The X - Universal Trading Expert Advisor, Constructor, Strategy Builder

The X

Universal Trading Expert Advisor, Automatic trading robot with integrated strategies

This Expert Advisor includes all the useful functions that have been used in all the Expert Advisors including the function of averaging.

- Uses signals from 20 standard indicators included in MetaTrader 4 package.

- The function of averaging allows bringing an unprofitable position to profit by creating a grid of positions in the price movement direction. If the price moves against a position, the averager will open additional positions on the basis of your settings, thus it increases the volume and sets a common take profit for all positions by the given symbol.

- The martingale function allows using the standard martingale mode.

- Trailing stop, break even, trading time, auto lot, closing by total profit/loss. All these function are available in the full version of the Expert Advisor.

Attention! A new universal trading advisor Exp - The xCustomEA working on custom indicators:

The difference between The X and The xCustomEA?

These two EA are built on the same basis (MQL CODE and functions) and differ only in the fact that:

The X = Universal EA , This adviser who works for standard indicators of terminal MetaTrader (about 20 standard strategies of standard indicators).

The xCustomEA = This Universal Advisor who works for custom indicators.

- This advisor no has built-in strategies. You can set custom indicators in this EA.

- This means that you can choose a custom indicator, which shows the signals with arrows and trade on it.

- Also in this EA you can program your strategy on any indicators that are on the Internet!

- You can download ready-made strategies that have been programmed for this advisor. This list is updated whenever possible.

- You can download all signals from the strategy The X - and use your custom changes to the strategies!

If you do not know how and do not want to learn programming and you enough of standard indicators, your choice = The the X .

If you know how to program, and you have an interest in the study of other indicators, your choice = The xCustomEA .

Functions of these advisors = Equal!

Most Relevant Parameters

Trading strategy

- IndSigToTrade - selection of signal type;

- TF_IndSigToTrade1 - selection of timeframe for the signal;

- Signal_Reverse - reversing the main indicator signal;

- ClosePositionifChangeOWNSignal - closing opposite positions when the main signal changes;

- OWNSIGNAL_shift - bar a signal is taken from: 0 - from the current one, 1 - from the first closed one, 2 - from the second closed one.....;

- FILTER_IndSigToTrade2 - FILTER_IndSigToTrade6 - selection of signal type for filtration (five filters can be used simultaneously);

- FILTER_TF_IndSigToTrade2-FILTER_TF_IndSigToTrade6 - selection of timeframe for the filter;

- Filter1_Reverse-Filter6_Reverse - reversing the filter signal;

- FILTERSIGNAL1_shift - FILTERSIGNAL6_shift- bar a signal is taken from: 0 - from the current one, 1 - from the first closed one, 2 - from the second closed one.....;

SIGNAL FUNCTIONS

- Show_alert_without_opening_positions - show alert about a new signal instead of opening a position ;

- OpenBarControlOnly - only open positions at bar opening (emulation of operation mode "Open bars only") ;

- TypeTradeBUYSELL - selection of position types to be opened (BUYSELL, OnlyBuy, OnlySell);

- MinuteToOpenNextPosition - the number of minutes after the last opening/closing to open a new position ;

- ReverseSignal - true - reverse a strategy signal;

- OpenOppositePositionAfterStoploss - open an opposite position after closing the previous position by stop loss ;

- ONlyOnePosbySignal - opening only one position: either BUY and / or SELL;

- OnePosPerDirection - allow having one position per direction (BUY SELL);

- OnlyOnePositionPerMagic - opening only one position by magic number (on the entire account);

- OnlyAlternateSignals - alternate position types: BUY SELL BUY SELL;

- MAX_BUY_POSITION -MAX_SELL_POSITION - the maximum number of BUY SELL positions;

- ClosePosifChange - close positions when an opposite signal emerges;

- CloseChangeOnlyInProfit - close only profitable positions when an opposite signal emerges;

- MaxSpreadToNotTrade - MinSpreadToNotTrade - min/max allowed spread for the EA operation;

MAIN TRADING FUNCTIONS

- StopOrderUSE - Use pending orders or limit orders, false = open positions;

- StopOrderDeltaifUSE - distance for pending orders;

- StopOrderDayToExpiration - pending order expiration, days (1 - current day, 0 - беno expiration, xx - number of days);

- StopOrderBarToExpiration - pending order expiration, bars (according to the current TF);

- ReInstallStopOrdersNewSignalAppears - re-set a pending order when the signal changes;

- TypeFilling - order filling type allowed by the broker. Auto - detect fill type automatically;

- RoundingDigits - round prices of pending orders/opening/modification;

- Sounds - sounds for position opening and modification;

