EUR/JPY Responds to Long-term Slope Support into Close of Q3

- EUR/JPY near-term slope identified off the lows

- Updatedtargets & invalidation levels

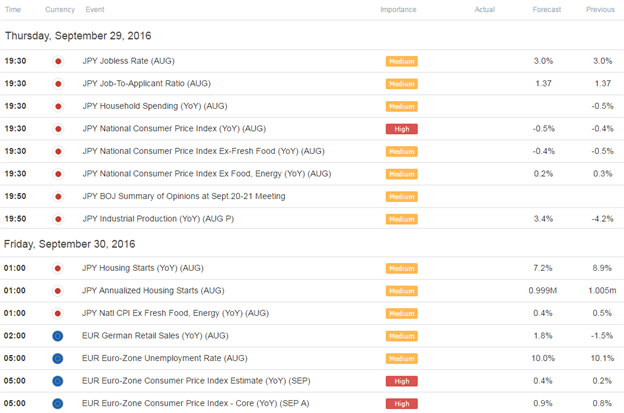

- End of quarter / Japan & Eurozone CPI numbers on tap

EUR/JPY Daily

Broader Technical Outlook: EURJPY is trading within a broad consolidation pattern off the July lows with the near-term recovery now approaching initial resistance. Note that the pair has continued to respect a longer-term median-line formation dating back to the 2000 low with the risk for a much more significant advance should at topside break materialize. A resistance trigger-break in daily RSI has also given way with our focus weighted to the topside while above basic TL support extending off the July low. Key resistance stands at 116.03 with a breach above this region eyeing the July high-day close at 116.60 & the 61.8% extension of the advance off the yearly lows at 117.80.

EUR/JPY 60min

Notes: The pair is trading within the confines of a near-term ascending median-line formation extending off the monthly lows with the exchange rate responding to confluence resistance today in New York trade today. Look for a pullback here to offer favorable long-entries with our near-term focus higher while above the highlighted median-line confluence around 112.95 (near-term bullish invalidation) – a break below the weekly opening-range lows would be needed to shift the broader focus lower in EURJPY.

A breach higher eyes targets at 114.72/74 backed by the trendline confluence at the 115-figure. A breach above this mark is needed to validate a breakout with such a scenario eyeing subsequent topside objectives at the monthly open at 115.40, trendline resistance off the monthly highs & the 61.8% retracement at116.03.

A quarter of the daily average true range (ATR) yields profit targets of 35-38 pips per scalp. From a trading standpoint we’ll favor fading EURJPY weakness while within this. Caution is warranted heading into the close of the week, month & quarter tomorrow as these types of environments can be extremely difficult to intraday trade. Also note that we have Japan & Eurozone CPI numbers on tap into the close. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount.

Relevant Data Releases