Optimistic Draghi Not Enough to Save the EUR

The European Central Bank is expected to leave its massive bond-purchase program unchanged in its June monetary policy meeting, but Mario Draghi may have a reason to be optimistic this time, despite inflation in the EU remains subdued and far below the 2% Central Banks' goal, as the latest May EU CPI fell by 0.1% compared to a year before, indicating that Mr. Draghi, will once again ask for patient and wait for the full impact of its latest announcements to unfold.

The ECB has announced and extension of its stimulus package last March, up to €1.8 trillion that has not yet been fully implemented, as the ECB will start to buy corporate bonds this June. This suggest that the Central Bank will refrain from add more stimulus, in spite of poor inflation, as the ECB is well-known for supporting the "wait and see" stance.

But there's a good chance that the Bank will raise its inflation forecast for the first time this year, given that oil prices have posted a nice recovery in these past months. In the past March meeting, European policy makers downgraded their CPI projections due to the poor developments in oil markets. Therefore, the general sentiment points this time for an upbeat tone.

A hawkish stance could give the EUR some support in the nearest term, but seems unlikely that the common currency can rally just on an upward revision of inflation and growth expectations. Unless data starts to improve, the common currency has little room for rallies in the mid-term. A dovish stance would be a major surprise, and therefore result in a large EUR's decline.

Whatever the ECB does, remember that the FED will have its next

policy meeting next June 16th, and market is heading into it with high

expectations of a rate hike, either for June or July, and therefore

investors may remain cautious until that meeting. Maybe it's too early

to say, but if the US Federal Reserve fails to deliver, the common

currency will benefit regardless local data.

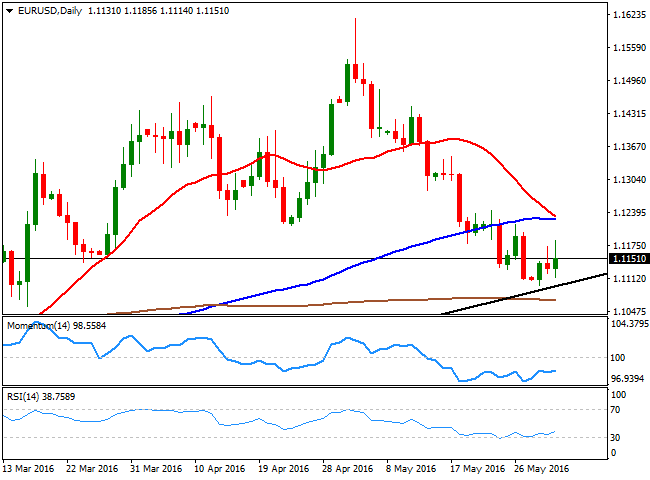

The EUR/USD pair has shed around 550 pips during the past May, after topping at 1.1615 at the beginning of the month. The decline extended down to the 1.1100 price zone earlier this week, and the market has been consolidating around it, ahead of the upcoming big events, the ECB meeting and the US NFP report.

The technical outlook is quite bearish, as in the daily chart, the price is below its 20 and 100 SMAs, both converging at 1.1225, and it would take a steady recovery beyond it to limit the persistent downward risk, and see the pair extending up to the 1.1280/90 price zone. Further gains are unlikely, or at least, not sustainable beyond the initial reaction.

The pair has a major support around 1.1080/90, a daily ascendant

trend line coming from November 2015 low. If somehow the pair fells

below it, the decline can extend down to 1.1000, where the price is expected to turn back into consolidative mode ahead of the release of the US employment report.