- Magic - magic number;

- CommentToOrder - comment to positions opened by the EA;

- Slippage - slippage in points;

STOP ORDER FUNCTIONS

- VirtualStops - virtual stop loss/take profit/trailing stop instead of real ones;

- ForcedModifySLTP - Forced modification of stop loss and take profit of open positions;

- SetMinStops - auto conversion of placed orders (stop loss, take profit, trailing stop, distance, breakeven) to the minimum possible level on the server;

- StopLoss - if 0 - not used;

- TakeProfit - if 0 - not used;

AUTO LOT AND MARTINGALE SETTINGS

- lot - fixed lot;

- DynamicLot - dynamic lot;

- LotBalancePcnt - risk % of deposit for the dynamic lot;

- RiskRate - exchange rate of the deposit currency in relation to the US dollar for dynamic lot calculation;

- MaxLot - maximum lot for calculation;

- Martin - martingale ratio for a trade following a losing one, not used of set to 1;

AVERAGING

- UseAverage - use averaging, opening additional orders against a trend;

- OnlyModify - do not open averaging positions bu use stop loss/take profit modification;

- TakeProfitALL - total take profit of all positions when opening averaging positions;

- Distance - the distance between orders in the grid;

- DistanceMartin - ratio for grid step;

- LotsMartinAverager - lot increase of the grid of positions;

- MaxOrders - the maximum number of orders in the grid, 0 - unlimited;

ADDING VOLUME IN TREND

- AdditionalOpening - open additional orders in trend direction;

- StopLossALL - total take profit of all positions when opening averaging positions;

- DistanceAdditionalOpen - distance of opened grid positions for adding to positions in the direction of a trend;

- LotsMartinAdditionalOpen - lot increase of the grid of positions;

- MaxOrdersOpenAdditionalOpen - the maximum number of orders in the grid, 0 - unlimited;

TIME SETTINGS

- TradeStartStopbyTime- = true, false. If set to true:

- SeveralTimeWork - trading time in the following format: Trading Start Hour:Trading Start Minute - Trading End Hour:Trading End Minute ;

- OpenHour OpenMinute - Opening hour and minute;

- ClosePeriod_Minute - closure time as the number of minutes since OpenHour OpenMinute ;

- CloseHour CloseMinute - Closing hour and minute;

- CloseAllTradesByOutOfTime - close positions after the end of the trading time;

- TradeByDays - Days - (choose trading days) separated by commas;

- DayForOptimization - trading day for the optimizer;

- TradeStartbyTimeMonday - start trading on Monday;

- OpenHourMonday - OpenMinuteMonday - opening hour and minute on Monday;

- TradeStartStopbyTimeFriday - start trading on Friday;

- OpenHourFriday - OpenMinuteFriday- opening hour and minute on Friday;

- CloseHourFriday - CloseMinuteFriday - closing hour and minute on Friday;

- CloseFriday - true, false (if true, close regardless of the state (profit or loss); if false - positions will be closed according to the EA's algorithm);

TRAILING STOP

- TrailingStopUSE - use trailing stop;

- IfProfTrail - use only for profit positions - break even mode;

- TrailingStop - trailing distance, 0 - minimum allowed;

- TrailingStep - distance step;

- SaveTPafterTrailingStop - keep take profit during trailing stop modification;

TRAILING STOP by PARABOLIC SAR

- TrailingStopSAR - use Parabolic based trailing stop;

- TrailingStopSAR_TimeFrame - indicator timeframe;

- step - maximum- SAR indicator settings;

BREAKEVEN SETTINGS

- MovingInWLUSE - move a position to breakeven;

- LevelWLoss - move the Stop Loss at LevelWLoss pips;

- LevelProfit - when the trade gains LevelProfit points of profit;

CLOSE BY TOTAL PROFIT AND LOSS

- TypeofClose - closing type by profit;

- TrailOptions - distance for profit trailing (operates with the prifitessss parameter);

- TypeofClose - profit trailing modification step;

- CloseProfit - close if profit+;

- prifitessss - number of units (depending on TypeofClose) for closing profit;

- CloseLoss - close if loss;

- lossss - number of units (depending on TypeofClose) for closing a loss;

- OFFAfterClosePROF OFFAfterCloseLOSS- close the EA upon reaching profit/loss;

- CloseTerminalAfterClosePROF CloseTerminalAfterCloseLOSS- close the terminal upon reaching profit/loss;

CURRENCY PAIR SETTINGS

- PAIR1-PAIR12 - names of currency pairs for the EA to trade, up to 12 at a time;

INDICATOR SETTINGS

- Indicators options - standard indicator settings; only configure indicators used for the signal and filter;

