What the heck does the phrase “sell in May and go away” mean and can it translate to forex trade opportunities? Here are points that you need to know.

What the heck does “Sell in May and Go Away” mean?!

The phrase, used more widely in the equities markets, refers to traders cashing in their high-yielding investments ahead of the summer months (usually June to August). With traders out on vacations, the months following May usually see significant drops in trading volume.

This creates a self-fulfilling prophecy of selling in May followed by months of low volume (and sometimes low volatility) trading, which is why it’s better for most traders to just “go away.” The occurrence is first observed in the U.S. markets but has since been noticed in Canadian and European markets as well.

How does this apply to forex trading?

Traders cashing in on their high-yielding investments means more activity for the major currencies. And with the bulk of traders selling dollar-denominated assets, mass profit-taking could mean more demand for the dollar.

Can forex traders get some of the self-fulfilling action?

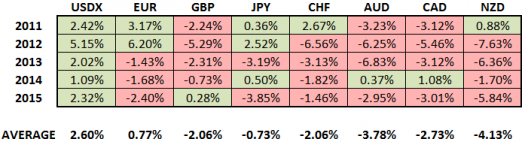

Are there any forex trade opportunities from equities traders taking their risky bets off in May? Let’s take a look at how the major currencies fared against the low-yielding Greenback for the past five years. Looking at the chart below, we can identify at least 3 occurrences that can translate to forex trade ideas:

May Performances of the Major Currencies vs. USD

1. It’s 5/5 for the Dollar Index

Over the last five years the dollar index (USDX),

a measure of the dollar’s performance against a basket of currencies,

has always ended the May month in the green. The index saw its highest

gains in 2012 and has an average gain of around 2.60%.

2. Comdoll trading is the way to go

Commodity-related currencies like the Aussie, Loonie, and Kiwi usually

present the best trade opportunities. One possible explanation for this

is that the comdolls have the highest interest rates, which make them

vulnerable to wide scale profit-taking.

Looking at the chart above, we can see that the three have reacted inversely to the USDX in four out of the last five years. Next, the comdolls have the most volatile average price action among the major currencies. Lastly, save for one or two instances, the Aussie, Loonie, and Kiwi tend to have coordinated reactions during the month.

3. Among the European currencies, GBP and CHF react the most to the dollar

If you’re not into comdoll trading, then you might want to look at the

pound and franc for trade opportunities. The pound, another

high-yielding currency, is also vulnerable to profit-taking. Meanwhile,

the relatively stable USD/CHF is one of the best pairs to place your

dollar biases on.

As per the chart above, we can see that GBP and CHF’s 5-year average volatility are close to that of the USDX’s. In fact, both currencies tend to be as volatile as the dollar index in each of the last five years.

So should I buy the dollar this month?

Not really. There’s no thing as a sure thing, after all. This time the dollar could be dragged by forex traders who have moved their Fed rate hike bets from June to September. Not only that, but the rising gold and oil prices could also boost risk appetite.

Don’t be so quick to drop your long dollar bets though. Increased concerns for China’s growth could convince traders to buy “safe-havens” like the Greenback. In addition, long-term traders can also hunt for “bargains” and price in the Fed’s overall tightening bias against dovish central banks like the ECB, BOJ, RBA, BOC, and the RBNZ.

Though there’s no guarantee of where the markets are going, a risk-averse trading in May is one of the probabilities that forex traders can take advantage of in the next few weeks. In any case, make sure you have your plans in place before you enter any trades!.