ING warn that pound sterling will reach levels of 'extreme' undervaluation against the euro over coming months while the euro is not at risk of a fall to parity against the dollar despite the threats to the EU posed by Brexit.

Copy signals, Trade and Earn $ on Forex4you - https://www.share4you.com/en/?affid=0fd9105

- Pound to euro exchange rate today = 1.2161

- Euro to pound sterling exchange rate today = 0.8223

- Euro to dollar exchange rate today = 1.1096

Analysts at ING are the latest to rewrite their 2016 - 2017 exchange rate forecasts now that the Leave vote has won the June 23rd referendum.

The result has shaken previous assumptions on the outlook for the British economy and the interest rates the Bank of England will set in response.

In short, we are headed for a lower-for-longer interest rate environment which should significantly ease inflows of foreign capital creating downward pressures on the exchange rate.

ING concede that the exercise of drawing up their initial post-Brexit forecasts was a difficult one owing to the political dimensions now involved.

“While a whole host of political permutations may undermine the merits of basing forecasts on any single set of assumptions, it is clear that the lack of visibility will push GBP towards the extremes of under-valuation,” says Chris Turner, Global Head of Strategy at ING in London.

ING’s Behavioural Equilibrium Exchange Rate (BEER) model for EUR/GBP has suggested the euro to pound sterling pair should trade towards 0.90 over the next three to six months.

0.90 corresponds to 1.10 in pound to euro exchange rate terms.

The BEER model will be used by ING as a gauge for extreme EUR/GBP over-valuation.

BEER tells us where EUR/GBP could be trading on a medium-term basis using longer term inputs, such as productivity differentials, terms of trade, external imbalances and government consumption as a share of GDP.

ING primarily use the model to highlight how far GBP could over-shoot in the event of Brexit.

"Given the myriad of political risks over the next three to six months in particular, we see EUR/GBP trading very close to that level," says Turner.

This would place the ING forecast towards the lower end of the 1.10-1.20 range most analysts are forecasting for this pair.

Turner tells clients that whether Sterling falls to such a level will depend on key issues, such as:

- how quickly the Conservatives choose a new leader

- whether that new leader seeks an early general election to secure a mandate for EU negotiation

- the stance taken by EU leaders.

However, the official forecast figure from ING differs to the forecast given by the BEER model owing to other inputs.

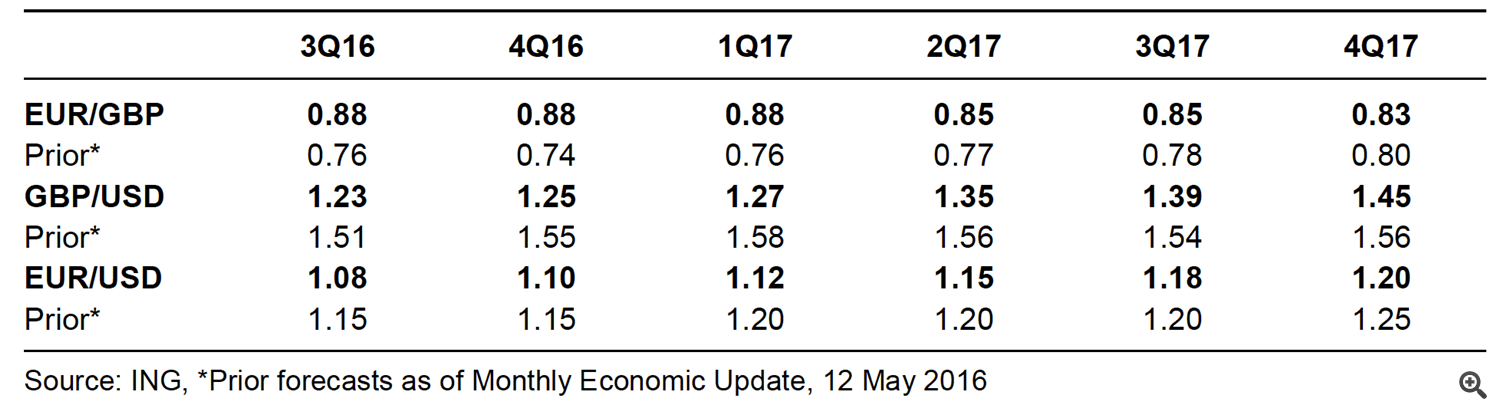

Here are the official forecasts:

For those looking to approach the EUR/GBP from the other angle, and convert GBP into EUR, note that 0.88 EUR/GBP = 1.1364 pounds to euros.

0.85 = 1.1765.

0.83 = 1.2048.

Why the Euro to Dollar Rate (EUR/USD) is Forecast to Remain Above 1.08

Of course a big question for foreign exchange analysts going forward will be the direction EUR/USD takes.

We have seen the euro-dollar track the pound-dollar of late, albeit the moves are of lesser scope.

This is understandable in that the uncertainty over whether Brexit is implemented, and what it means for the future of the EU, should also keep the EUR pressured.

“Consistent with some of our pre-referendum work, we think Cable could get close to 1.20 during this period, while EUR/USD could get dragged down to the 1.07/1.08 area,” says Turner.

However, over a longer timeframe ING are quite constructive on the euro.

Some of the reasons they are not looking for EUR/USD to trade down to 1.00 are:

- Dovish re-pricing of the Fed cycle

- The ECB’s 2012 introduction of the OMT programme

- The ECB’s 2015 introduction of the PSPP programm

- EUR/USD valuation (cheap at 1.10 vs slightly over-valued during 2010-12 crisis)

- Eurozone current account surplus now worth 3% of GDP (1% in 2012)

Indeed, the risks in the forecasts are biased towards the upside.

“The ECB has to tread very carefully with the EUR. One mis-step, potentially one where a new deposit rate cut hurts, rather than helps the Eurozone banking sector, could see a parallel drawn to the BoJ’s actions in January – actions which resulted in a stronger, not weaker currency,” says Turner.