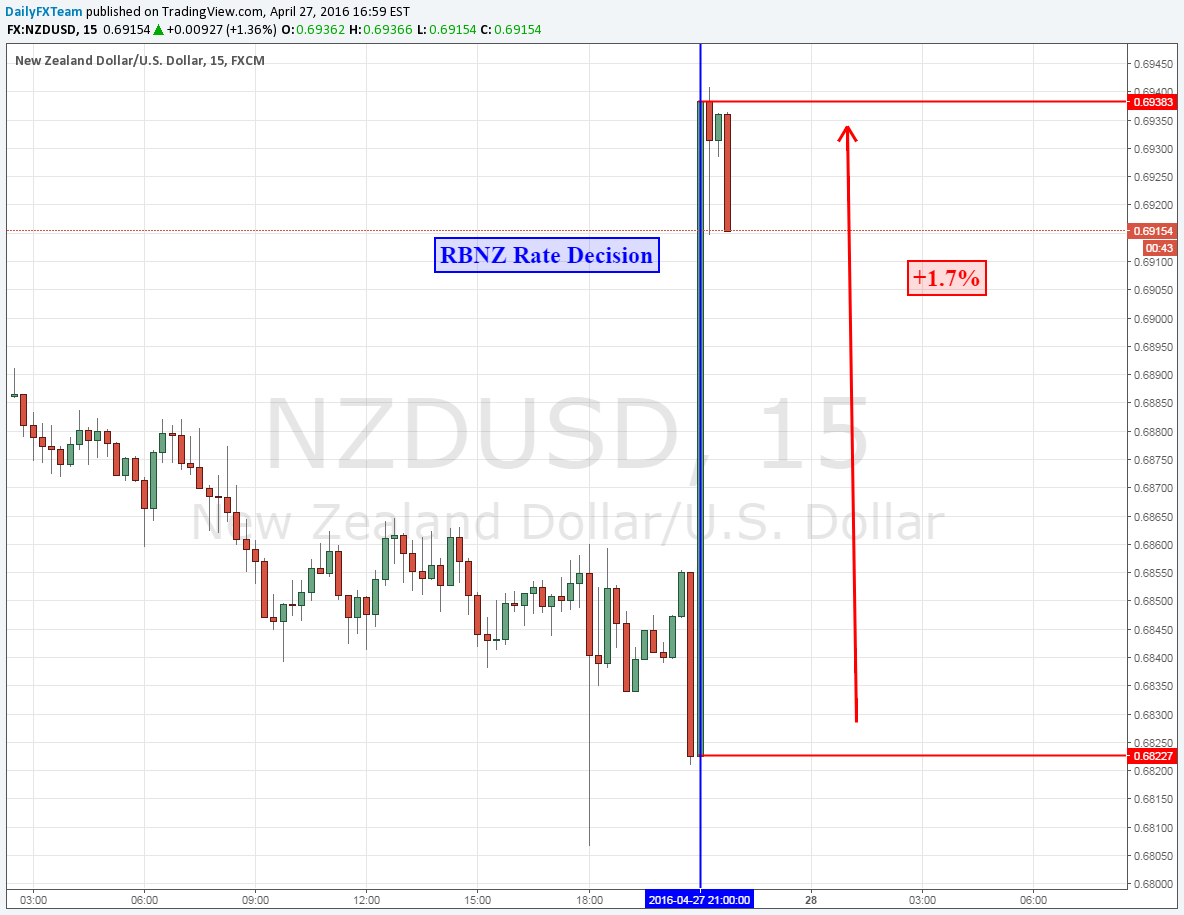

New Zealand Dollar Gains as RBNZ Disappoints Rate Cut Bets

Talking Points

- RBNZ holds main lending rate at 2.25% in April as expected

- The NZD rallies against its major counterparts

- Neutral tone likely disappointed future rate cut expectations

The Reserve Bank of New Zealand left its main lending rate unchanged at 2.25 percent in April as widely expected. Heading into the monetary policy announcement, the markets were looking for clues that the central bank would signal rate cuts in the future. That is because the RBNZ announced it may further ease policy to ensure that average future inflation settles near the middle of its 2 – 3 percent range having unexpectedly cut rates in March.

Following the announcement, the New Zealand Dollar rallied across the board. At the same time, front-end New Zealand government bond yields took off. This suggests that the markets interpreted the RBNZ rate decision as undermining near-term easing bets. In other words, they expect the central bank to cut its main lending rate later rather than sooner.

According to the Reserve Bank of New Zealand, they expect inflation to strengthen as the effects of low oil prices slowly filters out of the big picture and capacity pressures gradually build. In addition, while headline inflation remains low, annual core CPI remains within its target range. Long-term price expectations appear to be well-anchored at 2 percent. The central bank noted that further easing may be required.

With that in mind, the RBNZ appeared to give no notice of an imminent rate cut ahead. This could be the catalyst behind the New Zealand Dollar’s rally. Overnight index swaps are pricing in at least one rate cut over the next 12 months.