2 Ways to Use Moving Averages with CFDs

Indicators can be very handy tools for the CFD trader. They can assist in simplifying developments on a chart. This way traders can instead focus on placing the trade and managing their risk.

After all, no system or strategy can perfectly predict future movements on a chart, right? The goal of technical analysis (and trading in general) is to find setups that may offer favourable probabilities of success. This is like trading in the direction of the trend; if a market is trending higher, the trader looks for ways to efficiently buy into that market. While the future is uncertain, that trader can look at the bigger picture of that market to say ‘if the bias (trend) that’s been seen is going to continue, then I should be in an optimal position by being long in the market.’

This is the value of indicators: They can help to simplify technical analysis so that traders can generate trade ideas that may offer attractive probabilities and setups. Of all of the available indicators, one of the simplest is also one of the most versatile and that is the Moving Average. In this article, we’re going to discuss two different ways to trade with moving averages.

How To Calculate the Moving Average (MA)

The moving average equation is the last X periods’ closing prices added together, and then divided by the number of periods. This provides a ‘smoothing’ effect for price action; where each individual candle may be higher or lower, but the moving average value will smooth these near-term fluctuations by averaging the price of the current candle with prices of previously-printed candles.

The benefit here is one of simplicity. Because if a market is trending higher, often accented by ‘higher highs’ and higher lows,’ the moving average will reflect these higher prices while also tilting upwards. And this leads us directly into our first usage of Moving Averages.

