APAC Currency Corner – Weekend Worries

The trifecta of the closely watched Chinese economic metrics surprised on the downside over the weekend. This negative data should dictate this week’s risk environment, for the early part at least. However, in early trade markets have been mixed.

China Data

Retail Sales figures, typically a rosy spot for China’s economy, underwhelmed by printing +10.1% YoY in April vs. 10.6% forecasted and 10.5 % the prior month. The number was overburdened by a significant pull back in car sales which only increased by 5.1% versus a 12.3% jump in March. Reading between the lines, as with other stimulus measures in China, the impact of the tax cut that emerged back in December 2015 for the rural Chinese who wished to purchase small family cars is beginning to fade. Moreover, while the tax incentive gave temporarily support to the automotive industry, it is offering no panacea for the flagging mainland economy.

Moreover, the drop in industrial production will undoubtedly spark fears about the strength of a rebounding Mainland economy. Clearly, the positive economic momentum in March has apparently turned soft in April, which will likely send negative reverberations across all asset classes.

Sadly, the pain did not stop there, as fixed asset investment (FAI) continued to deteriorate, coming in at 10.5% versus 11.0% forecasted and 10.7% the previous month. This weaker-than-expected print will sound alarm bells that private companies are holding back on investment due to economic uncertainty. Even more troubling is the fact that FAI has been sliding all year. Critics will also point to market entrance barriers, weighing on this year’s figures.

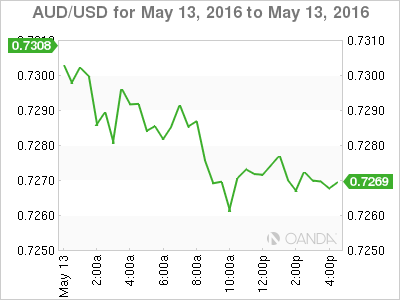

The Aussie dollar

As expected the Aussie opened a touch lower from the NY close after the miss on the trifecta of Chinese economic data but has since recovered. However, given the proximity of key domestic economic releases this week, including the RBA minutes and the unemployment report, it will likely be a tough grind lower even if the risk-off environment accelerates. However, the downturn in China’s economic data will certainly weigh on the Aussie going forward.

Traders would be eyeing tomorrow’s RBA policy minutes for a glimpse behind the RBA’s about-turn on interest rates, looking for hints if this was a one-time move or the start of a more aggressive interest rate easing cycle. There will be plenty of interest in the Fed minutes released on Thursday, which might explain the confusion on how Fed members are viewing the economy. However, it is unlikely to alter the market view that the Fed will remain dovish through 2016.

Later this week, the key April employment report is due out with the market calling for a net increase of 12,000 jobs and the unemployment rate ticking higher to 5.8%. Keep in mind the jobs number is notoriously volatile and traders, along with the RBA, usually view the level of unemployment as a more accurate gauge the health of the jobs markets.

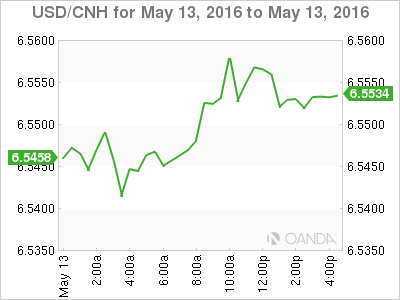

The Yuan

USDCNH was very well bid through Friday APAC session but toppled one big figure midsession London trading through 6.5400 and dragged all of USDASIA currencies in tow in extremely choppy price action., likely exaggerated by dwindling liquidity as traders took profit ahead of the weekends China economic data

The initial uptick on USDCNH came on the heels of Friday’s China loan data which indicated a significant drop in new lending amidst mounting Bad Debt ( risen 18 consecutive quarters). This negative turn of events is causing concern for the market as PBoc now deals with the hangover from the excessive indulgences of the recent stimulus binge.

In the wake of the string of tepid economic reports out of the Mainland, dealers are left with the following dilemma: How much influence will this recent poor economic data factor into the Fed’s June rate hike decision in the face of Friday’s robust US economic data?

PBoc Fix 6.5343 vs 6.5246

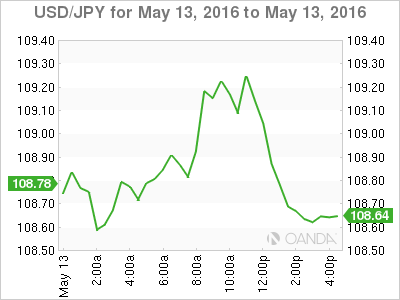

The Yen

Is it time to wake up and smell the coffee? After three high volume passes at the 109.50- 75 level, which held, this may have traders looking south once again. Despite the strong US retail sales data suggesting a June, Fed hike is back on the table, there are also suggestions by Bank of Japan’s Kuroda that it will lower rates again in either June or July. USDJPY was back testing the 108.50 level in early APAC trade.

We are seeing traders reacting to the ineffectiveness of monetary policy in a zero-rate environment to influence currency direction significantly. Instead, they are likely positioning themselves for heightened risk aversion as the market deals with the fallout from recent negative turn in China’s economy along with adverse effects the stronger Yen will have domestically. Despite some hawkish Fed rhetoric, the market remains very sceptical that the Fed will change its ultra-dovish lean during 2016.

With that in mind, I suspect traders will be eyeing the Nikkei as well as global equity markets to measure investor risk sentiment which will likely influence currency decisions. On the domestic data front, Japan’s April Producers Price data ( PPI) came in well below expectations (-.3 % vs. .2 %). Despite the downside miss, the currency reaction was initially muted. However, the inflation miss does cry out for the need for additional stimulus as Japan is in the midst of a three-year running battle with deflation , the negative PPI should lend mild support to USDJPY in today’s session. BoJ Governor Kuroda is scheduled to attend parliament at 15:20 local time.