PROFIT?LOSS LIMIT SETTINGS

- LimitFor - calculation limit in the time range;

- LimitType - limit calculation type (dollars, points, percentage;

- LimitForLosses - limit of loss in the deposit currency;

- LimitForProfits - limit of profit in the deposit currency;

- ClosebyLIMITING - close upon reaching the limit;

- UseCurrentProfit - take into account floating profit of currently open positions;

DRAWDOWN LIMITATION SETTINGS

- DrawDown_Level - enable drawdown management block;

- Type_DrawDownHR - drawdown calculation type based in history settings and current settings;

- DrawDown_Level_One - the first drawdown levels as percentage;

- Type_Deal_Level_One - what to do at the first level of drawdown (disable new signals \ disable averaging or additional opening \ disable all trades \ alert)

- DrawDown_Level_Two - the second drawdown level in percent;

- Type_Deal_Level_Two - what to do at the second drawdown level (close all profitable positions \ close all unprofitable positions \ close all \ alert);

OTHER SETTINGS

- Tester Withdrawal - block of emulation of withdrawal in the strategy tester;

The list of indicators and filters

IndSigToTrade..FILTER_IndSigToTrade2, FILTER_IndSigToTrade5.

Signal

- occurs when there are all conditions for a signal, such as the fact of crossing the MA line. Or the emergence of a new point of ZigZag.

For example: the level of intersection 70 is RSI indicator signal. And if the RSI is above level 70, it's a filter.

Signal - that is what appears at the time of receipt of quotations, is fixed on the bar. Advisor accepts the fact of the signal.

For example : I turn on the light. This is a signal because the light just turned on. When you turn on the light, the man woke up. This is a signal.

Position can be opened at the commission of a signal fact crossed the line, then opened position. If the lines have been crossed before, it is not a signal. The signal has already passed.

Filter

- This is the current position of the indicator, such as current position MA lines relative to each other. Or the current last node ZIGZAG

Filter - is that at the moment shows the indicator. It is not the fact of the signal. This is the current position of the indicator.

For example : The light was burning. This filter because the light has been switched on and it is already burning. When the light of a person is not sleeping. This filter.

signal filtering occurs on the current indicator. If Fast MA above the slow MA, it is a filter that must be opened only BUY.

No Signal

The main signal is added to No Signal

When choosing which advisor ignores the main signal and trades on the filters.

When using the main indicator signal is generated as it is! on the current bar.!

This means that the signal to open appears as a fact of the signal. If the signal has a filter does not permit the open position, then the signal is ignored.

When using NoSignal, you can ignore the fact of the main signal and work on filters.

When using filters, the signal is considered to be the current position indicators regarding their signals, but the fact of no signal.

For example :

Signal - this is the intersection of two MA between itself and the fact of the signal is the intersection point of the two MA.

Filter - a position of the two MA relative to each other. If in the past they crossed, the filter shows the current position of the MA lines.

Moving Average (MA) (Signal 1)

Technical indicator Moving Average (Moving Average, MA) shows the average price tool for some period of time. When calculating the Moving Average, one averages out the instrument price for the period. As the price changes, its moving average either increases or decreases.

Signal is calculated by the relative position of two moving averages, one of which must have a smaller period (rapid MA) and the other, respectively, a larger (slow MA). Their parameters can be specified in the variables.

BUY signal is output when the fast MA is located above the slow and SELL signal when the above rapid slow. State "no signal" is not used.

Moving Average Convergence/Divergence (MACD) (Сигнал 2)

Technical Indicator convergence / divergence moving averages (Moving Average Convergence / Divergence, MACD ) - is a trend following momentum indicator. It shows the relationship between two moving averages of prices.

Technical MACD Indicator is the difference between two exponential moving averages (EMA)

MACD is most effective in an environment where the market swings with high amplitude in a trading range. intersection, overbought / pereprodannosti and divergence - often used MACD signals.

It operates four variables. Signals are also simple: BUY - the main line above the signal, SELL - the main line below the signal. "No Signal" is not used.