Moving Averages as a Trend Filter

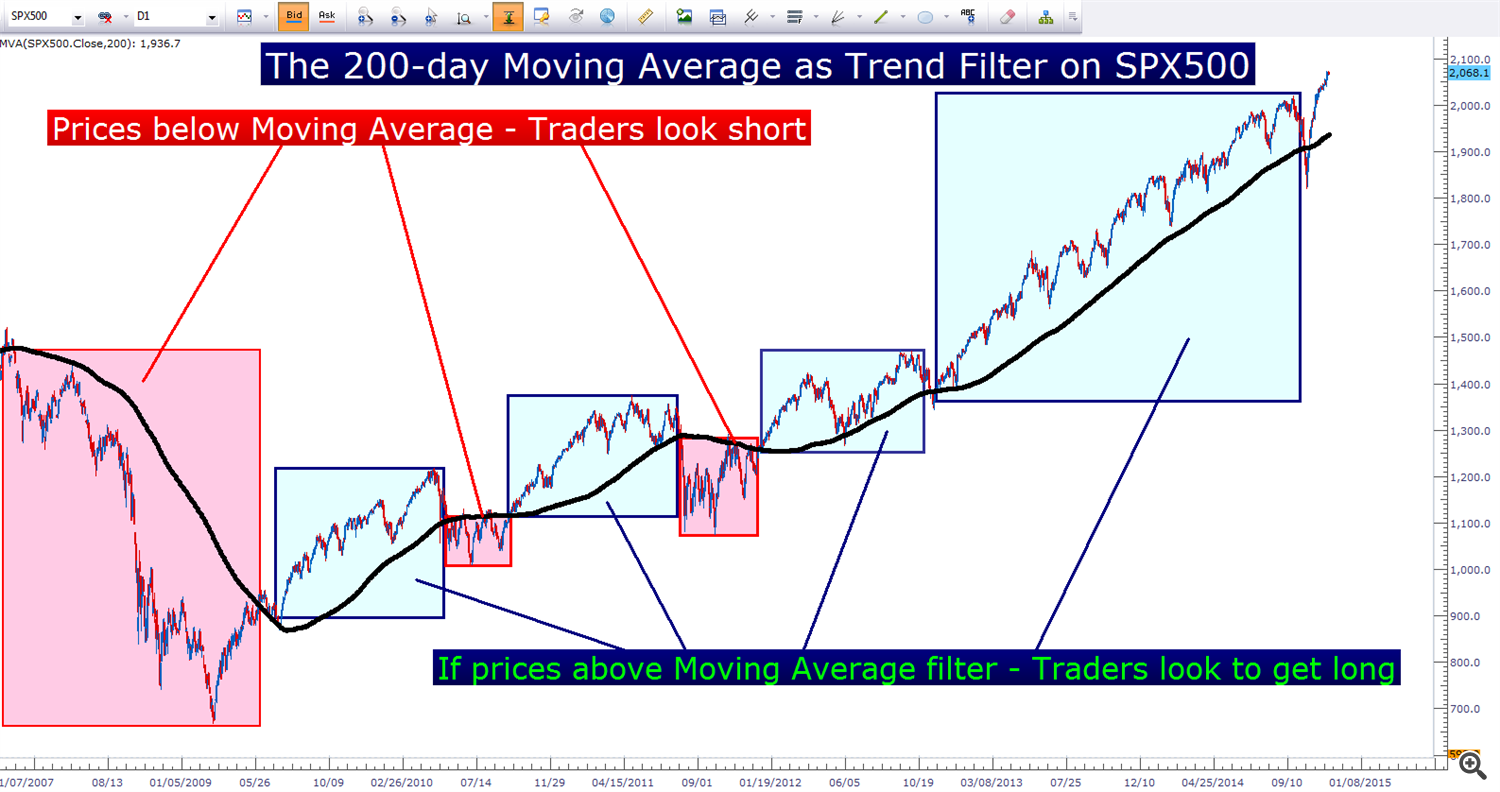

This is probably the most common usage of moving averages amongst traders. Because moving averages can assist in detecting trending formations, traders can look to current price’s relationship to the moving average to identify a trend. The chart below depicts this usage of Moving Averages:

Moving Average Filters can help traders generate a trend-side bias

Traders can use ‘tight’ filters, or more ‘loose’ variations. And the differentiation can be huge based on how aggressively a trader wants to speculate in a market. Short-term variations of moving averages, like 3 or 5 periods, are going to mirror current price significantly more than a ‘looser’ moving average of 200 periods.

With a tight or shorter-term filter, traders will be able to more aggressively enter into new trends. The downside is that the shorter-term being used for the filter will entail more noise with lower probability of each individual trend coming to fruition.

More loose filters will be slower to identify new trends, but will generally help traders to prevent the additional ‘whip’ that may be seen from tighter variations.

Which is better? That really depends on the individual market being traded and the rest of the strategy being employed by the trader.

For most cases of the moving average in the strategy is being assigned solely as a trend filter, longer-term or looser filters can work better because they leave more flexibility to the trader in addressing the trend. A common example of this type of filter is the 200-Day Moving Average. Surely, the 200-day moving average isn’t going to catch every trend at the early stage, but it will also help traders avoid much of the whipsaw that would be seen as a result of a tighter filter.

