Daily Analysis of Major Pairs for April 13, 2016

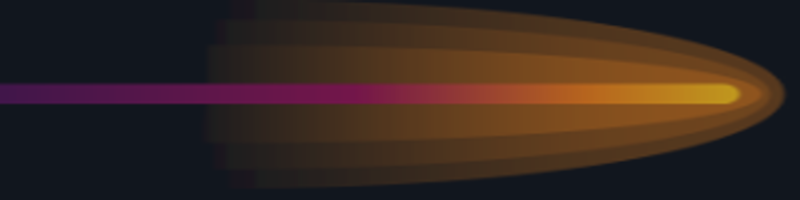

EUR/USD: This pair has been flat so far this week. The price has gone neither above the resistance line at 1.1450 nor below the support level at 1.1300. A breakout is imminent today or tomorrow, which will most probably favor the bulls. Failure to breach the resistance line at 1.1450 to the upside would jeopardize this expectation.

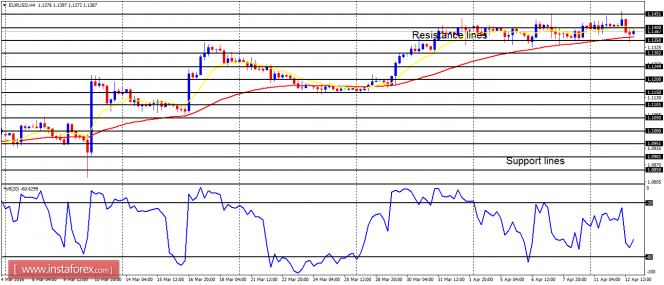

USD/CHF: The USD/CHF consolidated on Tuesday, not going below the support level at 0.9500. The support level should be broken to the downside, reaching the next level at 0.9000. A bearish confirmation pattern can be oberved on the market, and if a breakout happens, it is likely to be to the downside.

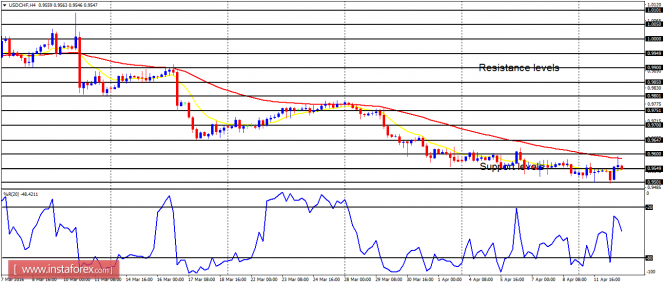

GBP/USD: There is now a clean bullish signal on the GBP/USD; and because the bulls have made an effort to push the price up so far this week, short trades do not look rational here in the short term. The bulls may be able to push the price up towards the distribution territories at 1.4350 and 1.4400. There can be some volatility on the market today, which will most probably favor the bulls.

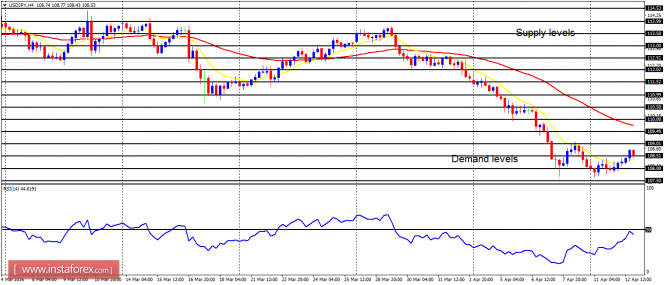

USD/JPY: Here, the EMA 11 is below the EMA 56, and the RSI with the period 14 is below the 50 level. Further southward movement is possible. There is a strong bearish confirmation pattern on the chart, which will hold out as long as the price continues to move downwards. The current rally in the context of the downtrend may be a trap for the bulls, as it offers the bears an opportunity to sell at better prices. There won't be a serious threat to the current bearish outlook unless the price moves upwards by at least 300 pips.

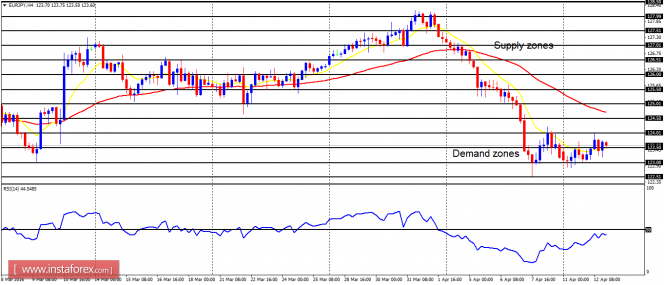

EUR/JPY: The bears are still willing to push the price further southward. The EMA 11 is below the EMA 56, and the RSI with the period 14 is below the 50 level. This shows a bearish outlook on the market. When the price breaks out of the current short-term consolidation, it will most probably go towards the demand zone at 122.50.

The material has been provided by InstaForex Company - www.instaforex.com