REVEALED: 12 Second "Fix" to go from $300 to $100K with Rebate King EAs BackTesting

OK, so you downloaded the Rebate King 19 EAs Portfolio. It is like getting into a helicopter while you normally drive a car. There are 19 EAs to choose from - do you turn them all or only a selected few? What are their strengths and weaknesses? How long do you have to wait to determine whether the systems work and what is the potential risk to reward for using the Rebate King?

Yes, you can leave them all on if you have the time and money. However, if you want to go from $300 to $100K with Rebate King's backtesting, it will take some work. Don't worry, we have done all the hard work. It is up to you to understand the risks and to commit to the plan.

We are going to use StrategyQuant software to expedite our results.

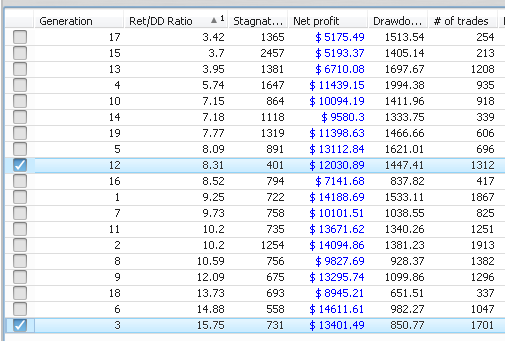

As you can see, strategy #3 has the highest return/DD ratio (Ret/DD ratio) of 15.75 with 712 days of stagnation. This is a pretty good risk to reward ratio tested from 2000 to 2015. However, the stagnation is too long i.e. you may have to stick around for 2 years if you turn on the strategy at the wrong time. It will take two years before you can see any decent profit. Look at strategy #12, it has a Ret/DD ratio of 8.31; however, its stagnation is only 401 days. This is more than one year; hence, it is unacceptable.

“The whole is greater than the sum of its parts.”

This is where we can combine some of the EAs to obtain better Ret/DD ratio and to shorten the stagnation period. Hence, the whole is greater than the sum of its parts.

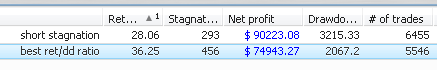

In order to obtain a return of 74,943 pips vs. a drawdown of 2067 pips, we turn ON the following EAs while the rest of the EAs are OFF.

EAs ON: 3, 5, 6, 7, 16, 17, 19

In order to obtain a stagnation of less than 1 year, we need to turn ON the following EAs while the rest of the EAs are OFF. The drawdown in StrategyQuant is based on closed trades; whereas, the drawdown in MT4 is based on floating equity with slightly higher losses.

EAs ON: 3, 5, 6, 12, 14, 16, 18, 19

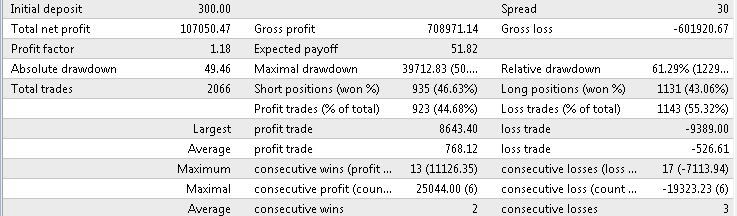

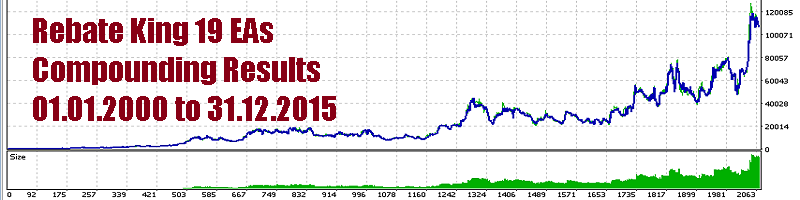

If you are NOT interested in results from 2000 to 2015, we offered compounding results from January 2010 to December 2015. As promised, below is the 12-second "fix" to go from $300 to $100K with Rebate King 19 EAs Portfolio's backtesting.

Lotsize = 0.0 (for compounding) , Risk = 0.07 (7% risk per trade)

EAs ON: 3, 5, 6, 7, 16, 17, 19

See results below:

Attached are the three settings files and you can download the Rebate King Portfolio EA here:

https://www.mql5.com/en/market/product/13400#full_description

Past Performance is Not Necessarily Indicative of Future Results