SEE ALSO:

https://www.mql5.com/en/blogs/post/657889

Risk currencies stabilise |

|

|

|

| It was an uncomfortable start to the New Year in many respects, but it’s not possible to pin it down to one particular thing, rather it was a confluence of factors that came to set a risk averse tone across many markets. This was most evident in stocks and especially in Asian, given the gyrations seen in China and the contagion elsewhere. The S&P500 managed to rally into the close, which allowed for a steadier start for Asian stocks, but it was hardly plain sailing. If we look more specifically at currencies, then there was some unwind of the risk aversion moves that were being seen yesterday, with USDJPY moving up from the 118.70 low made during yesterday’s session. The Aussie also managed a modest recovery to the 0.72 level, whilst EURUSD has retained the softer tone gained in the latter half of yesterday’s European session, currently holding just above the 1.08 level. For today, the main focus on the data calendar will be the release of the latest CPI data for the Eurozone, which is expected to nudge up to 0.3% YoY on the headline rate, with the core rate seen rising to 1.0% (from 0.9%). Headline rates are expected to move higher over the coming few months as the effect of the sharp decline in energy prices 12 months ago falls out of the calculation. Despite the rising tensions between Saudi Arabia and Iran, oil prices ended yesterday’s session lower, but the story is worth keeping an eye on. Naturally, the US employment report on Friday retains the attention of markets this week. |

|

|

| Today's important market news | | 12:30 | | PMI Construction | | 13:00 | | Consumer Price Index (YoY) | | 13:00 | | Consumer Price Index - Core (YoY) |

|

|

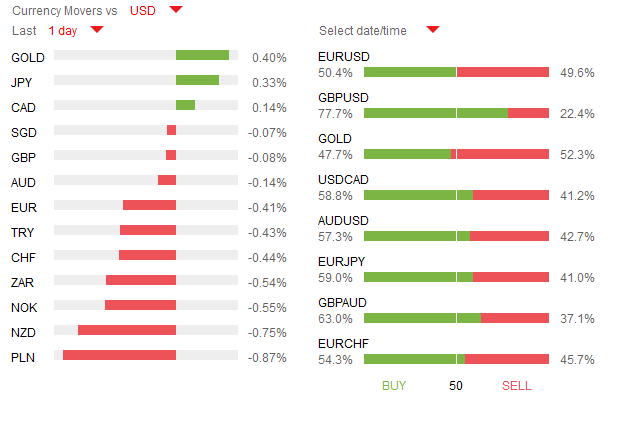

Currency Movers |

Client Positions |  |

|

SEE ALSO:

https://www.mql5.com/en/blogs/post/657889