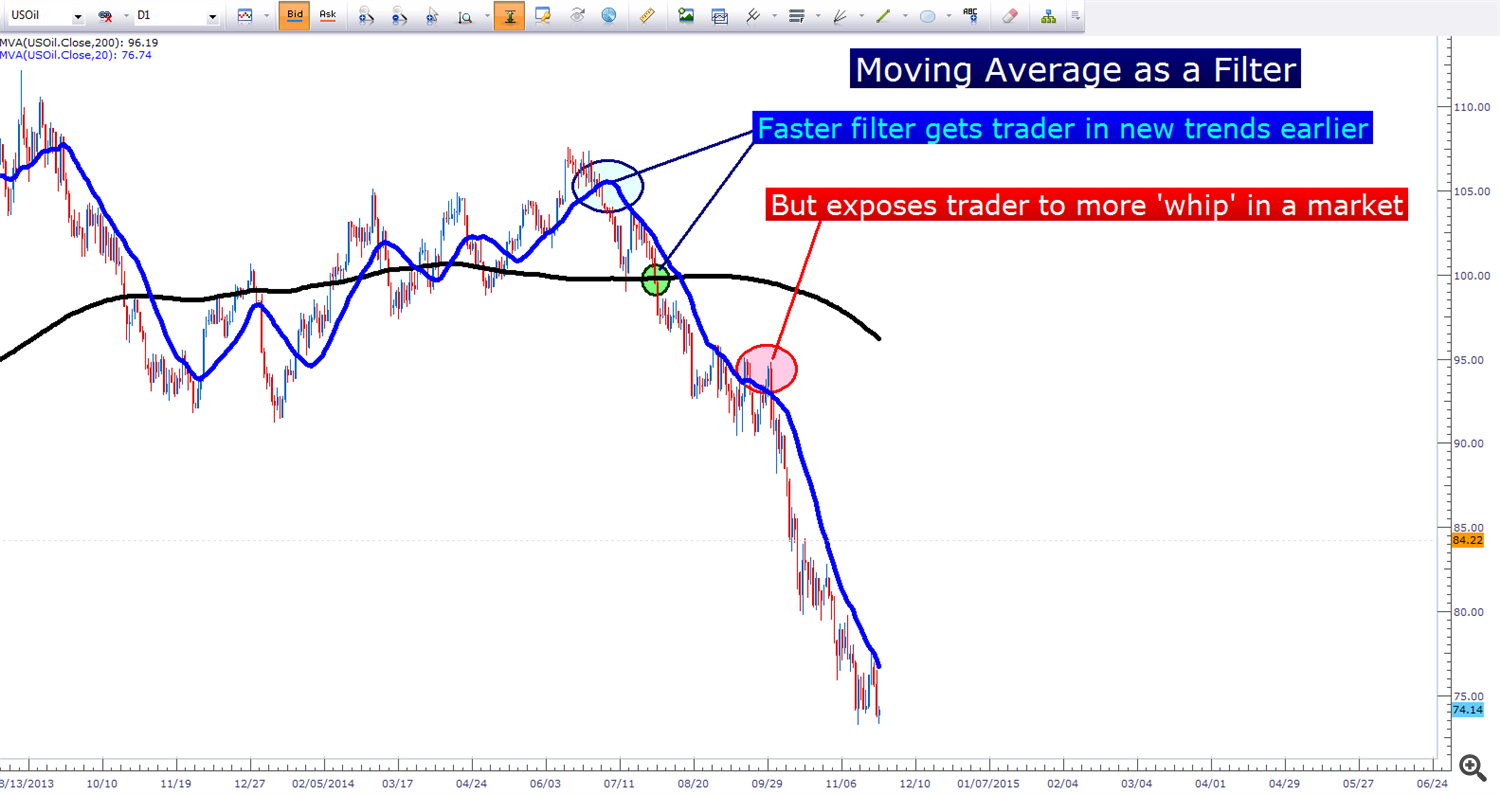

Picture for a moment an up-trending market turning into a down-trend (pictured below) as we’ve seen recently in Oil. After the high was set, as traders began pricing in lower-lows and lower-highs, it took quite a while for prices to hit and then move below the 200-day moving average. A faster version would have picked this reversal up far quicker as shown in the chart below:

However, the downside of the faster filter is that periods of congestion or ‘whip’ in the market can throw off numerous misleading signals. The chart below shows how a tighter filter would have proved challenging to the trader as Oil congested before resuming the down-trend. Notice how the looser filter would have allowed the trader to continue pressing the short-side of the trade.

There is no right or wrong answer for how tight or how loose an individual filter should be. In the efforts of consistency and synergy amongst strategy tools – traders should look at looser variants. Common inputs for this type of filter would be 50, 55, or 100 periods of the chart that’s being analyzed (with appropriate trigger being placed on the same time frame).

Moving Averages as a Positional Trigger

Once a trader has identified the trend or the direction of a prevailing bias in the market, they then need to decide how to enter in that market.

This is where many traders will add something like an oscillator of the RSI, MACD, or Stochastic variety. This could work out well, as it allows the trader to take a diametric view of a market: The trend filter to identify momentum while the trigger looks at overbought/oversold.

The potential problem that comes with using an oscillator is that overbought or oversold don’t necessarily mean much to a market. After all, the strongest trends (the ones you want to be in) will continue moving higher regardless of how overbought a market is. If there is good information that’s compelling traders around the world to move prices higher, they likely won’t care very much whether or not RSI gets oversold.

Moving averages can, once again, be extremely helpful for this portion of strategy logic.

If a trend is moving higher – then the trader wants to buy, right? Sure, there could be times in an up-trend when a short position may work out – but remember, this isn’t a prediction game, it’s about probabilities. If the trend is up then the trader wants to buy to get those probabilities in his or her favor. The trend filter can help the trader accomplish this.

If the trader wants to buy, then how do they want to do it? Well, we can employ the same logic that we have all been taught since we were children: Buy low, and sell high. You’ll hear this regurgitated across markets and trading education, but what in the world do the terms ‘low’ and ‘high’ mean? Surely, these are relative metrics. If a market is trending higher, what could be considered ‘low’ right now would have likely been considered ‘high’ earlier in the trend.

Because of the responsive relationship of the moving average to current price, traders can incorporate a moving average trigger in the effort of ‘buying low and selling high.’

