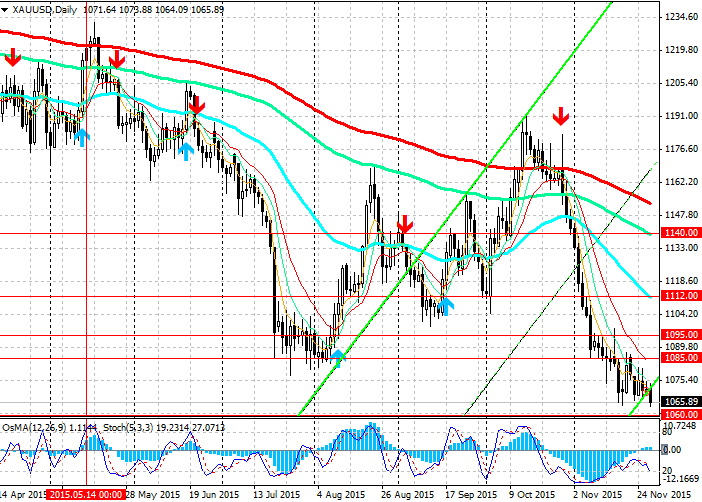

XAU/USD: decline after an active weekend. Trading Recommendations

Trading recommendations and Technical Analysis – HERE!

Today with the opening of the Asian session the XAU/USD pair has fallen quite active after last weekend in the U.S. and closed American banks and financial markets.

Given the short working day in the U.S., after the start of the U.S. trading session volatility in the pair will decline.

The downward trend in anticipation of higher interest rates in the US in mid-December, will continue until the fed meeting on December 15-16. Further movement of the pair will largely depend on the decisions and comments of fed officials.

The expectations of market participants can be expressed with futures on interest rates by the fed, which indicate a 78% probability of rising interest rates. WSJ dollar index rose to a 13-year high.

The US economy shows signs of steady recovery. And although inflation remains below the target level of 2.0%, the fed may begin to expect market participants to increase interest rates in the US, despite the fluctuations of some members of the FOMC that was evident in the minutes from the last FOMC meeting.

In the context of rising interest rates, the attractiveness of the dollar from investors with respect to gold will grow. Investment in gold does not bring income, and the cost of borrowing for its purchase and storage will grow. Demand for gold may appear when the signs of instability in financial markets and political tensions in the world.

See also review and trading recommendations for EUR/USD!