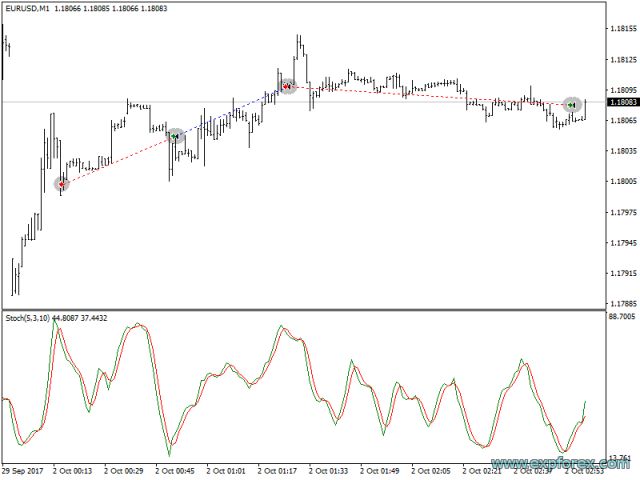

Stochastic Oscillator (Сигнал 3)

Technical indicator Stochastic Oscillator (Stochastic Oscillator) compares the current closing price to its price range over a given time period. Indicator is represented by two lines. The main line called% K. The second line% D - is moving average of% K. Usually% K is represented by the solid line and the% D - dashed.

The oscillator consists of two lines - the main and the signal that allows you to trade the signals of the intersection of these lines. BUY signal - higher than the main line, SELL signal - the main line below.

RSI indicator (signal 4)

Technical Indicator Relative Strength Index (Relative Strength Index, RSI) is a price-following oscillator that oscillates in the range from 0 to 100. By introducing Relative Strength Index, Y., Wilder recommended using a 14-period embodiment. Later widely as 9 and 25-indicators. One of the common methods of analysis Relative Strength Index indicator is to look for divergences in which the security is making a new high, but the RSI is failing to surpass its previous high. This divergence suggests an impending reversal. If the Index then turns down and falls below its most recent trough, it will have completed a "failure swing" (failure swing). The failure swing is considered a confirmation of the impending reversal.

Similar to the CCI and DeMarker'u. Signals are output from zones perekuplennosti (RSIHighLevel) and pereprodannosti (RSILowLevel). Therefore, rare BUY signals correspond to the intersection of the upper level downwards, and signals SELL - the intersection of the lower layer from the bottom up. The main condition - "no signal". display period can be set in RSIPeriod parameter and calculating the price - in RSIPrice parameter.

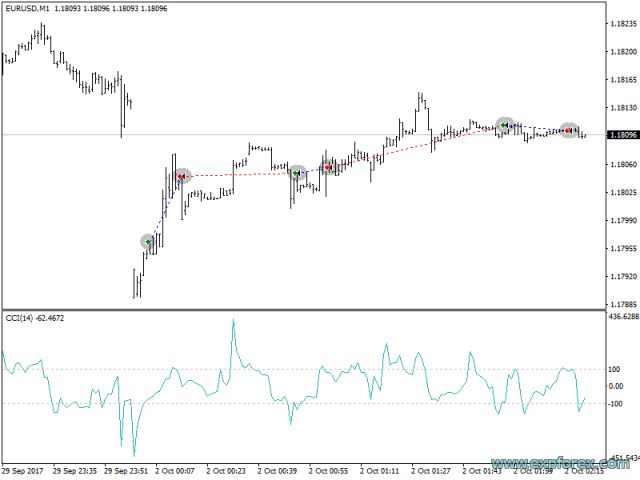

Commodity Channel Index (CCI) (Сигнал 5)

Technical Indicator Commodity Channel Index (Commodity Channel Index, CCI) measures the deviation of the commodity price from its average statistical price. High values of the index indicate that the price is unusually high compared to average and low - that is too low. Despite the name, Commodity Channel Index is applicable to any financial instrument not only to goods.

all three signals are also used, but the main condition is still "no signal". Rare occurrence trade signals corresponds to the intersection of the upper level downwards (BUY) and the intersection of the lower layer from the bottom up (SELL). The upper and lower layers are defined by the value of the external parameters and CCIHighLevel CCILowLevel. Period and price calculation of the indicator values are determined and CCIPeriod CCIPrice.

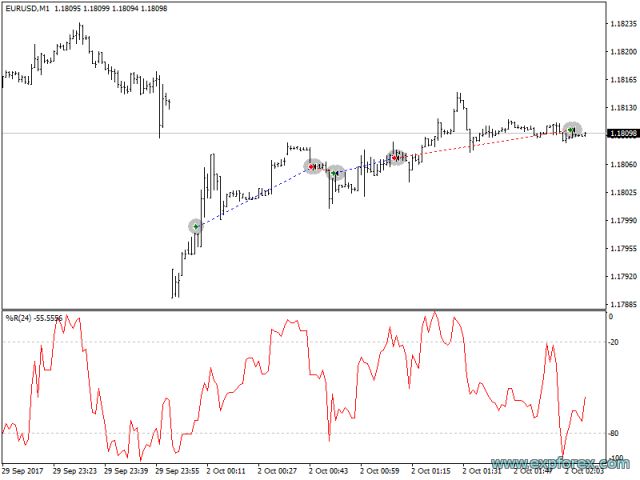

Williams Percent Range (WPR) (Сигнал 6)

Technical Indicator Percentage Range of Williams (Williams' Percent Range,% R ) - a dynamic indicator, which determines whether the perekuplennosti / resale. Williams' Percent Range is very similar to a technical indicator Stochastic has Oscillator . The difference between them consists only in that the former has an upside-down and the internal smoothing.

