First, a few words about the forecast for the previous week:

■ giving the forecast for EUR/USD, we assumed that the pair should go down - to the centre line of the rising channel, which started last December and is clearly visible on W1. The pair did show a sharp decline, but it has not yet reached the goal in the area of 1.1135, stalling at the 1.1250 support;

■ with regard to GBP/USD, that one third of experts, who claimed that the pair would not go beyond the boundaries of the March lateral canal 1.4050 ÷ 1.4450, turned out to be right. That was what happened, and the pair narrowed the range of its fluctuations even more, keeping within 1.4090 ÷ 1.4350;

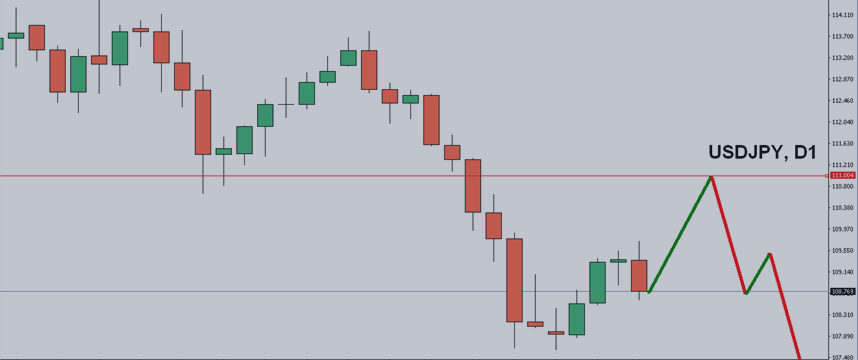

■ USD / JPY. Here graphical analysis, which had warned of the possibility of an upward breakthrough of the pair, was right It really went to the north, but this movement was more sluggish than expected, and the offensive outburst of the pair dried in 200 points, at the level of 109.70

■ as for the USD/CHF, the forecast for this pair has been fully justified - at last, there was a long-awaited rebound of the pair from the support of 0.9500, as a result of which it broke through the resistance of 0.9650 and, having turned it into a support, it finished the week at 0.9680.

***

Forecast for the coming week:

Summarizing the views of several dozen analysts from leading banks and brokerage firms, as well as the forecasts made based on different methods of technical and graphical analysis, we can say the following:

■ with high probability, the EUR/USD will continue its movement on the uplink for the fifth month in a row. It is now slightly above its centre line, which runs at the level of 1.1135 ÷ 1.1150. According to 50% of the experts, the pair must come down to it, then rebound off and go to the upper boundary of the channel. Indicators on H4 agree with this. As for the second half of the analysts and graphical analysis on H4 and D1, they believe that the pair may move northward almost immediately. The first resistance is at the level of 1.1350, the second - 1.1450, and finally, the upper boundary of the channel is in the zone of 1.1600;

■ the forecast for GBP/USD remains unchanged - movement to the February lows. It is 85% of the experts (65% vs. last week), and 80% of indicators together with graphical analysis on D1 that agree with this. The remaining 15% of the analysts are of the opinion that the pair will continue to move in a sideways channel, with the support of 1.4050;

■ predicting the future of USD/JPY, 100% of indicators on H4 and D1 look down, but they are only supported by 30% of the experts. The remaining 70% believe that the rebound of the pair will end only after it reaches the resistance in the 111.00 area. Graphical analysis agrees with this, specifying that it may take about a week. Support is now at 108.70, breaking through which the pair may fall first 100 points lower, and then reach the bottom at the level of 106.70. However, the latter can happen in early May;

■ As for the last pair of our review - USD/CHF, it is about 70% of the experts, together with graphical analysis and indicators on H4 and D1, that talk about the continuation of the upward movement of the pair, in an attempt to reach the 0.9800 level. After that, according to the readings of graphical analysis on D1, the pair may return to the 0.9500 support zone.

Roman Butko, NordFX & Sergey Ershov