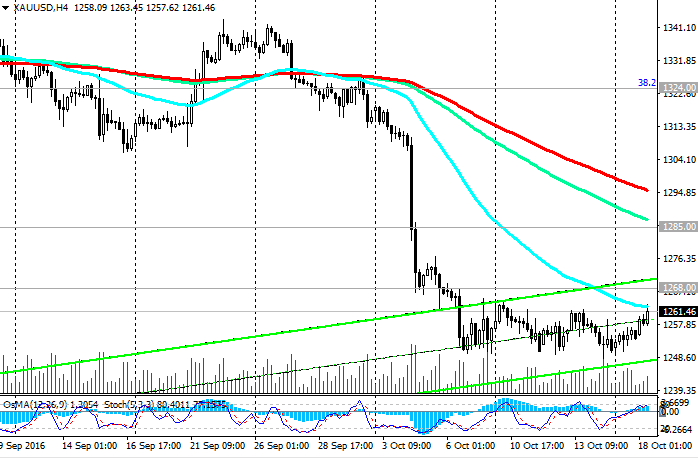

While the pair XAU / USD is below the key resistance level of 1268.00 (EMA200 on daily and weekly charts), pressure on the pair is maintained.

Indicators OsMA and Stochastic on the 4-hour and daily charts deployed on long positions, signaling upward correction. The immediate objectives of this growth can be a resistance level 1268.00, 1285.00 (EMA144 on the daily chart). The further growth of the pair XAU / USD - is questionable.

The pair XAU / USD has broken the important support level of 1268.00 and decreases in the downward channel on the daily chart with the lower boundary, passing near the key support level of 1218.00 (23.6% Fibonacci level of the correction to the wave decline from October 2012).

We can assume a further decline in the price of gold and the pair XAU / USD in this channel with the immediate goal of 1218.00.

Break of the support level of 1218.00 (23.6% Fibonacci level) will create preconditions for the further decrease in pair XAU / USD and return to the downward global trend, which began in October 2012.

Only after securing the pair above the level of 1285.00, you can revert to the medium-term long positions. And only fixing prices above the local resistance level of 1324.00 (38.2% Fibonacci level) will create favorable conditions for gold buyers. A breakthrough in the case of higher levels of the range of 1370.00, 1385.00 to increase the risk of further growth of gold prices to the level of $ 1400.00 per ounce.

Support levels: 1250.00, 1218.00

Resistance Levels: 1268.00, 1285.00, 1324.00, 1350.00, 1370.00, 1385.00, 1400.00

Trading recommendations

Buy Stop 1272.00. Stop-Loss 1265.00. Objectives 1285.00, 1300.00, 1324.00, 1350.00, 1370.00

Sell in the market. Stop-Loss 1272.00. Objectives 1250.00, 1218.00, 1200.00

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.