It is in line with the RSI, CCI and DeMarker. BUY Signal - perekuplennosti level crossing (WPRHighLevel) downwards, SELL signal - pereprodannosti intersection (WPRLowLevel) level upwards. Everything else - the "no signal". Changing the outside can only parameter indicator period - WPRPeriod.

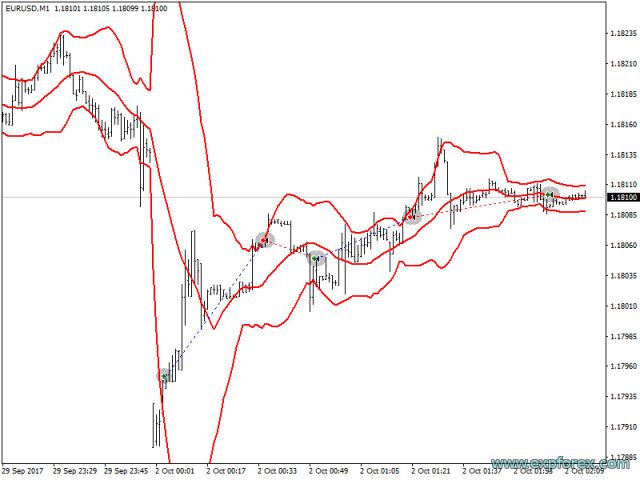

Bollinger Bands (Bollinger Bands) (signal 7)

Bollinger (Bollinger Bands, BB) are similar to Envelopes . The difference between them lies in the fact that the bands (Envelopes) arranged above and below the curve moving average at a fixed, expressed as a percentage of the distance, whereas the borders are constructed Bollinger Bands at distances equal to a certain number of standard deviations. Since the standard deviation depends on the volatility, strips themselves adjust their width: it increases when the market is unstable, and decreases in more stable periods.

There are three types of signals: BUY - the closing price of the previous candle below the bottom line, the SELL - the closing price of the previous candle above the top line, "no signal" - the closing price of the candle between the lines.

Indicator Envelopes (signal 8)

Technical Indicator envelopes lines (envelopes, Envelopes) is formed by two moving averages , one of which is shifted upwards, and the other - downwards. Selection of optimum relative number of band margins shifting is determined with the market volatility: the higher it is - the greater the displacement.

Since the appearance and nature of the indicator - the channel signals are similar to the signals in the channel during operation. BUY - the closing price of the candle is below the lower line, SELL - the closing price of the candle above the top line and "no signal" - the closing price between the lines.

Alligator (signal 9)

Most of the time the market remains stationary. Only 15-30% of the time the market generates some trends and traders who are not located in the exchange, almost all of their income is taken from the trends. My grandfather used to say: "Even a blind chicken will find its corns, if it is fed at the same time." We refer to trade with the trend "a blind chicken market". It took us years, we have produced an indicator, that lets us always "keep their powder dry" until then, until we find ourselves in a "blind chicken market".

Bill Williams

Technical Indicator Alligator - a combination of Balance Lines ( Moving averages, the Moving Averages ), use fractal geometry and nonlinear dynamics.

Also, for all lines use the same method of averaging (AlligatorMethod) and the calculation of the price (AlligatorPrice). A feature of the indicator is that all lines have a positive shift to the right. This allows you to safely read the value of the indicator on the current bar as they are already precisely formed and may not be changed.

BUY Signal - Lip line above the line of teeth, and tooth line above the jaw line, SELL signal - line lip below the line of teeth, and tooth line below the jaws. In all other cases there is no signal.

Moving Average of Oscillator (OsMA) (Сигнал 10)

Technical Indicator Moving Average Oscillator (Moving Average of Oscillator, OsMA) - is the difference between the oscillator and the oscillator smoothing. In this case, the oscillator uses the basic MACD line, and as anti-aliasing - signal.

The signals are considered little different:

- BUY - the value of the histogram is above zero,

- SELL - the value of the histogram is below zero. State "no signal" will be only in those rare cases, when OsMA value will be zero.

