USD/CHF: meeting of National Bank of Switzerland at the rate of 10 December

Trading recommendations and Technical Analysis – HERE!

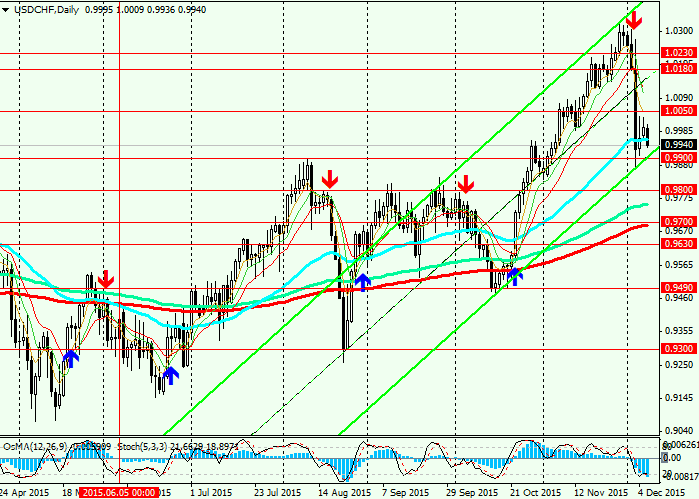

After a sharp decline of the dollar last week, caused by the massive closing of short positions on the EUR amid the disappointing markets of the ECB's decisions to expand the program of monetary easing in the Eurozone, USD/CHF remains positive momentum.

The main consumers of Swiss companies are the Eurozone countries and China. Phased monthly reduction of Chinese imports out of the country reduces the export income to the budget of Switzerland.

Data released this morning, showed further decline in imports to China in November, and exports from China, indicating a slowdown of the economies of major trading partner of Switzerland. Thus, imports in November in China by 8.7% in annual terms.

Released last week, the data show the slowdown of the Swiss economy and almost zero growth rate of inflation. Thus, the index of leading indicators (KOF) noted a decrease in economic stability in Switzerland in November (versus forecast 97,9 100,2 100,4 and in the previous month). GDP growth in Q3 in Switzerland was null (0.2% forecast and 0.2% in the previous quarter). Over the year GDP grew by only 0.8%. Also in November fell real volume of retail trade in Switzerland (by 0.8% yoy vs. +0.4% in forecast), and decreased the index of business activity SVME (49,7 against the forecast of 51.0 and 50.7 in October).

On Thursday 10 December scheduled meeting of NB of Switzerland, which will also be addressed and the question on monetary policy in the country. Despite negative Deposit rates, the Swiss franc is in demand in the financial market as a safe-haven currency. According to the NBS, the franc is overvalued. Expensive national currency, according to the Central Bank, which harms the sustainable development of the Swiss economy by reducing the competitiveness of Swiss products more expensive and making exports from the country.

It is not excluded that the Swiss NB will go for another easing of monetary policy in the country to maintain its economy and increasing the competitiveness of the Swiss goods on the world market.

In this case, the pair USD/CHF recovers recently incurred losses and will continue to rise in the medium term. A phased programme of monetary policy tightening in the U.S. will further support the pair.