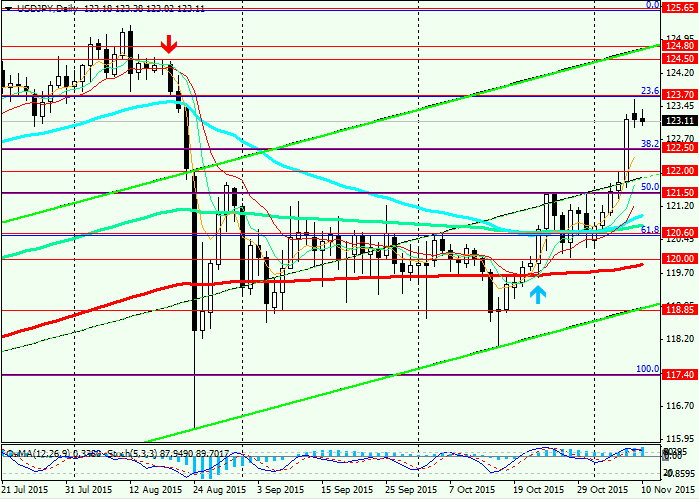

USD/JPY: Market lacks dynamics. Trading Recommendations

Trading recommendations and Technical Analysis – HERE!

NFP data in the US in October, were significantly better than expected, increase the likelihood of interest rate rises in the US in December. However, after the growth of the US dollar during the year to other currencies and against the background of the monetary policy in other countries with the world's largest economies to mitigate the monetary policy within their own countries, as well as lingering concerns about global economic growth, the Fed may not go to raise interest rates. Although representatives of the Fed and its head Janet Yellen repeatedly hinted earlier on the possible hike in interest rates in December, much will depend on incoming data on the US economy and its labor market. Such a stipulation can not alert the market participants. Despite the strong NFP figure for October in the United States, the rate of inflation in the country remains well below the inflation target of 2.0%.

Important market participants will now be directed to the US economic data and indicators on employment and inflation in November and early December (up to the Fed meeting on 15-16 December).

If you receive the same negative economic news from the United States before the Fed meeting in December is not excluded profit and partial closing of long positions on the US dollar, which could give the dollar a short-term declining trend.

Phrase Fed chief Janet Yellen that a rate hike in December, "is really possible," she said a week ago, does not mean that it will happen.

According to the data released today, the consumer price index in China in October compared with the same period last year grew by 1.3% after rising 1.6% in September. On the eve of Sunday came as negative data on the trade balance of China. Together with the decline in exports in October (-6.9%) greatly reduced imports (-18.8%).

Incoming economic data from China indicate the continuation of the slowdown of the Chinese economy and weakening domestic demand and inflation.

Nevertheless, the Japanese stock index Nikkei Stock Average trading results increased by 0.2%, and the USD / JPY pair rose slightly at the end of the Asian trading session. While the pair maintains positive momentum resulting from the strong NFPR in the United States and comments Bank of Japan at the end of last month, indicating their intention to adhere to the bank's loose monetary policy. Bank of Japan Kuroda said the central bank "will not hesitate to further easing, if needed", and the "constraints of available monetary instruments" does not.

At the same time the Bank of Japan for the third time in a row has lowered the forecast of inflation for the next year - up 1.4% from the previous value of 1.9%. It is also expected that in this fiscal year GDP will grow by 1.2% instead of 1.7% previously anticipated. Next year GDP growth forecast of 1.4% instead of 1.5%.

However, for the further growth of USD / JPY pair lacks the dynamics and it looks like there are no guidelines for further movement, which will continue until Friday, when at 13:30 (GMT) publishes data on the level of retail sales in the US in October.

See also review and trading recommendations for the pair USD/CAD!