USDOLLAR: Key Levels to Know Heading into NFPs, March Open

USDOLLAR: Key Levels to Know Heading into NFPs, March Open

Talking Points

- Break of weekly opening range shifts focus lower

- Key near-term support 12123/31

- Updated targets & invalidation levels

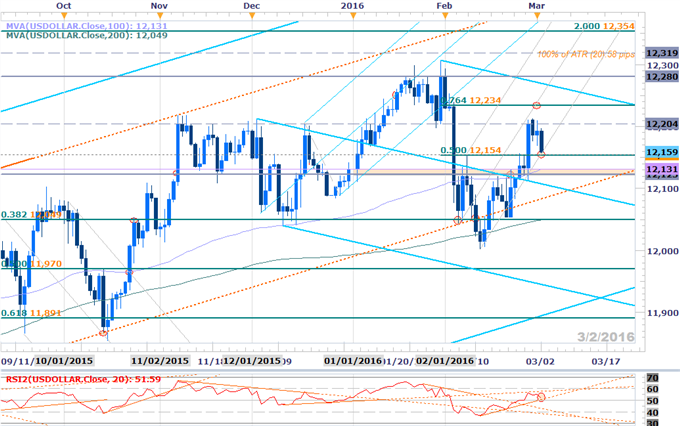

USDOLLAR Daily

Technical Outlook: The Dow Jones FXCM U.S. Dollar Index (Ticker: USDOLLAR) is testing a near-term support confluence at 12154 where the 50% retracement of the 2016 range converges on the lower median- line parallel extending off the February lows. A close below this level targets a more significant support confluence at 12123/31. This region is defined by the 2016 open, the April high-day close & the 100-day moving average. Note that a pending RSI support trigger is in view with an accompanied move sub-12123 needed to validate the break.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

USDOLLAR 30min

Notes: A break below the weekly opening range low today shifted the focus lower in the index with intra-day momentum diping to its lowest levels in more than a week. A break below this near-term support confluence targets the lower median-line parallel extending off the March 1st low (~12140) & the key12123/31 support zone. A break here is needed to validate a more meaningful reversal in the index with sucha a scenario targeting the 50% retracement at 12108 & the key 61.8% retracement at 12083.

Interim resistance now stands at 12173 backed by the upper median-line parallel with a break above the 2015 high-day close at 12204 needed to shift the focus back to the topside (bearish invalidation). Cuation is warranted heading into event risk into the close of the week with U.S. Non-Farm Payrolls on Friday likely to fuel added volatility in the USD crosses. Consensus estimates are calling for a print of 195K with the unemplopyment rate widely expected to hold at 4.9%. We’ll also be closely watching the average hourly earnings & labor force particiaption rate with

Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount!

Check out SSI to see how retail crowds are positioned as well as open interest heading into February trade.

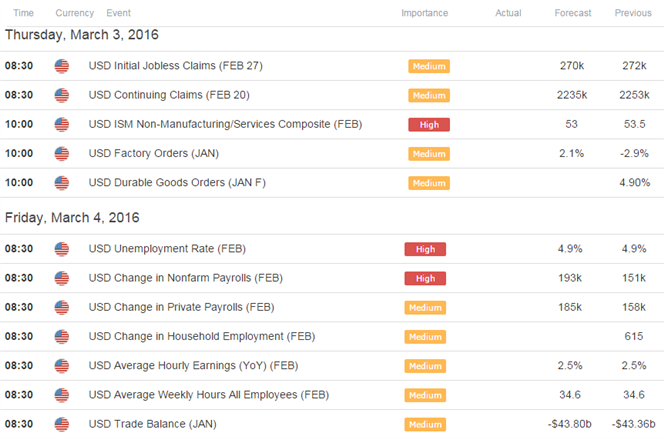

Relevant Data Releases