Trading recommendations and Technical Analysis – HERE!

Today is the most important day in the fate of the Euro in the near future. As expected, the ECB President Mario Draghi at a press conference at 13:30 (GMT) will announce the ECB's plans for monetary policy in the Euro area. Practically there is no doubt that the ECB would expand the program

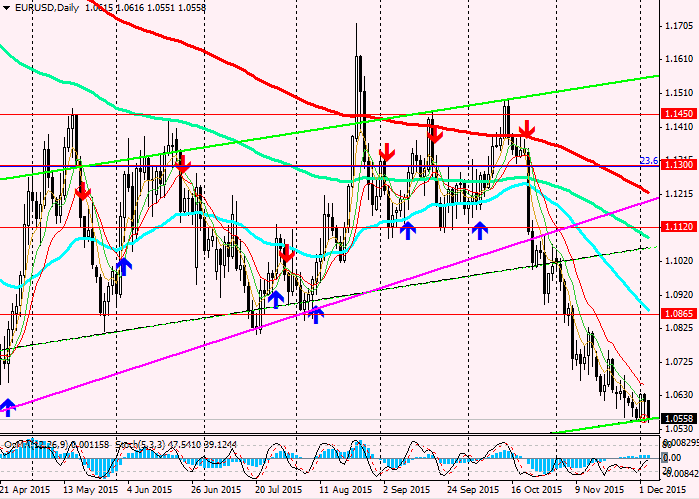

easing of monetary policy. It is likely that it will be reducing rates on deposits and the expansion of the asset purchase program. In this case, even if the interest rate in the Eurozone will not now (12:45 GMT) reduced from the current level of 0.05%, the EUR/USD will react. After the breakout of the 1.0500 level, which by the end of this year, many economists say, the road will be open for Euro parity with the dollar.

In favor of this scenario says the fact that the fed will begin tightening monetary policy in the USA at its meeting on 15-16 December. As has declared yesterday the head of the fed Janet Yellen, the delay in raising rates could have adverse effects on the economy.

FOMC member Wilms, speaking later also said that if you wait too long before raising rates, it could cause a negative economic reaction.

The fed will increase rates based on economic data and developments. However, Janet Yellen expressed confidence in the steady growth of the U.S. economy, falling unemployment and gradual increase in inflation toward the target level of 2%.

Thus, the fed is ready to raise short-term interest rates if the U.S. economy or the world markets will not be unexpected events.

Yesterday's data on employment (ADP) in November in the US exceeded market expectations (+217 000 against the forecast of +190,000 and previous growth in October at 196 000). The data confirm the steady state of the labor market in the USA and are a good precursor to yield a positive NFPR tomorrow at 13:30 (GMT). However, if a NFPR tomorrow worse than the forecast (+ 200 000 new places vs. +271 000 in the previous month) U.S. dollar weakens in the market, including in EUR/USD. Taking into account the end of the week and profit taking on long dollar positions, in this case, the weakening of the U.S. dollar may be significant.

See also review and trading recommendations for USD/CHF!