Trading recommendations and Technical Analysis – HERE!

For the pair USD/TRY, as with most other dollar pairs, with the exception, perhaps, EUR/USD, is characterized by the weakening of the dollar in the past two weeks. Released earlier in the week "minutes of the FOMC" did not contribute additional clarity on the prospects of higher US interest rates. Among fed officials, there is a difference in views on the need to raise rates in December. Although the phrase fed chair Janet Yellen pronounced in the beginning of the month in testimony before the U.S. Congress that a rate hike in December “really possible” cannot be discounted, the opinion of the heads of the fed that it would be premature for this step affects the dynamics of the US dollar in the direction of fixation of long positions on the dollar and its weakening.

The reservation made in the minutes of the FOMC that an increase in December is possible if the increase in the number of jobs and the inflation backdrop will not change for the worse, makes the U.S. dollar vulnerable. Even if the interest rate will be increased, further monetary tightening will be slow.

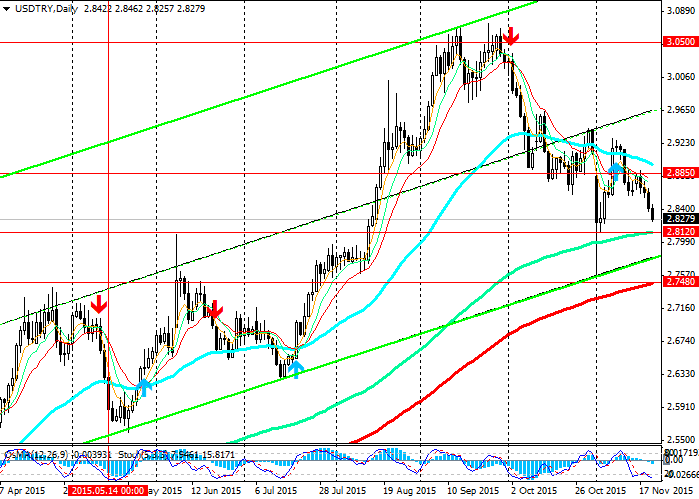

From 1 October, the pair USD/TRY is in a stable descending trend. It is worth noting that the demand for Turkish Lira increased immediately with the onset of air bombardments in Syria. Turkey shares borders with Syria through its territory and plays an important role in transit of oil from the Middle East to Europe. The increased risks associated with possible disruption of oil supplies, increase the demand for Turkish Lira. Additional support Lira received from victory on last 01 November elections in Turkey's ruling party justice and development.

As stated by Prime Minister Ahmet Davutoğlu soon after the victory of his party, the main task of the new government will be to find ways of attracting foreign direct investment, and promoting the business to increase exports and reduce imports into the country. The improvement of the economic situation in the country entails, as a rule, and the strengthening of the local currency.

See also review and trading recommendations for EUR/USD!