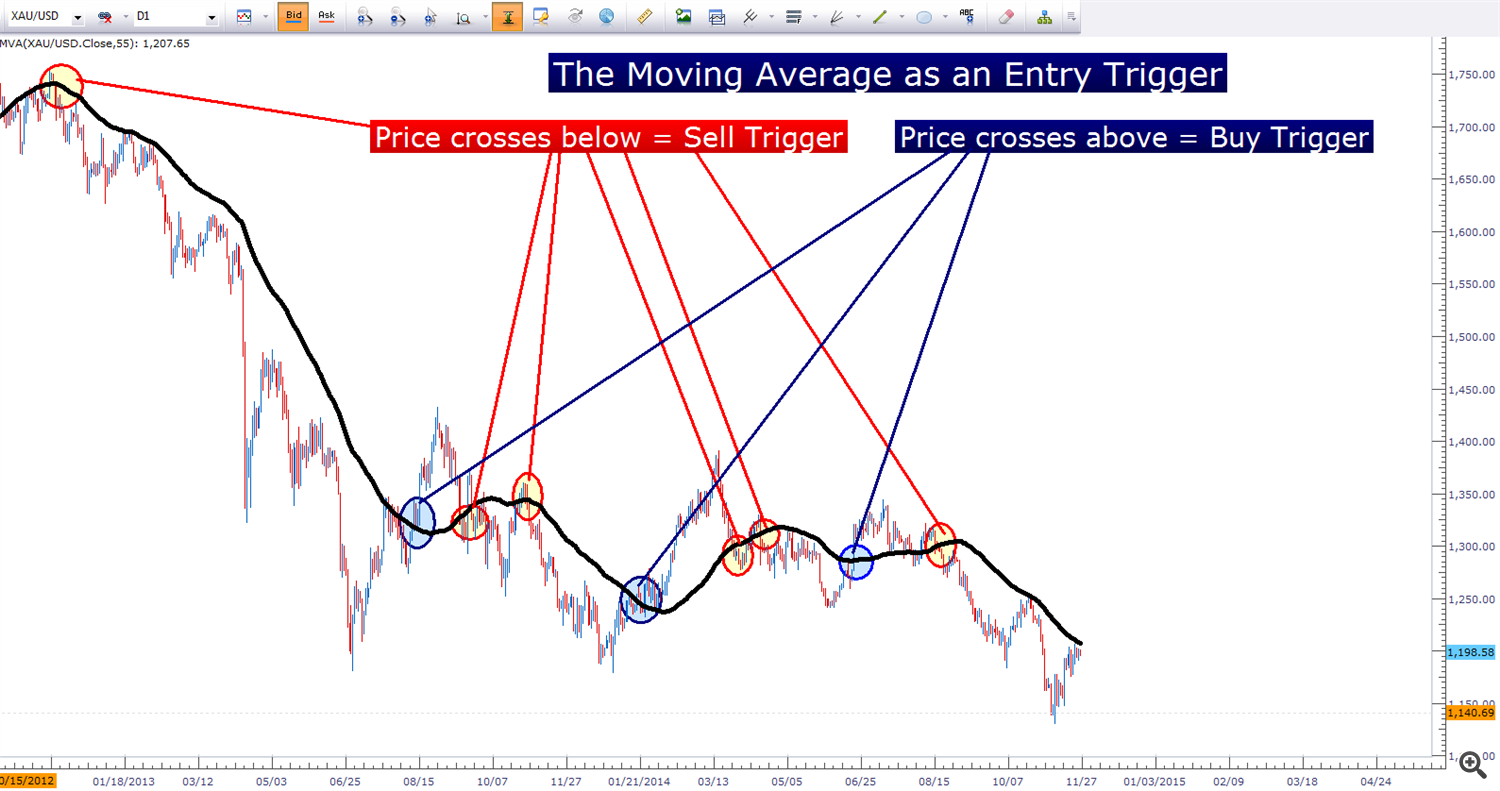

To use a moving average as a trigger, one simply needs to observe price crossing the indicator to see a signal. When price crosses above a moving average trigger, that’s a signal to go long; and when price crosses below, that’s a signal to go short.

The Moving Average Trigger offers the trader a signal with according crossovers.

As you may notice from the above chart, there can be quite a few signals when trading with a moving average trigger. Trading this in isolation, as in not using a trend-filter, is a surefire way to get chopped up in ranging or congested market. If prices are congesting, and not trending, buying each time price moves above or selling each time price moves below will often see traders chasing their own tails.

Instead, traders should look to use the moving average trigger with a positional bias; as in they’ve already decided that they want to buy because prices are staying above the longer-term moving averages, indicating an up-trend. And then when price crosses back above the shorter-term moving average (the trigger), the trader can look to open the position.

And when price crosses back below the moving average trigger; the trader can look to close the long position. It’s important to note the relationship here… if prices are above the longer-term moving average, indicating an up-side bias; the trader does not trigger short positions when prices move below the moving average trigger.

Rather, traders can wait for price to cross the moving average in the direction of the longer-term bias before re-entering long. The picture below will show the proper usage of a moving average trigger. As long as the trend continues, the trigger can continue to offer favorable entries in the direction of this bias.