EUR/USD forecast: eyes on EMU’s CPI – Commerzbank and UOB

29 February 2016, 10:04

0

42

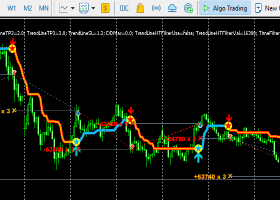

EUR/USD has faded the stab to session highs near 1.0960 following the European open, although it manages to keep the trade above the 1.0900 ahead of EMU’s inflation figures.

Karen Jones, Head of FICC Technical Analysis at Commerzbank, noted the pair “on Friday the market charted an outside day to the downside and eroded the base of the channel currently. We regard a close below here as the trigger for the resumption of the bear trend and target a move to 1.0560/1.0457”.

The research team at UOB Group added “The neutral phase that has been in place for about 2 weeks ended last Friday. As highlighted in recent updates, a daily closing below the key 1.0990 would indicate the start of a sustained down-move in EUR. That said, downward momentum is not very strong at this stage and we have a modest target of 1.0810. In order to maintain the current momentum, any rebound should not move above 1.1030”.