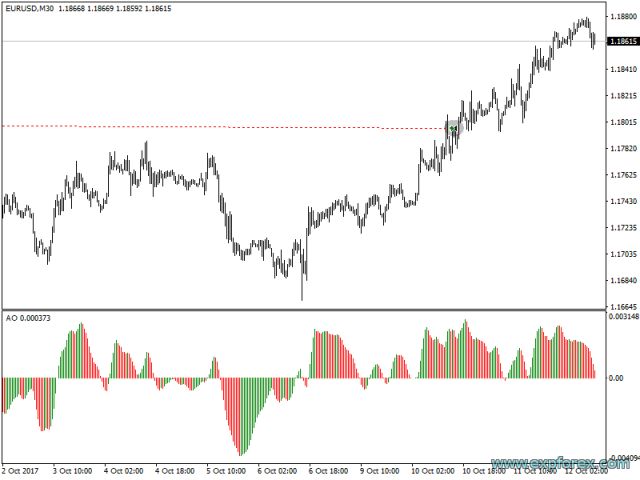

Awesome Oscillator (AO) (Сигнал 11)

Technical Indicator wonderful Oscillator Bill Williams (Awesome Oscillator, AO) - a 34-period simple moving average, plotted through the middle points of the bars (H + L) / 2, is subtracted from the 5-period simple moving average, built on the central points of the bars ( H + L) / 2. He tells us exactly what is going on at the current time with the driving force of the market.

It does not have the options available to the user. One of the principles of the indicator is to look for "saucers". "Saucer" Bill Williams calls the two increases the value of the bars in the positive area, between which there is a bar with a lower value. Accordingly, the "inverted saucer" - it reduces the value of two bars in the negative area, between which there is a bar with a large value. Thus, to identify the "saucers" need three candles formed the last (in the code - four). BUY signal - "saucer", the SELL signal - "inverted saucer", "no signal" - all the other cases.

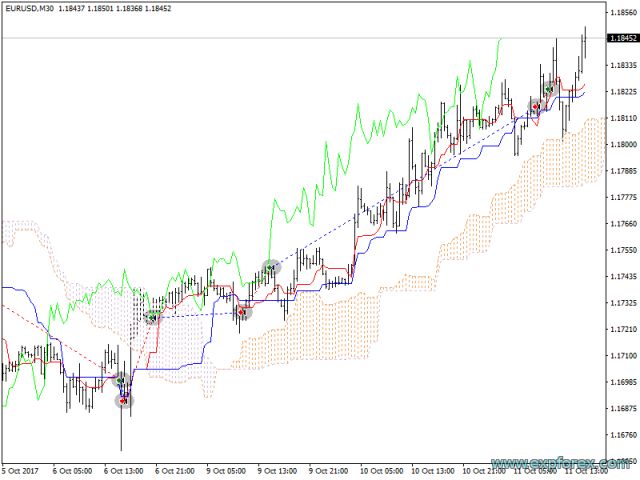

Ichimoku (Сигнал 12)

Technical Indicator Ichimoku Kinko Hyo (Ichimoku Kinko Hyo) is designed to determine the market trend, support and resistance levels and to generate buy and sell signals. This indicator works best at weekly and daily charts.

the principle of work on the intersection of lines and TENKANSEN KIJUNSEN,

if TENKANSEN more than KIJUNSEN - signal to BUY

If TENKANSEN less than KIJUNSEN - signal to SELL

Accelerator/Decelerator (AС) (Сигнал 13)

The technical indicator Acceleration / Deceleration (Acceleration / Deceleration, Accelerator / Decelerator Oscillator, AC) measures acceleration and deceleration of the current driving force. This indicator will change direction before the driving force, and she, in turn, will change its direction before the price. Understanding that AU is earlier warning signal provides obvious advantages.

The same signals as in AO

Bar (signal 14)

Work in the direction of the bar

If Close is higher than candles candles Open (Bull bar) - BUY signal

If Close is lower than Open candles candles (Bear Bar) - signal SELL

ADX (signal 15)

Technical Indicator Index Middle Directional Movement (Average Directional Movement Index, ADX) helps to determine the existence of a price trend. It is built on the approaches described in the book "New Concepts in Technical Trading Systems" Welles Wilder.

signals from a strategy guide: https://www.metatrader5.com/ru/terminal/help/indicators/trend_indicators/admi

this signal can take two types of signals for opening

if ADXLevel = 0, then used the strategy:

Wilder recommends buying when + DI crosses above the -DI, and selling when + DI crosses below -DI.

! if ADXLevel = 0, then used the strategy:

Wilder recommends buying when + DI crosses above the -DI while ADX above ADXLevel, and selling when + DI crosses below -DI while ADX above ADXLevel.

