Trading recommendations

Sell Stop 1.0990. Stop-Loss 1.1045. Targets 1.0975, 1.0915, 1.0825, 1.0710

Buy Stop 1.1050. Stop-Loss 1.1005. Targets 1.1090, 1.1120, 1.1185, 1.1205

Technical analysis

Today the EUR/USD after a minor correction during the Asian session remains under pressure trading near yesterday's closing levels near the 1.1005 mark.

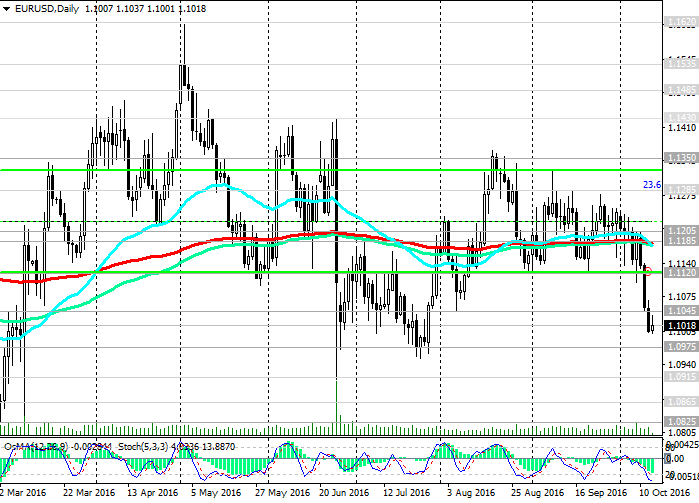

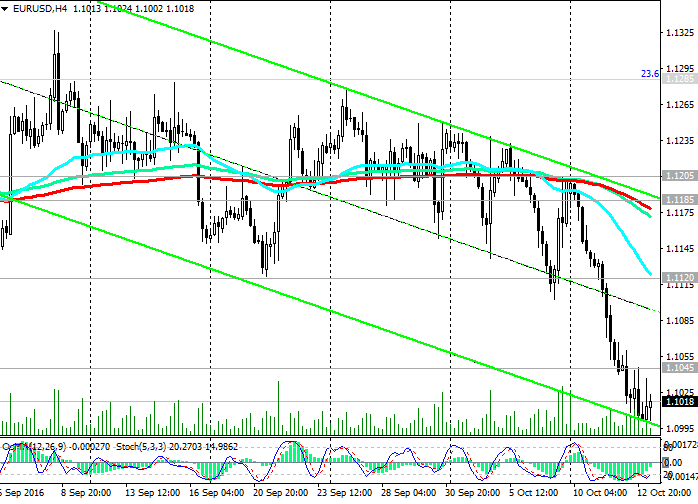

During the active reduction since the beginning of this month the pair has broken the important support levels 1.1185 (EMA200, EMA144 on the daily chart), 1.1120 (the lower bound of the range between the levels of 1.1285 (Fibonacci 23.6% retracement level of the last wave decline from 2014 highs) and 1.1120 (lows of September)). Also broken the lower bound of another wider range between the levels of 1.1045 (Aug lows), 1.1350 (August highs).

Indicators OsMA and Stochastic on the 4-hour, daily, weekly charts are on sellers side, on the monthly chart indicators also deployed on short positions.

On the weekly chart has formed a new downstream channel with a lower limit, passing below the level of 1.0710 (at least one year). In case the pair will be the immediate goal of the support level 1.0975 (July low). The reverse scenario is a return in the range above the levels 1.1045, 1.1120.

Different as orientation of the Federal Reserve monetary policy and the ECB will put pressure on the EUR / USD pair in the medium term and, most likely, until the end of the year, when the Fed meeting will be held in December.

Support levels: 1.0975, 1.0915, 1.0825, 1.0710

Resistance levels: 1.1045, 1.1120, 1.1185, 1.1205, 1.1285

Overview and Dynamics

As always, three weeks after the Committee meeting at the Federal Open Market (FOMC), yesterday published reports from this meeting. The minutes stated that "some of the participants of the meeting considered that it would be appropriate to raise the target range for interest rates relatively soon, if the labor market continues to strengthen, and economic activity -. Grow Others prefer to wait for more conclusive evidence of approaching inflation to the established by the Committee open market operations target level of 2%. "

Thus, among the FOMC members, there are some differences in the timing and rate of increase in US interest rates. However, most Fed officials believed that it would be appropriate to raise rates once more before the end of this year. Now, most market participants expect increasing rates in the US in December, despite the fact that in early November, will be held another meeting of the Fed on this issue (01-02 November). As was noted in the minutes, "reasonable arguments can be given in favor of a rate hike at the meeting or in favor of waiting additional information on the labor market and inflation."

On expectations of a rate hike in December, the US dollar is boosting its position against most other major currencies.

At the same time, growing concerns about the European economy put pressure on the euro. Pound continues to decline on fears related to Brexit, and pulls the euro. Thus, the pair EUR / USD is under double pressure from a strengthening in the currency market, the dollar and euro weakness. Reducing the EUR / USD pair has upward pressure on the dollar index and the downward pressure on commodity prices, commodity currencies, emerging markets and China. In all likelihood, a further decline is likely the pair EUR / USD 1.0975 with the immediate objectives, 1.0915, and 1.0825.

From the news today forward data from the US. At 12:30

(GMT) will be published a report on the number of new (primary) applications

for the grant on unemployment in the US last week. The result is higher than

expected indicate a weakness of the labor market, which has a negative impact

on the US dollar, and vice versa. The previous value is 249 000, 254 000 -

the forecast. Also at that time published

an index of export/import prices in the US for September. Weak or negative

values will put pressure on the dollar. Also pay attention to the speech of

the head of the Bank of England, scheduled for the period after 12:30, and a

member of the FOMC Patrick Harker (beginning at 16:15). Carney Speeches and

Harker will add additional volatility in the foreign exchange market.

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.