Daily Analysis of Major Pairs for May 23, 2016

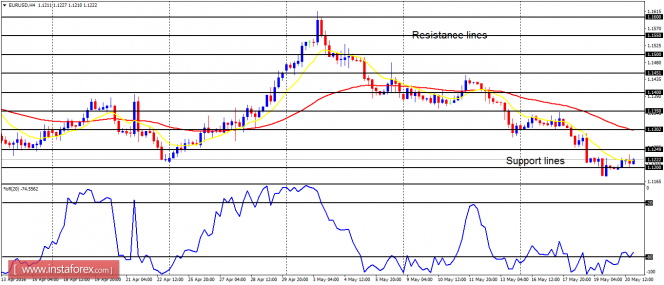

EUR/USD: Compared to USD/CHF, EUR/USD moved in the opposite direction last week. The price closed below the resistance line at 1.1250, as it threatens to test the support line at 1.1200. This support line, including another support line at 1.1150, might be tested this week. Nevertheless, it is possible that the EUR would rally this week – an event that could hamper the extant bullishness in the market.

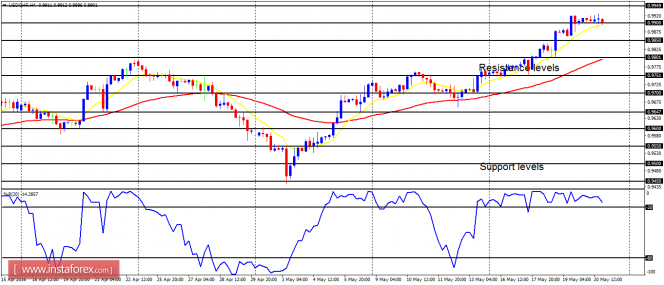

USD/CHF: As it was forecasted, the USD/CHF pair was able to move upwards by 160 pips last week, closing above the support level at 0.9900. The next target should be the resistance level at 1.0000, which means a parity area for USD versus CHF. However, there is one challenge bulls might face this week, and that is the anticipated rally in CHF, which would make it difficult for bulls to push the price far higher.

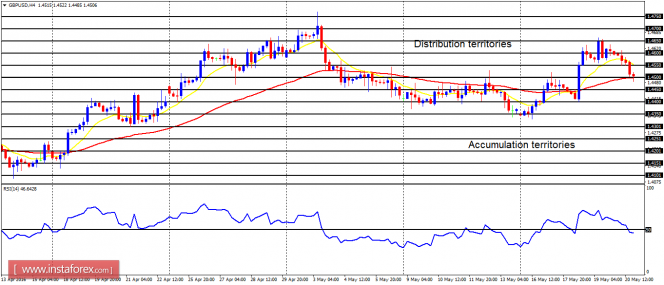

GBP/USD: This pair moved upwards by 300 pips last week, and later dropped by 140 pips to close at 1.4506. There would have been a Bullish Confirmation Pattern on the 4-hour chart, but the bearish correction is conspicuous enough to force the market back into a neutral zone. Nevertheless, the most probably direction this week is northwards.

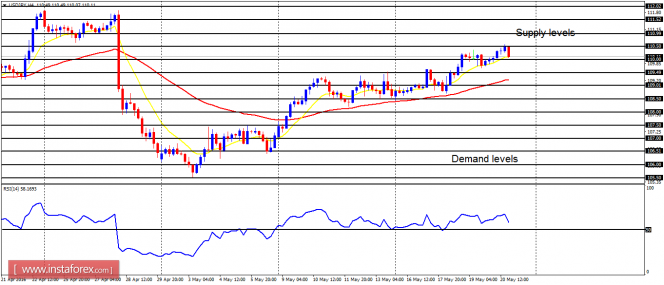

USD/JPY: This market is bullish – having moved upwards by 170 pips last week. The EMA 11 is above the EMA 56, while the RSI period 14 is above the level 50. Further upwards movement is anticipated. The price is now above the demand level at 110.00, and the next target is the supply level at 111.00. Other JPY pairs could also go bullish this week.

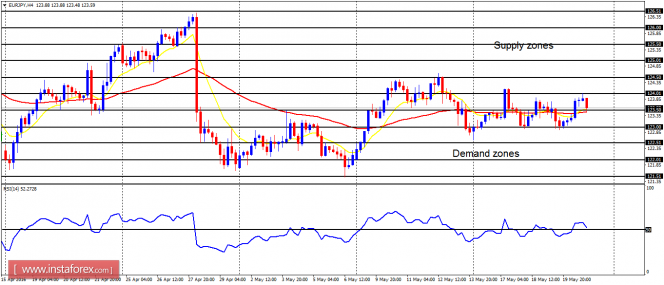

EUR/JPY: The EUR/JPY pair has moved sideways throughout last week, with the price not going above the supply zone at 124.50 or going below the demand zone 122.50. A breakout would happen this week, which would take the market out of the equilibrium zones. The higher probability is a breakout in favor of bulls.