When the ADX is used as a filter, using the position of the lines + DI> -DI = only BUY, + DI <-DI = only SELL,

- if ADXLevel is 0, then the permission to open a SELL DI-> DI +

- If ADXLevel is 0, then the permission to open BUY a DI +> DI-

- If ADXLevel equal to 0, then the permission to open SELL a DI-> DI + and ADX> ADXLevel

- If ADXLevel equal to 0, then the permission to open BUY a DI +> DI- and ADX> ADXLevel

ZIGZAG (signal 17)

A signal to open a position on the indicator ZIGZAG ZIGZAG is the intersection of Extrema.

When using the signals it is important to adjust the parameter shift.

A value of 0 - position is opened at once in the direction of the intersection of the current Bid price of the last extremum ZIGZAG.

When set to 1 - the position is opened when the intersection is fixed at 1 bar closed.

Last extremum extremum 1 is considered fixed when the extremum of this already delayed new segment ZIGZAG. The intersection of the maximum and minimum points and is a signal to open position.

ZIGZAG filter is considered to be the direction of the last segment ZIGZAG 0.

ATR (signal 18)

Technical indicator Average True Range (Average True Range, ATR) - a measure of market volatility. It was introduced by Welles Wilder in his book "New Concepts in Technical Trading Systems" and since the indicator is used as a component of numerous other indicators and trading systems.

Average True Range can often reach a high value at the bottom of the market after a sheer fall in prices occasioned by panic selling. Low values of the indicator often correspond with long periods of sideways movement, that are observed in the market summits and during the consolidation. It can be interpreted by the same rules as other volatility indicators. The principle of forecasting using Average True Range is formulated as follows: the higher the value of the indicator, the higher the probability of a trend change; The lower the value, the weaker the trend.

ATR shows volatility of the market.

Trading Strategies for ATR as a filter is to confirm the current trend.

When the ATR increases it means higher voltailnost market.

Low rates mean ATR Nizkuya market volatility.

External settings:

ATR_period = 14; - calculating the period indicator ATR

ATRprice = PRICE_CLOSE; - Price type for which will filter calculation (the Close, the Open, High, the Low ...)

ATR_MA_period = 1; - The number of candles for calculating the average line (MA), 1 - means that calculates the direction indicator signal from the current and

previous bar (depending on the shift parameters)

ATR_MULTIPLIER = 1; - ATR coefficient index, e.g. EURUSD ATR = 0.0020, using ATR_MULTIPLIER coefficient = 2, the calculation is included

ATR = 0.0040.

Filter logic of ATR:

PRICE (ATRprice) of the current bar is higher than PRICES (ATRprice) previous bar + (ATR * ATR_MULTIPLIER) = high volatility BUY filter

Price (ATRprice) of the current bar less than the price (ATRprice) previous bar - (ATR * ATR_MULTIPLIER) = high volatility filter SELL

ADX Wilder (signal 19) - for only MT5

Technical Indicator Average Directional Movement Index Wilder (Average Directional Movement Index Wilder, ADX Wilder) helps to determine if the price trend. This indicator is built in strict accordance with the algorithm described by Welles Wilder in his book "New Concepts in Technical Trading Systems".

This signal can take two types of signals for opening

if ADXLevel = 0, then used the strategy:

- Wilder recommends buying when + DI crosses above the -DI, and selling when + DI crosses below -DI.

! if ADXLevel = 0, then used the strategy:

- Wilder recommends buying when + DI crosses above the -DI while ADX above ADXLevel, and selling when + DI crosses below -DI while ADX above ADXLevel.

- When the ADX is used as a filter, using the position of the lines + DI> -DI = only BUY, + DI <-DI = only SELL,

- if ADXLevel is 0, then the permission to open a SELL DI-> DI +

- If ADXLevel is 0, then the resolution It is to open a BUY DI +> DI-

- If ADXLevel equal to 0, then the permission to open a SELL DI-> DI + and ADX> ADXLevel

- If ADXLevel equal to 0, then the permission to open a BUY DI +> DI- and ADX> ADXLevel

Money Flow Index (Сигнал 20)

Technical Indicator Index Cash Flow (Money Flow Index, MFI) indicates the rate at which money is invested into a security and then withdrawn from it. Construction and interpretation of the indicator is similar to Relative the Strength the Index , with the only difference that volume is important to MFI.

Trading Indicator Money Flow Index

Index Cash Flow (Money Flow Index, MFI) indicates the rate at which money is invested into a

security and then withdrawn from it. Construction and interpretation of the Strength indicator is similar to Relative

the Index, with the only difference that volume is important to MFI.

