EUR/USD Forecast: US Jobs Data Awaited

The EUR/USD pair is confined to a 20 pips range ever since the day started, and not far from the base of this week's range, ahead of the release of the US Nonfarm Payroll report. The pair failed to regain the 1.1200 figure this Thursday, as the ECB's economic policy meeting resulted pretty much dovish, with only minor reviews to inflation and growth forecasts, disappointing EUR bulls and those expecting a more optimistic stance from Draghi.

But now attention is focused in the US Nonfarm Payroll report and how it will affect the US FED decision of raising rates, or when. The consensus point for 164,000 new jobs added in May, while the unemployment rate is expected to have fallen down to 4.9%. Wages, however, are seen down, with average hourly earnings expected at 0.2% from previous 0.3%.

Indeed, the headline reading will trigger the initial move, but whether if it is sustainable or not, will depend on salaries. If wages came in below expected, it will put a possible rate hike further away in time, and therefore weigh negatively on the greenback, in spite of a strong headline.

A strong headline and a surprise increase in wages, beyond expectations, could on the other hand, sent the greenback higher against all of its major rivals.

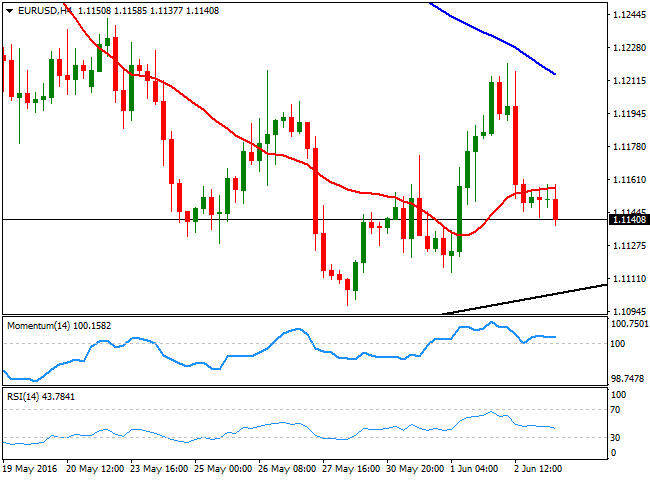

Trading around 1.1142, the key support comes not at 1.1097, this week low that now converges with the daily ascendant trend line coming from November 2015 low. A break below it, should signal a downward continuation towards 1.1040/50, with a break below it pointing for a probable test of the 1.1000 level.

The immediate resistance comes at 1.1160, and an upward acceleration through it should see the pair retesting yesterday's high at 1.1220, and even extend up to 1.1245 a strong static resistance level. If this last is beaten, the rally can extend up to 1.1280/1.1300.