First, a few words about the forecast for the previous week:

■ if you look at the graphs D1 and W1, it is clear that the EUR/USD continues to move within the ascending channel that started last December. As expected by 50% of analysts and graphical analysis on the H4 and the D1, the pair started the week demonstrating commitment to the upper boundary of the channel, quickly reached the resistance at 1.1350 and then abruptly went down to the strong support in the zone of 1.1200, which is clearly visible on the monthly time-frame;

■ with regard to GBP/USD, contrary to the forecasts of most analysts who spoke about the pair's strive to the February lows, the pair followed the "advice" of the remaining 15% of the experts and went to the north - to the upper boundary of the lateral channel 1.4050 ÷ 1.4450, where it has already been moving for the sixth week in a row;

■ the forecast for USD/JPY was fulfilled by 100%. It had been assumed that as a result of the upward bounce that began on April 11, the pair should reach at least the height of 111.00. In order to fully accomplish this task, the pair was assigned the whole past week. And it was on Friday, as if sensing that the time limit was running out, the pair rushed up, broke through the resistance of 111.00 in a powerful jerk, and stopped only at the level of 111.76;

■ USD/CHF. The forecast for this pair is also fully justified. We predicted for it a continuation of the upward trend with a view to reach the level of 0.9800, which is what happened on Friday night. The pair just lacked 4 points to reach this goal, having won the height 0.9796.

***

Forecast for the coming week:

Summarizing the views of several dozen analysts from leading banks and brokerage firms, as well as the forecasts made based on different methods of technical and graphical analysis, we can say the following:

■ according to 85% of experts and 90% of the indicators on H1, the EUR/USD should continue its downward movement in the zone of 1.1100 ÷ 1.1150. On the other hand, according to the graphical analysis and indicators on D1, the pair, basing on the support of 1.1200, will move in the sideways channel 1.1200 ÷ 1.1450 during the next week. If we talk about a longer-term outlook, hitting the lower boundary of the channel in early May, the pair must quickly reach the local bottom in the 1.0900 area;

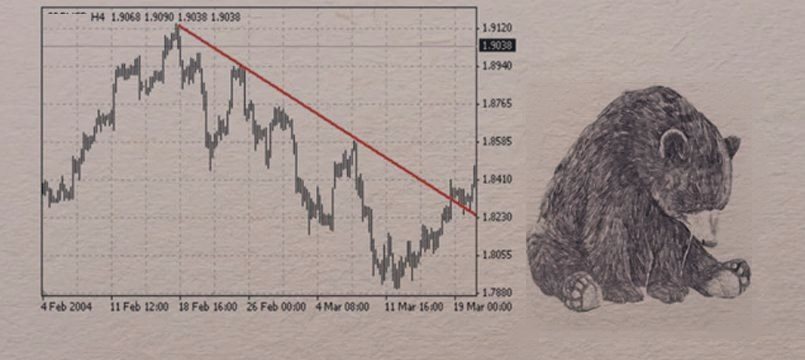

■ despite the fact that last week the pair GBP/USD disappointed the majority of experts, the main forecast for it remains unchanged - movement down. With this 75% of the experts agree, they believe that, having repulsed from the upper boundary of the lateral channel 1.4050 ÷ 1.4450, the pair is to go down to its bottom border in the near future. At the same time, graphical analysis on D1 says that after breaking it, the pair is still to reach February lows at 1.3850. However, it may happen not earlier than the first - second decade of May;

■ it is clear that, when predicting the future of USD/JPY, all indicators look upward. However, more than 80% of analysts and graphical analysis on D1 and H4 categorically disagree with this, they believe that, having repulsed from the resistance in the zone of 112.00, the pair must go down - to support 110.60. It is these two levels that will determine the movement of the pair in the near future, after which it will once again attempt to reach the bottom at the level of 107.70;

■ as for the last pair of our review - USD/CHF, about 70% of the experts, together with the indicators on H4 and D1, believe that the pair will consolidate for some time above the level of 0.9800. The main resistance in this case will be the level of 0.9900. An alternative view is expressed by graphical analysis on D1, claiming that the level of 0.9800 will remain insurmountable resistance for the pair, rebounding off which it will go down - to support 0.9500. Since the pair is now in the zone of 0.9800, the validity of the first or second prediction will become evident in the near future.

Roman Butko, NordFX & Sergey Ershov