Indicator signals analogous to signals from RSI indicator;

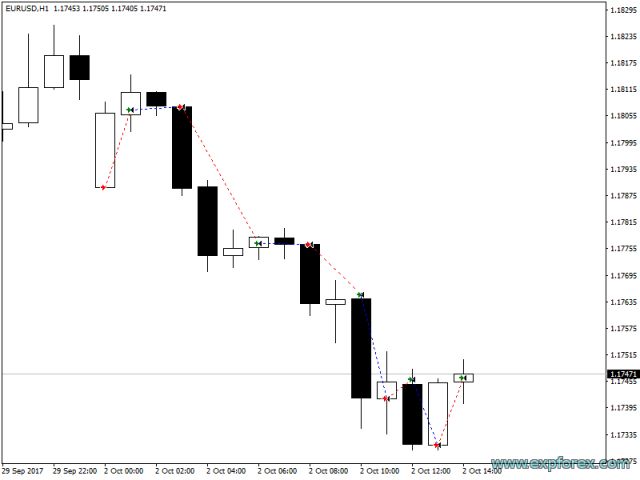

Fractals (signal 21)

Fractals (Fractals) - is one of five indicators of Bill Williams' trading system, allows to detect the bottom or the top. The technical definition of a fractal-up - is a series of at least five consecutive bars where the highest high before and behind him are two bars with lower highs. The opposite configuration (series of five bars, in which the lowest minimum before and behind are two bars with higher lows) corresponds fractal. The fractals are High and Low values and are indicated by arrows up or down.

Trading Indicator Fractals

signal for opening positions is the intersection of the last fractal level:

When crossing up the price of the last top-fractal - open BUY position;

At the intersection of the lower down the price of the last fractal - open SELL position;

Filter: Similarly, the main signal:

If the price is above the last upper fractal - only BUY position;

If the price is below the last lower fractal - only SELL position;

Attention! Fractal can be drawn at least 2 bar is closed and can be drawn into the past for

an unlimited number of bars ago. Keep this in mind when analyzing the signal!

What are the values in the parameters in points or pips?

In points! The item is taken from the value of the Point () variable

- If you have a 5 \ 3 digit broker, then 1 point = 0.00001 \ 0.001

- If you have a 4 \ 2 digit broker, then 1 point = 0.0001 \ 0.01

Do you have the kits and settings for this Expert Advisor?

No, I created the Expert Advisor as a designer. This EA requires your optimization. According to your strategy, and according to your capabilities, but using our functions.

Why are the test results in mt4 and mt5 terminals different?

Because they are different terminals, with different history of quotations, with different principles of the strategy tester.

What settings do you use on your signal?

Default settings. I only test the correctness of the functions, and not the profitability of this advisor.

Why?

Because this advisor was created as a designer. Each user must find their own strategy.

Want my strategy? TickSniper already set up automatic trading robot

I want you to make several changes to the Expert Advisor.

I take new functions very carefully only when these functions are useful to most users of the system. Unfortunately, I can not program each function separately for each user. Y

I can add a couple of functions only when I see a sense in these functions. Excuse me.

Can you add a few custom indicators to the Expert Advisor?

No, this advisor was created only for standard indicators. I can not add all the Internet indicators to this Expert Advisor.

When will you add more indicators?

I add only those indicators I think are necessary. Unfortunately, I can not add all the indicators to the Expert Advisor. The Expert Advisor is so full of external parameters

Parameter | Description |

|---|---|

| OWN Signal options Block of signals and filters | |

| IndSigToTrade | Select an indicator and a signal to open the first and main position.

|

| TF_IndSigToTrade1 | The timeframe for 1 main indicator.

|

| Signal_Reverse | Flip the signals of this indicator. This option reverses the signals of the main indicator only. |

| ClosePositionifChangeOWNSignal | Enable \ Disable closing of positions on the opposite signal of the main indicator, without the participation of other filters and other parameters The ClosePositionifChangeOWNSignal parameter is divided into 3 values:

|

| OWNSIGNAL_shift | The bar number for the signal that the indicator will generate,

|

| FILTER_IndSigToTrade | Selecting an indicator and signal for filtering signals from the main indicator Therefore, by including a filter, you can wait a long time to open positions! Be attentive and check your settings on the strategy tester |

| FILTER_TF_IndSigToTrade | Timeframe for the filter.

For example: When using MA as the main signal with TF = M30, you can enable filtering on the older MA with TF = H4 |

| Filter_Reverse | Flip the signals of this filter. This option reverses the signals of only this filter. The MA main indicator shows BUY, but the older MA indicator shows SELL when using this function we turn over the signals of the older MA and get the aggregate signal BUY |

| FILTERSIGNAL_shift | The bar number for the signal that the indicator will generate,

|